Hi, good to see you again at the market structure learning session.

This time we will discuss the topic of liquidity, and this topic is quite important for all of you to learn about market structure.

If you have friends who want to follow the complete market structure series, you can read the complete parts below.

To move the price of a market, of course, requires very large liquidity.

Well, the role of liquidity here is intended to move the market with large price fluctuations.

If the price doesn't move, of course the market doesn't have enough liquidity.

So, maybe you are asking why we know and have to study liquidity in the market structure, especially for derivative trading.

Determining liquidity is actually easy however, it can be subjective.

But what is most certain is that the swing point highs and swing point lows are liquidity in the market that will be swiped in the near future according to market movements.

Try to pay attention to the image above and the area that I marked.

It is possible that traders think that area is support, and there has been a price reaction there.

But make no mistake, it is a liquidity position, and it is close to the area where traders usually place their stops.

Then you can see that the price immediately swiped down according to the direction of the market structure, regardless of support.

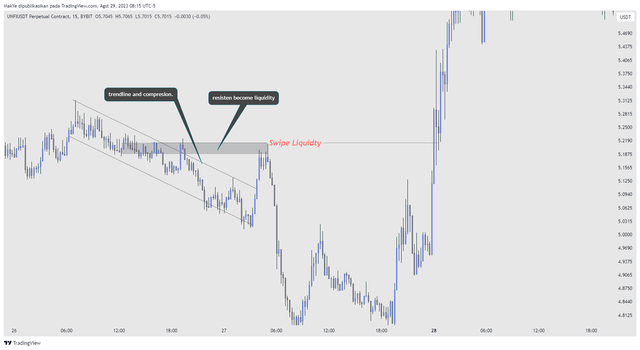

Trendlines or Compressions

You see the compressed price in the image above.

The price forms a channel.

If the price forms a trendline like that, then it will be swiped up if you take a short position in the resistance area.

Why is it called liquidity in the trendline area?

Yes, because in that area most retail traders place stop losses, and that can be seen from the price action in the market.

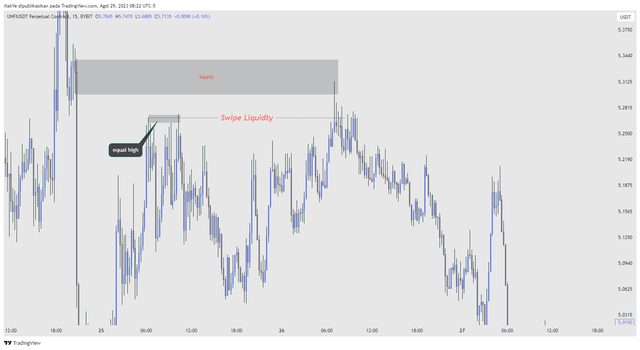

Equal high and Equal low

if this might really need more carefulness in looking at the candle structure in the market.

If there is a candle with an axis that is parallel or slightly more parallel, then you have to be careful.

Moreover, above it is a supply area, as shown below.

So you can be sure that the market will swipe, and you will be hit by a stop loss if you go short in the same parallel rejection candle area.

because your short position is a liquidity position.

Conclusion |

|---|

By knowing the liquidity area of a market, we can, of course, anticipate hunter stops or fakeouts on the market, which is actually liquidity in a market.

It's good for friends to practice on charts so that it's easier to identify liquidity, because this can be very subjective if we don't practice it continuously on market movements.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

share via twitter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a manual curation from the @tipu Curation Project.

Also your post was promoted on Twitter by the account josluds

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 3/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Suplai demand dulu...

Aku pemahaman tentang likuiditas pelan pelan aja dulu. Muehehe.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mantap pelan pelan akumukasi market struktur 😁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @gitshock.trading ,

We appreciate your active participation and contributions to our community. To ensure a positive environment for all members, we have implemented a set of guidelines to maintain respectful and constructive discussions while upholding community guidelines.

This is a nice post on liquidity in the cryptomarket.

The market always move to take out liquidity in the market

Now Engage, Connect, and Inspire Each Other to Reach New heights.

Thank You.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank for your feedback bro 🤗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit