Hi all!

It's been a long time since I wrote on this platform because there were several things in my life that made my concentration drain quite a lot.

However, I will greet all my friends in this article by reviewing one of the important continuations of the market structure series that I reviewed some time ago.

Without further ado, I will review a crucial topic in discussing market structure, namely induction.

And let's review, inducement is one of the most important parts of market structure.

In my understanding, an indemnity is a pullback that is in the market structure that makes prices continue their trend movement.

The condition for the formation of an inducement is the presence of a pullback.

A pullback is a small wave movement that forms within a market movement.

When the pullback is successfully penetrated, either up or down, the market will usually move again according to the ongoing major trend.

Why is this called an inducement? because this is a pullback on the previous movement, and to continue the price trend, you must take an inducement.

In the picture above, you can see that there is a wave of movement called a pullback. The pullback breaks down slightly, and the price immediately rises and forms a new break in structure.

So, when a pullback breaks down, the major trend is bullish, and if a pullback breaks upwards, then the trend is bearish.

Well, this is perhaps a crucial statement that you may have heard.

There is no inducement, no trading plan setup.

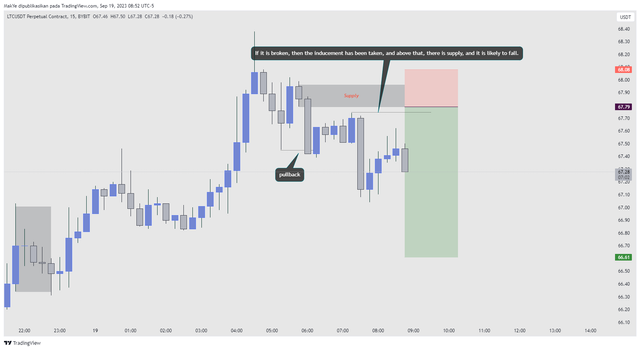

Take a look at the picture below. I made a short trading plan on Litecoin.

It can be seen that there has been a pullback, and then it has been formed by a prospective inducement.

So, if the high area is broken, then the inducement is valid and the price enters the supply area.

The hope is that the price will continue to fall and break the previous low.

The conditions for a valid inducement, as I said above, are that you must take a valid pullback area.

If you find a case like the one below, there are 3 area boxes that I marked as pullbacks, which will later become inducements.

On the first pullback, the price did not take the pullback and continued rising.

Then we can conclude that the inducement has failed, and the inducement moves to the second pullback.

However, we can see that the price failed to take a second pullback and continued to rise again. At this point, we see that no valid inducement has been formed.

So, on the third pullback, the price corrected, took the pullback, and became a valid inducement.

and you can see the price go up.

Conclusion |

|---|

By knowing valid inducements and the formation of inducements, we can see the market in a mechanical structure or according to standard rules.

This will give us stronger confirmation in seeing the market in more detail.

Where is your twitter promotion link

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sorry i'm forgot it.

i will be fixed bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

share via twitter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have a question for you brother.

What strategy do you think fits best for swing trading?

SMC or the Popular Support and resistance strategy?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm sorry, friend, for being late in responding to your reply.

Honestly, I like using market structure, and SMC is the technique I use to carry out analysis when using a swing trading style.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit