Volume Indicator is a none joke indicator in the financial markets as the volume itself is very important when it comes to trading it is through the volume that you will get to know the movement of the asset you are analyzing which will also help you to know the numbers of order that is filled, the inflow and outflow of the asset.

It is believed that a high volume means people are interested in an asset, which is why as people are buying the asset it is rising, whereas low volume is the opposite of high volume, which without further ado, let's discuss the "ease of movement indicator".

| Ease Of Movement Indicator |

|---|

Before we dive into what the ease of movement indicator is, I want you to know that it is Richard Arms is the developer of the ease of movement indicator.

Tradingview

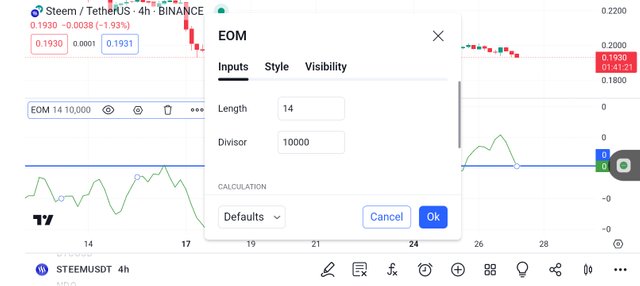

His purpose in developing this EOM was for traders to be able to know the relationship between volume and the price of an asset like STEEM/USDT. The most important aspect of the financial markets is for you to know the relationship between the price of the asset you are analyzing and the volume of the asset.

Another, good thing about the ease of movement indicator, is that you can use the indicator to know if the price of the asset you are analyzing will rise or fall if the price of the asset should keep moving for a specific period, you will see how the indicator will keep moving with the price. Looking at the screenshot we have shared you will see that this ease of movement indicator has a line that moves upward and downward, that oscillates between two figures (positive and negative)

| Readings |

|---|

It is very easy to read this indicator which is all you need to do, for you to draw a horizontal line straight from the neutral point which is the zero (0) as we have drawn as shared below.

Tradingview

Now once you have drawn your line as indicated above, you will have to whether the ease movement indicator, is below or above the neutral point, when you see that the EOM is above the neutral point, then you should know that the price of the asset is moving with ease, whereas when you see that the EOM is below the neutral point, then you should know that the price of the asset is declining with ease.

Ideally, speaking an opportunity to buy is open when the EOM has substantially moved below the neutral point, in a situation like this the asset might likely be experiencing an oversold which you can buy and keep holding for a short period.

Tradingview

Also, an opportunity to sell is open when the EOM has moved to its highest point. In a situation like this, it means the price of the asset is experiencing overbought, which you have to hold on to and wait for the market to begin to reverse back.

| Calculation |

|---|

The ease of movement indicator is calculated using different mathematical equations which we have shared in this post.

Tradingview

Step 1: The distance at which the asset moved in a certain period is the first thing to calculate. This 14-day period is the common period in which you have to calculate the distance by comparing it with the neutral point of the previous midpoint. After getting everything you will then add it up and divide whatever you have by two as shown in the formula

Distance moved = ((H+L)/2 – (Previous high + previous low)/2)

Step 2: In this step, the box ratio is what you have to calculate and the use of 100 thousands is the most relevant number that matches with others. Below is the for this.

Box ratio = ((V/100 thousands)/ H+L 1-period EMV = ((H+L)/2 – (Previous H + Previous L)/2) / ((V/100 thousands) (H-L)

Step 3: In this step, the 14-day period SMA of the 1 EMV period is what will become the EOM.

Disclaimer

The ease of movement indicator is what we have learned today, which is a volume Indicator that helps us to know the relationship between price and volume. Note that this post is strictly written as educational content, and not as investment advice. Please treat it as educational content.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://x.com/AkwajiAfen/status/1806211825169551542

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@theentertainer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit