Hello friends of Steem Alliance, I hope this year that is just beginning is very good for everyone. Today I want to share in detail a strategy that I am using since a few months ago, very specifically on the Dow Jone Index or also known as US30.

This is a strategy that is based on concepts of Smart Money a way of analyzing charts that became trend a few years ago. Obviously, this is just one way to understand the market, and to be able to establish entry points.

To begin with let's define what this trading strategy is, when we talk about Smart Money we are talking about trying to follow the actions of institutional investors or "smart money" in the market. This is not always easy to determine, logically, and there is no way of knowing if this is really the case, but I can tell you that it works quite well at least 70% of the time.

There are two concepts that are fundamental in this strategy, such as (1) Orderbloks, which in this case we call specific areas in a price chart where we can observe a significant accumulation of buy or sell orders by institutional investors or the so-called "Smart Money". And the other concept is (2) Imbalances or gaps, which refer to significant imbalances between supply and demand in the market.

The latter is very easy to find on the charts, below, and through an example of a trade I made today (05/01/2024), I will show you how to find them, and actually this is crucial, it is really important because it will determine the entry point in the trade.

Strategy details

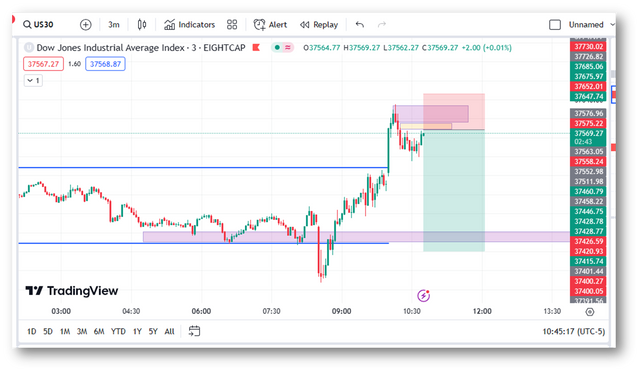

Let's see step by step the strategy, it is a strategy for intra day. I will start by telling you what each of the numbers in the following image means:

- 1 The blue line I have there specifically and it determines the maximum price that the price marked between 12 midnight and 9.30 am, New York time. (-5 UTC) (Image below) 2 The blue line I have there specifically and it determines the peak price.

- 2 The blue line I have there specifically and determines the minimum price that marked the price between 12:00 midnight and 9:30 am New York time. (-5 UTC) (Image below) (-5 UTC) (Image below)

- 3 From 9.30, which is the time when the US index market opens, I expect it to break above the high it made in the early morning or to break above the low. And that it starts to make what I call signs of price weakness, where as you can see, it starts to make lower and lower highs than the previous one. Once this is done, I locate the last candle that marked above and that is my order block. Since I assume that the smart money placed their orders there, and for this reason the price started to fall. *(Image below)

- 4 And this is the point where there is a gap between the first candle that started to fall and the third candle. As you can see, the first and the third do not touch. What I do to mark my entry here is to wait for the price to return to the gap, and I mark my Stop Loss above the orderblock. My Take Profit I place it at the London session low (Number 2). (Image below).

An important data to consider is the seasonality. In this case the analysis was done in m3 temporality, so it is Intra day. But it can also work in m5, or in m15.

As you can see, I waited for the entry point, and as soon as it touched that point of the imbalance I entered with two trades, and with a risk of 0.5% of the total account. With the intention of looking for a 1%, that is, a 1-2 profit ratio.

Note in the following image that once it touched the imbalance it started to react. That is why it is necessary that all the above mentioned are fulfilled, if not, simply do not enter the operation.

At this point you just have to let the trade do what it has to do. Which in this case went to Take Profit, but that is something that happens at least 70% of the time. And this means that there is a 30% chance that it will go to Stop Loss, and there is no problem with that. It can happen, and we should not let it affect our psychology because the profit margin is good.

In order not to place so many images I will share a gif where you can see the complete development of the operation, until it reached Take Profit. There are those who can roll the Stop Loss to the Entry Point once the trade reaches TP 1 or TP2, it will depend on the trader's risk management. In my case, in this opportunity, I let it run without rolling the SL.

And as you can see below, the price went down to the LOW that it marked in London, where I decided to close the trades.

I hope this strategy is easy to understand for you. I should also point out that it requires practice, and that in my case I apply it for this particular American index, but it can be perfectly applied in the Forex market with currencies, for example EURUSD or GBPUSD.

It will depend on what you feel comfortable for you to trade. Also the Smart Money Concept strategy is applicable to Cryptocurrencies, of course, but if you have to do it with larger timeframes.

Thank you very much for reading this far, any doubt you can leave it in the comments and I will gladly answer them.

The images used were captured as screenshots from my Trading View account.

My Twitter promotion

https://twitter.com/josevas217/status/1743345606989431002?t=784PifaHkz4X1DiqECjIIw&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been rewarded by the Seven Team.

Support partner witnesses

We are the hope!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @josevas217 ,

We appreciate your active participation and contributions to our community. To ensure a positive environment for all members, we have implemented a set of guidelines to maintain respectful and constructive discussions while upholding community guidelines.

This is an interesting analysis you have shared using smart money concept.

Keep sharing quality post in the community

Now Engage, Connect, and Inspire Each Other to Reach New heights.

Thank You.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for verification

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit