Hello crypto friends, be welcome to my new post about cryptocurrencies for all users and users in Steemit.

Detailed analysis:

Hello, today I will analyze the current drop in the price of Bitcoin below $70,000 due to negative macro-economic reports that affect investor sentiment.

Bitcoin price movement and market analysis ?

This predicts us a hawkish stance on interest rates at the next PH meeting, which will influence market expectations and Bitcoin prices.

Statistical analysis suggests there are around 500 days left in the bull cycle, with a potential price target of $120,000 six months from now.

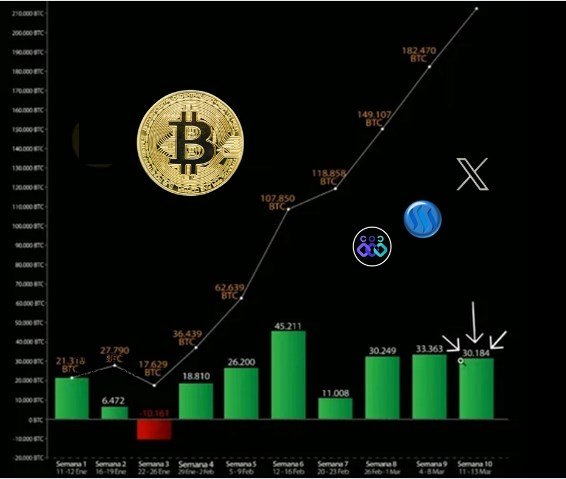

Daily Bitcoin price movements reflect corrective actions based on positive or negative data trends.

The recent corrections linked to a higher-than-expected producer price index (PPI) indicate caution in the market, but do not alter the general trend of bitcoin.

Impact of macro-economic data ?

Various economic indicators such as PPI and retail sales growth contribute to market alerts and influence future predictions.

Three major data releases this week create market alert for the potential impact of the March 20 meeting on interest rates.

Analysis of the bullish cycle of Bitcoin ?

Here we delve deeper into the phases of Bitcoin bull cycles, emphasizing the pre- and post-halving dynamics of price movements.

Understand bullish cycles ?

Each bull cycle spans approximately 1,000 days, with distinct phases before and after halvings that affect price trends.

Pre-halving periods historically coincide with market lows, indicating accumulation opportunities ahead of significant price increases.

Post-Halving periods: witness prolonged bullish streaks lasting around 500 days, suggesting continued bullish momentum in Bitcoin prices.

Evaluation of the current cycle ?

Three major bullish peaks are anticipated in this cycle driven by ETF developments and potential deviations from historical halving patterns.

Bitcoin investment trends ?

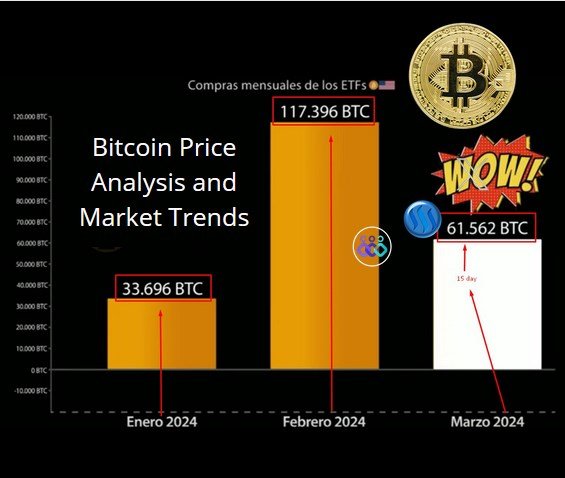

The significant increase in Bitcoin purchases by investors is discussed, highlighting key data points and trends that indicate a bullish outlook on Bitcoin investments.

Bitcoin buying trend ?

Investors have been steadily purchasing Bitcoin through ETFs on a monthly basis, with over 33,000 bitcoins in January, 117,000 in February, and 61,000 already purchased in March.

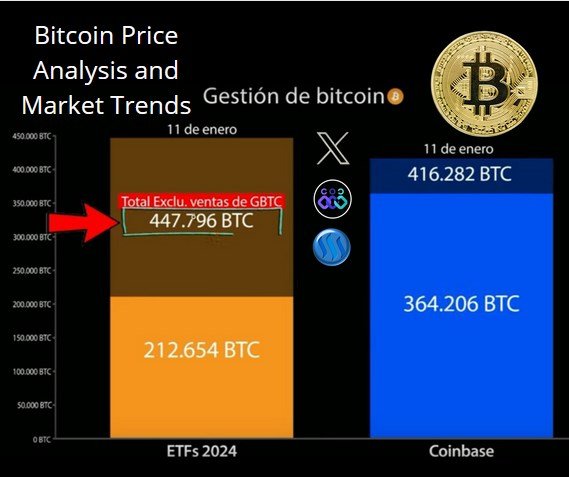

Since the introduction of CF trading, a total of 447,000 bitcoins have been accumulated in two months.

In particular, despite some sales of (Grayscale) a substantial amount remains invested.

Coinbase Data Insights ?

The introduction of CF trading on Coinbase caused an accumulation of 364,000 bitcoins from January to March.

This influx indicates significant buying pressure on exchanges like Coinbase.

The overall decline in bitcoins available on exchanges is notable as investors turn to platforms like Coinbase to make purchases due to limited availability elsewhere.

Market impact and predictions ?

The reduction in available bitcoins, coupled with the increase in ETF purchases, suggests a rapid upward price movement. Recent large ETF purchases have led to all-time highs in Bitcoin prices.

Despite traditionally lower buying days towards the end of the week (Thursday and Friday), long-term statistics indicate an 80% chance of price increases six months after peak prices are reached.

Bitcoin price forecast ?

MY hunch tells me that it digs into statistical predictions about future Bitcoin prices based on historical trends following the price spikes already seen on the rise.

Information about price prediction ?

Following previous peak prices of around $9,000 on March 5 and subsequent statistical analysis indicates an 80% probability of price increases six months later and an average very close to $120,000 for each bitcoin.

✅ Vote @bangla.witness as lead witness please.

Thank you for reading me grateful.....

.gif)

Let's remember to comment on my publication, I will gladly answer you.

This article is written by @OscarDavid79 free of copyright

Twitter

https://twitter.com/oscardavidd79/status/1768715771847307467

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for supporting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for supporting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@theentertainer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello, good afternoon ? I have noticed that in my publication the curator OPPPS does not reflect his vote. And the other colleagues if they are reflected; Something is happening, because it is happening every time and very constant.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit