Understand leverage in commerce ?

Here is the importance of using leverage responsible in the world of digital trade.

Leverage can improve efficiency, but undue use can lead to significant losses.

Exploring the responsible use of leverage ?

The proper use of leverage can make trade more efficient and effective.

Using leverage as a game form or rapid profits can result in substantial losses.

Merchants aim to preserve capital, since it is essential for sustained commercial success.

Surfing of losing gusts is common in commerce; Preserving capital helps navigate through such phases.

The main merchants emphasize impeccable risk management as a key factor for success.

Importance of trade management in trade ?

Risk management plays a crucial role in the longevity and profitability of commercial efforts.

Implementation of effective risk management strategies

emphasize the need to conserve capital risking low percentages per operation.

It is worth balancing the percentage of risk to guarantee the time invested in trade.

A widely accepted risk percentage is 2% of the total value of the operation per operation.

Adjust risk levels based on personal circumstances and preferences for aggressiveness or conservatism.

Calculation of the size of the position based on the available capital, the risk by operation and the stop of the loss from the point of entry.

Calculation of the position size for effective risk management ?

Determining the appropriate position size is vital to administer the risks effectively during operations and key steps in calculating the position size.

- The calculation of the size of the position implies considering the available capital, the risk by operation and the distance of detention of the loss from the point of entry.

[Risk Management Strategy in Commerce] ?

In this section, the speaker explains how to calculate the size of the position depending on the percentage of risk and the distance of loss loss, emphasizing the importance of risk management in trade.

Calculating position size ?

When risking a certain percentage (for example, 2%or 3%) of the account capital, multiply the percentage by the available capital (for example, 0.02 for 2%).

Example: with a 10,000 account and risking 2%, calculate the position of the position multiplying 10,000 by 0.02.

If the stop loss is established in a certain percentage (for example, 5%), calculate the size of the position by dividing the amount of risk by the stop loss.

Importance of leverage ?

The use of leverage can significantly affect the size of the position. Without leverage and risk of 2%, a 10,000 account would require a 200 position.

With activated leverage (for example, 2x), the required position size is doubled to cover potential losses effectively.

The leverage allows operators to control larger positions with less capital, but increases both the potential for profits and risk exposure.

Understand the impact of leverage ?

Regardless of the leverage used (for example, 3x or 10x), the size of the position remains constant, while the margin requirements are adjusted accordingly.

The increase in leverage reduces the required margin, but does not alter the real position size or the amount of potential loss.

Risk management demonstration ?

Show how leverage affects margin requirements without changing real position sizes or risk quantities.

Even with higher leverage like 10x, the position size remains consistent, while margin obligations decrease proportionally.

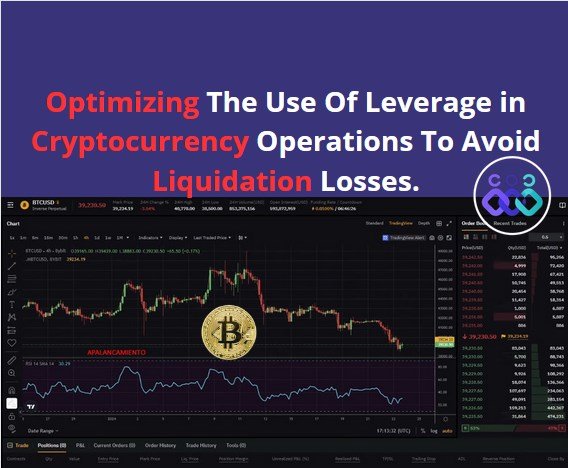

Operational levers and liquidation levels ?

In this section, the speaker analyzes the importance of liquidation levels when determining leverage in trade to avoid being prematurely liquidated.

Understanding of liquidation levels ?

The level of liquidation should not be between the entrance price and the loss of loss. Placing it there makes the loss ineffective.

The highest leverage is about the settlement price at the entrance price. Adjust the leverage to ensure that the level of liquidation is out of the entrance and stop the loss points.

Calculation of the level of liquidation ?

Bybit provides a calculator to determine where the liquidation price is located depending on the leverage and the entrance price.

Example: Use of 10x leverage with an entry at 30,000 and a 5% stop loss would place the liquidation level by 28,500, ensuring that it is outside the critical range.

Risk management with leverage ?

A greater leverage increases the risk of premature settlement; The reduction of leverage can avoid this problem.

Properly structuring the exchanges by placing the entrance below for long and higher positions for short positions helps avoid unnecessary liquidations.

Risk management and position dimensioning ?

This part emphasizes risk management strategies, position size calculations and their independence from leverage options.

Key control ?

- Structure the operations correctly (then for long positions, up for short positions) prevents unjustified liquidations.

In conclusion.

The optimization of the use of leverage in cryptocurrency operations is essential to maximize profits and minimize losses by liquidation.

In order to achieve this, it is crucial to thoroughly understand the dynamics of the market I have implemented solid risk management strategies and maintain a balance between the ambition or ambitions of profits and the caution against possible losses.

The correct leverage management not only enhances the benefit opportunities I have even protects excessive exhibition operators that could result in forced liquidations and immense losses.

✅ Vote @bangla.witness as lead witness please.

Thank you for reading me grateful.....

.gif)

Let's remember to comment on my publication, I will gladly answer you.

This article is written by @OscarDavid79 free of copyright

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gracias por apoyar

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://twitter.com/oscardavidd79/status/1771628440489226529

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Leverage trading is indeed one of the best initiatives in the crypto trading space, and I think we have the same in all factors of the financial market.

The only issue os that, people abuse this initiative a lot especially the new trades, many make multiple losses due to overleverage , have learnt not to use more than 5x leverage on a single trade, it might be small, but to Is more effective.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also, it is friend to give adequate leverage no more than 5 times per trade in the same trade to avoid heavy losses. Thanks for your opinion.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@jueco

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit