Bear markets are a notorious aspect of the financial world that investors fear. A bear market is characterized by a sustained decline in the stock market or crypto market or a particular sector, with prices falling by more than 20% from their peak. While investors may benefit from bear markets in the long term, there are several negative consequences that can result from a bear market, both for individual investors and the broader economy. In this article, I will discuss some of the bad effects of a bear market.

- Loss of Investor Confidence:

When a bear market takes hold, investors start to lose confidence in the market. As share prices decline, they are likely to become more risk-averse and sell their investments, resulting in a further decline in stock prices or crypto asset prices. This cycle can continue until investor confidence is severely damaged, leading to long-term economic instability. - Reduced Consumer Spending:

During bear markets, people tend to become more cautious with their money, as they fear for their financial future. This caution results in reduced consumer spending, which can have a significant impact on the broader economy. When people are not spending, businesses may struggle, leading to layoffs and reduced economic growth. - Job Losses:

Bear markets can also result in job losses, as businesses struggle to stay afloat during times of economic downturn. Companies may be forced to lay off workers, cut back on hours, or reduce wages to stay competitive. In turn, this can lead to increased unemployment, which can be devastating for individuals and families. - Lower Investment Returns:

During bear markets, it can be challenging to earn a decent return on your investments. As stock prices or crypto asset prices decline, investors who have invested in stocks or crypto may experience significant losses. Other investments, such as bonds, may not be able to provide sufficient returns to compensate for losses in the crypto market or stock market. As a result, investors may be forced to hold onto their investments for an extended period, waiting for the market to recover. - Increased Debt:

When the stock market or crypto market is in decline, people tend to become more cautious with their money. This caution can result in people taking on more debt, as they try to protect their savings and investments. In turn, increased debt levels can lead to further financial instability, particularly if interest rates rise.

The bad effects of bear markets are numerous and can have a significant impact on the broader economy. While it is impossible to predict when a bear market will occur, investors should be aware of the potential risks and take steps to protect themselves. This may include diversifying your investments, holding onto your investments for the long term, and having a solid financial plan in place. By doing so, investors can better weather the storms of a bear market and come out the other side with their financial futures intact.

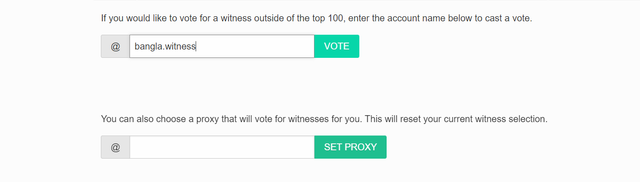

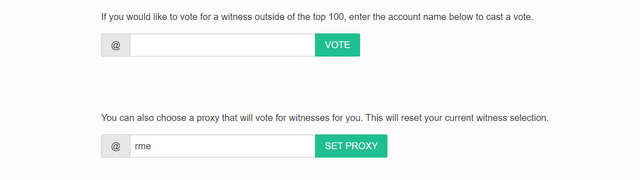

VOTE @bangla.witness as witness

OR

Thanks.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit