Hello to everyone in this community today. And I want to believe that we all are doing just well this morning. Today I am here to talk about an important aspect of cryptocurrency trading, I have titled this content A briefing regarding the importance of technical analysis in cryptocurrency market trading.

We as cryptocurrency users tends to trade cryptocurrency in the several exchanges both centralized and decentralized exchanges and also before we do that, there are activities which are necessary to be carried out before you execute a trade in the cryptocurrency market and these activities is called technical analysis.

Before I proceed, it is expedient that I explain to you all the meaning of the term technical analysis in cryptocurrency market trading.

WHAT ARE TECHNICAL ANALYSIS?

Technical am can be seen as a way of analyzing the market trend movement closely with the use of various tools in other to know the type of trade a trader is expected to execute in the cryptocurrency market trading.

It is also seen as a reading of what the market has depicted and also what the market is depicting at a given time to know the possible next trend movement of the market in other to be sure of the type of entry one should execute.

Technical analysis is very vital especially as cryptocurrency traders tends to trade their cryptocurrency assets in the market, it helps to see what the market has done previously and what the market is currently doing and possibly detect the next activities of the market.

The technical analysis is done with the help of certain tools that has been designed to make trading easier and these tools although not 100 percent perfect but it has the tendency of guiding you when making a trade in the cryptocurrency market.

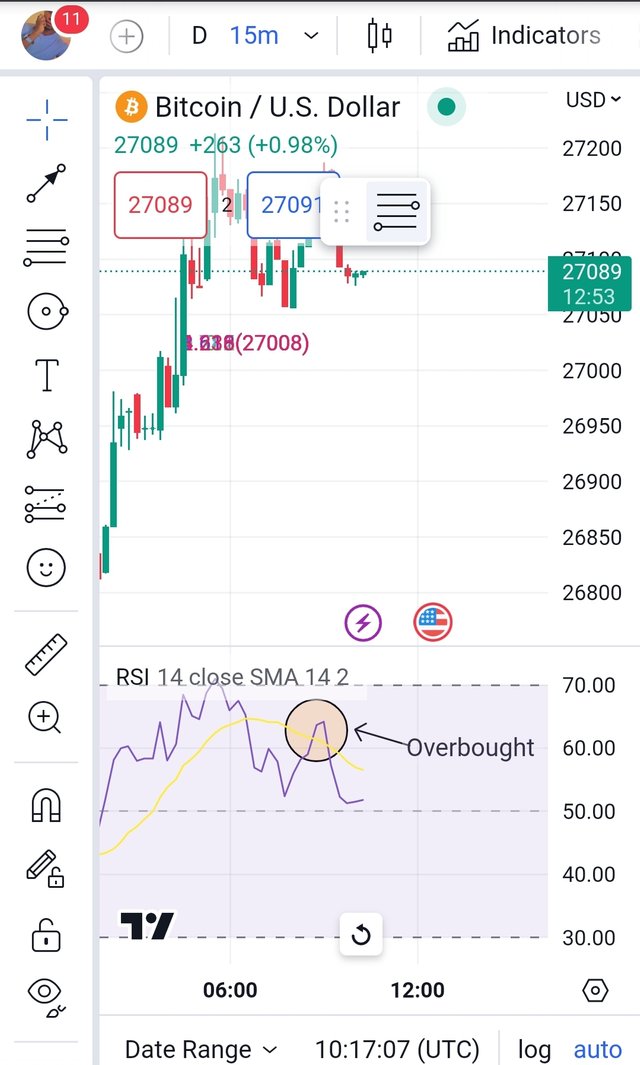

Tools like basic indicators such as RSI, Bollinger band, Triangular moving average and a lot more helps to give the trader a clear view of the market trend movement. The RSI indicator shows the movement of the market and also point out the overbought and oversold region of a particular cryptocurrency.

With this indicator, a trader has upper hand to detect the possible next trend movement and then decides whether to execute a particular market order or to refrain from the market at that particular time.

The overbought region tells the trader that the said asset has been purchased highly and as such there are possibilities that the assets will be sold anytime soon.

As a good trader, it is expected that you either execute a sell order or just wait for a breakout before executing your order and the same thing applies when the cryptocurrency is in the oversold region, the oversold region tells the trader that the said asset has been sold greatly and there is every possibility that the market might retrace anytime soon.

As a newbie in cryptocurrency trading, it very vital to learn how to read the movement of the market with the help of the technical analysis and that is why it is recommended that you learn first before starting up a trading journey.

Knowing the basic functions of each indicator and tools is expedient and essential for it will give you an insight on how to use it on your chat which will give you an edge in the market when executing a trade order.

IMPORTANCE OF TECHNICAL ANALYSIS IN CRYPTOCURRENCY MARKET TRADING

The importance of making a technical analysis before executing a trade is to help minimize loss while trading. Technical analysis helps us to view vividly what the market is depicting already and this helps to enable a trader to make wise decision during trading in the cryptocurrency market trading.

It tells a trader what is happening in the market and hence the trader will them choose to either stay in the market or come back later in other to avoid loss of assets when trading in the market as though this helps to protect a trader from making wrong moves in the cryptocurrency market trading.

It does not eliminate losses totally but it helps in managing risk and reward. It reduces the level at which one is liable to loss his or her assets in the cryptocurrency market trading and that is why it is advisable to perform a market analysis using the relevant tools to know what the market is doing before executing your trade.

Thank you all for reading from me and do have a great day ahead.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your contribution to the community. Keep on sharing quality original posts and please read our how-to posts which have been pinned in the community.

Nice review, we hope you can maintain a professional quality post if you want to share relevant topics in the Steem Alliance community.

Increase your Engagement in the community to exchange ideas and interact with teams from various communities.

Please always review the posts we have pinned on the community page. There are many guides that you should know, and they will be very useful.

Rating : 7/10

have a nice day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit