Hello everyone, introduce me @aryadwigantara will try to join the Mini Crypto Program, Part 2 held by the Steem Education community.

So in this first assignment, we discuss "How Psychology Influences Market Cycles", I will try to thoroughly explore the given task as much as possible, let's get into the topic of discussion.

How Psychology Influences Market Cycles

So in this task that was given to us, we have to do it on the CoinMarketCap website, so we have to enter first to complete some of the things given, after you enter the website as shown in the image below, then let's review one another together. one by one the questions that have been given to us.

1. Explain what is FOMO !

FOMO stands for Fear Of Missing Out, is an addictive trait of someone who is afraid of missing out on information, important news and important trends, where this causes the person to try to stay awake to be online continuously, in order to get information first. FOMO in the crypto world is also the same as the general understanding, where people are afraid of missing out on crypto assets that have a high selling value so they buy without thinking whether it is a good purchase price or even it is not the right time to buy, because his FOMO nature (Fear of Missing) he buys when a crypto asset is at a peak price, even though it is a very risky thing, that is the cause of FOMO which makes a person afraid of missing out on his chance to get rich by earning big profits . So in short, the nature of FOMO is where a trader has a fear of being left behind because the price of crypto assets continues to increase, thus making a trader forced to enter the highest price of the crypto asset. So I'll give you an example via a Crypto asset chart.

98989.png)

2. Explain what is FUD?

FUD stands for Fear, Uncertainly, and Doubt. FUD is a trait in you that is confused to determine when the price of crypto assets will increase in price. The nature of this FUD causes users to sell their Crypto asset prices due to a very rapid decline in crypto asset prices, because you have a doubtful nature and you don't know for sure when the asset price will rise again, actually this is your psychic nature as a trader who are impatient, because prices are starting to fall you start to panic and fear losing your money, so you sell your crypto assets to prevent losing all the assets you have, here is an example of a FUD chart

.png)

3. Explain where FOMO occur!

.png)

As you can see where FOMO occurs when a price on the ETH asset that we are reviewing is at a peak, FOMO is a condition where we are afraid that we will be left behind in getting the asset, while the ETH asset that has increased very rapidly makes us buy the asset. at its peak price, that is what is called FOMO or fear of missing out.

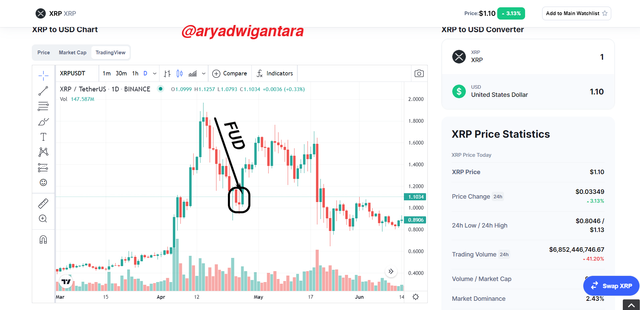

4. Explain where FUD occur!

As you can see in the graph above, that seeing FUD occurs when the price of a crypto asset is at its lowest point, Just imagine if you are a trader who has an XRP crypto asset because the price is still rising you don't sell it, and then suddenly the asset price The asset is experiencing a very rapid decline, so your psychic nature sells the asset because you are afraid of losing the asset, actually this is because of your impatient nature to sell the asset.

4. Choose the 2 cryptocurrencies you want, then use the graph of the 2 cryptocurrencies to explain where FOMO and FUD occur!

In the last problem we will try to take 2 crypto assets to see where FOMO and FUD occur, and we will try to explain them to the best of my ability, as follows:

ETH

.png)

So you can see in the picture above which shows a graph that has increased because the ETH crypto asset is discussed by many traders, then many traders buy the asset, and because you become FOMO (Don't Want to Miss) you also buy assets at very high prices. , and that is the pinnacle of FOMO due to your nature

.png)

can be seen in the graph above After you buy an asset at the peak price as a result of your own FOMO nature or don't want to be left behind, then the asset experiences a very drastic decline, and this makes you impatient and want to sell your assets to avoid losses all the assets you own, this is called the FUD Point, where you are not sure when the asset will increase so you sell it because the asset has decreased very drastically..

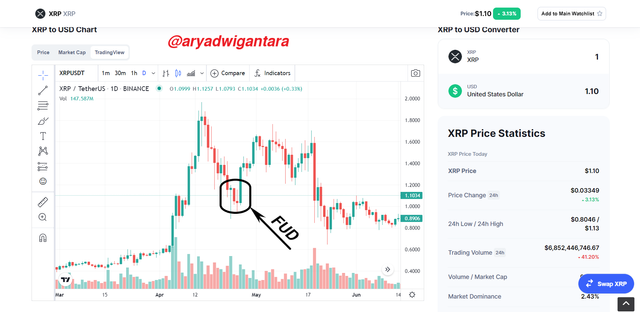

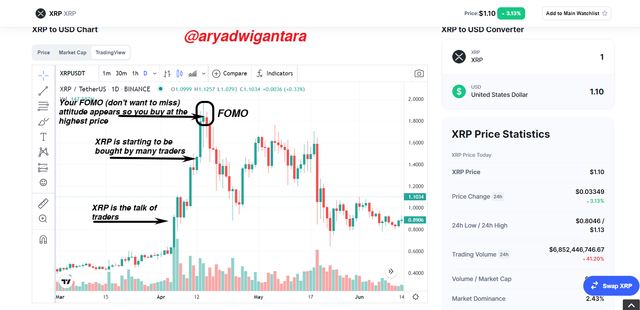

XRP

.png)

The same thing happened to XRP assets, you can see in the chart above, where initially the asset price increased because many traders were talking about the XRP asset, then there was another price increase in XRP assets because many traders bought it, because of your FOMO nature. (don't want to miss it) you buy the asset at a very high price, that's what happens if you have FOMO nature, even though this is a very high price but because you don't want to miss it you also buy it.

.png)

Then you can see in the chart above, as a result of initially you have a FOMO nature (don't want to miss it) and you buy at the highest price of the asset, then the price decreases very rapidly, making you worry and immediately selling your asset to avoid losses from all XRP assets that you own, as a result of this FUD happening you sell all these assets at the lowest point of the asset, FUD makes a trader's psychological nature impatient and makes traders take steps to sell them immediately.

Conclusions!

The conclusion from this task that I can take is where FOMO is a condition where you are afraid to miss buying an asset because the asset is experiencing a very rapid price increase, so you buy the asset even though the asset is at its peak. While FUD occurs at a time when prices experience a very rapid decline and make you worry that you will experience losses from the assets you have, so you sell these assets at their lowest point. So the thing to note here is that as a trader we have to try to control the mental nature we have, because otherwise it will be very dangerous, this can make us someone who is not careful in trading the crypto assets that we have, it may even be not profitable. what we achieve, we can actually lose big, so try to be careful in making decisions, to avoid losses in trading the crypto assets that we have.

That's what I can review about "How Psychology Influences Market Cycles", if this review of my assignment is still far from perfect, I apologize, I will try my best to continue to develop in the future.

CC:

@liasteem

@irawandedy

@klen.civil

@radjasalman

That is all and thank you

Regards

@aryadwigantara

.png)

Dear @aryadwigantara ,

Thank you for participating in this Mini Crypto program, I really appreciate your good intentions and your efforts in understanding our practice this time.

Here is an assessment of your practice;

This is a good explanation of FOMO and FUD, but FOMO and FUD occur not always above or below, but they go through several phases which then make a person FOMO or FUD.

I hope that you and I can study together at Crypto Academy.

Thank you very much, we will waiting for your next exercise, and we will waiting you at the season 4 of Crypto Academy. 👍💪

Has been assessed by;

@liasteem

@steem.education

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Big Thanks For You :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are welcome 👍👍👍

💪

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit