Assalamualaikum Warahmatullahi Wabarakatuh

Hi friends, here I will join the @Steem.Education community, I will try to enliven the minicrypto2 created by @liasteem brother.

In this minicrypto2 we discuss How Psychology Influences Market Cycles, so I will try to solve it.

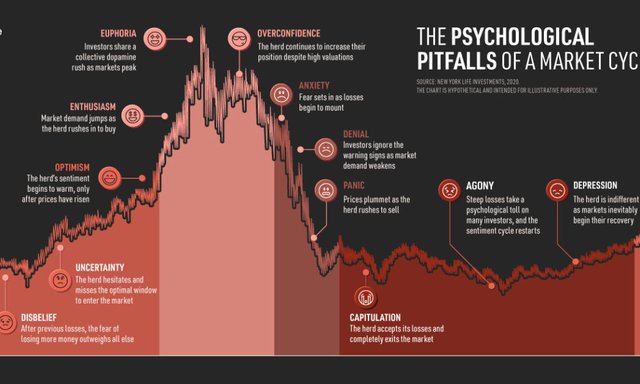

How Psychology Influences Market Cycles

So brother @liasteem directed us to enter CoinMarketCap, so friends must first enter the CoinMarketCap website, friends can click on the following link CoinMarketCap, the initial screen will appear as shown below.

.png)

So to see the cryptocurrencies that are on CoinMarketCap, you just have to scroll down, then there will be a choice of crop currencies that you can see the information.

Next we will discuss the 5 questions that have been given to us, the following are the tasks given to us:

- Visit the website CoinMarket , and explain what FOMO is!

- Explain what is FUD?

- Explain where FOMO occur! (Need screenshots)

- Explain where FUD occur! (Need screenshots)

- Choose the 2 cryptocurrencies you want, then use the graph of the 2 cryptocurrencies to explain where FOMO and FUD occur! (Need screenshots)

- Conclusions!

let's answer each question that has been given, here's my review of the first question

1. Explain what is FOMO !

FOMO (Fear Of Missing Out) is increasingly known among the public, the general understanding of FOMO is where the condition of a person's nature is in the addiction phase of social media, addicted to the digital world or someone's addiction as a result of being afraid to miss important information in the digital world. , so that someone who has this FOMO trait will carry out continuous monitoring of what he wants to get information first.

So FOMO in the world of crypto assets is also the same, where someone who has an addictive nature and makes himself afraid to get information ahead of others, so he will go online continuously to monitor price movements on the crypto asset.

So here I will give an example that I took from the graph on a crypto asset that is experiencing a FOMO incident, here is an example:

.png)

2. Explain what is FUD?

FUD (Fear, Uncertainly, and Doubt), is the opposite of the nature of FOMO, if in FOMO you have an addiction and a nature that is afraid of missing out on the latest information, then FUD is where you have a confused nature in deciding to sell your assets, so as example that you hold your asset in the hope that the asset will increase from the price you bought it, but immediately the asset decreases drastically and makes you sell it at the lowest point of the asset, that is what is called FUD, here is an example through a graph

.png)

3. Explain where FOMO occur!

FOMO occurs when a graph goes up, where as I have explained about the notion of FOMO nature, namely the tendency of someone who is joking or doesn't want to give in to other people, it's easier this way, the chart below shows that prices continue to experience increase, with the FOMO nature that a trader has, and he feels unwilling to give in to other traders, while other traders manage to get crypto assets at prices that are not too high, while you because of your FOMO nature you don't want to give in and dare yourself buy a crypto asset with a price position at its peak, as in the image below.

ggg.png)

4. Explain where FUD occur!

FUD occurs due to the nature of a trader who hesitates or does not hold fast in selling assets owned by a trader, an easy example is when a trader has a crypto asset but he is confused in determining the selling value, then immediately the selling value of the asset he owns by the trader, the price fell very far down, because you have the nature of FUD and you panic, as soon as you sell the price of the asset at its lowest position, you can see in the graphic image below.

ffgfhgf.png)

5. Choose the 2 cryptocurrencies you want, then use the graph of the 2 cryptocurrencies to explain where FOMO and FUD occur!

In this last question, it requires us to make a determination on the graph of the asset we are reviewing, where we have to determine the FOMO position and also the FUD that occurs for 2 crypto asset pairs, here I will look at Cardano (ADA) and Binance Coin (BNB) assets. , here are the results of my analysis:

Cardano (ADA)

ggg.png)

We can see in the Cardano asset (ADA) in the picture above that it shows a FOMO and FUD that occurs on the graph of the crypto asset, where in the red column the FOMO nature occurs, where FOMO occurs when you buy an asset at a price position the highest. While the green column is a FUD condition, or where it occurs when you are hesitant and afraid to make a sale so that when the asset is at its lowest point you just make a sale because you have a nature that tends to panic and can't determine the right time in selling your assets.

Binance Coin (BNB)

ffgfhgf.png)

We can look back at the crypto asset Binance Coin (BNB), the table in green shows the occurrence of FOMO, here actually the FOMO that occurs does not immediately go up, you may be hesitant at that time to buy it, but when the asset increases again, because you has a FOMO nature or does not want to lose to others, making you buy the asset when the asset price position is very high. While in the FUD position it occurs when you hesitate to sell the asset, when the asset experiences a very sharp decline, making yourself panic and immediately make a sale, this is due to the nature of the FUD you have, because you are hesitant and in a hurry to make decisions

Conclusions!

Here I can conclude that the nature of FOMO is an addictive nature and does not want to give in to others, the nature of FOMO is also very dangerous because it can harm you as a trader, try to control mentally in trading on the crypto assets you have. While the nature of FUD is also a trait that is not good for a trader, because the nature of FUD makes a trader rush and panic in making decisions to sell their assets. So the conclusion is that as a trader we must be able to control our nature and behavior in trading the assets we have, try to always do the analysis first in order to get the best position in buying or selling the crypto assets that you have.

Closing

This is enough for my explanation about How Psychology Influences Market Cycles, if there is a mistake in my explanation in conveying it to all of my friends, I apologize.

Thanks For:

@liasteem

@radjasalman

@klen.civil

@irawandedy

Dear @rnadewi ,

Thank you for participating in this Mini Crypto program, I really appreciate your good intentions and your efforts in understanding our practice this time.

Here is an assessment of your practice;

Has been assessed by;

@liasteem

@steem.education

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit