The Spotlight on Huobi Challenge has been a great one since it started and I am glad to be writing my second post. In this post, I will be writing on Huobi Spot trading. In my previous post, I explained the process of depositing funds to Huobi exchange, if you missed the post then you should read Creating an account and Depositing on Huobi Exchange. After depositing, the first place for a trader who wants to convert their coins to other coins or token would visit is the Spot trading page.

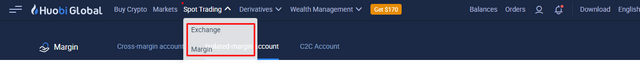

Different exchanges have different trading view and while traders enjoy one over the other, there is really nothing like the perfect trading view because it is dependent on preference and people have different choices. Huobi spot trading has three trading options which are the Spot Trading Exchange and Margin Trading. I will be explaining each of these trading page on this below.

Spot Trading Exchange

This is the general trading page for both beginners and professional traders who want to trade one coin for another. The page has an impressive view with the ability for traders to select the vision which is comfortable for them such as the day mode and the night mode.

The Spot trading exchange has a very well explanatory chart which can be changed to different views like the original view, trading view and Depth view thereby giving users the ability to chose the view they want to check the chart of whatever coin they are interested to trade with technical indicators readily available on the chart.

The spot trading exchange has six trading base coins used to trade, these coins are BTC, USDT, HUSD, ETH, HT, and Alts (which currently has TRX). These based coins serves as trading pairs for over 300 coins listed on Huobi exchange. The coins differ ranging from Exchange-traded product (ETP), Innovation, Defi, Polkadot, Storage, and others.

Margin Trading

This trading requires using other people's money to trade thereby increasing their result while trading. There is a margin account on Huobi exchange and in other to trade margin, traders will transfer funds from their spot account to their margin account. On Huobi Global, there are three margin accounts; the cross margin, isolated-margin, C2C account. With Margin trade, traders buy long and sell short.

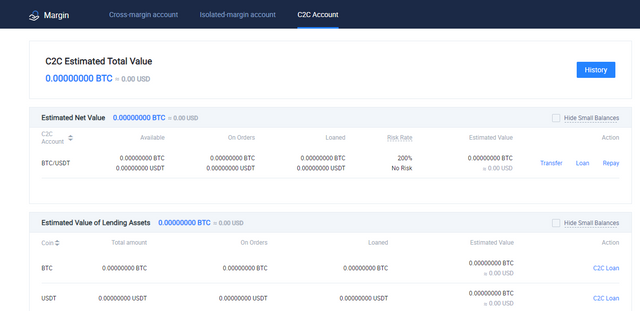

C2C account

C2C account is the account where users lend their spare tokens to margin traders and with that can earn profit as they set the interest expected to be paid by the margin borrowers. The Platform charges a service fee of 18% on profit made by the lender. The lender gets profit hourly from when the borrower collects the coin. Token that can be lent or borroweed are BTC and USDT.

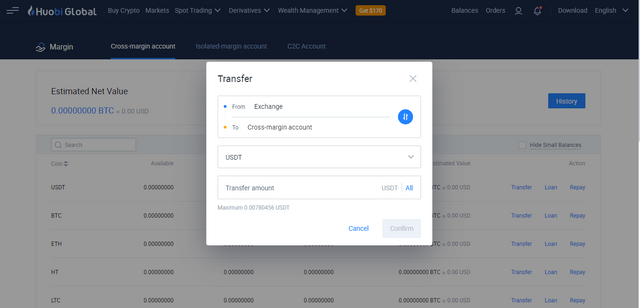

Cross-margin

With cross margin trading, traders can apply the same margin balance to as many trading positions as possible. Funds can be transferred from the spot account to the cross-margin account.

Cross-margin trade can be used to trade as many positions as possible but when the risk position of the account reaches ≤110%, the account is forced to lquidate so as to repay the loans and interest. To calculate the rate of account risk, the Min (Current Holdings, Holding Ceiling) divided by (Amount Loaned + Interest Rates) multiplied100%.

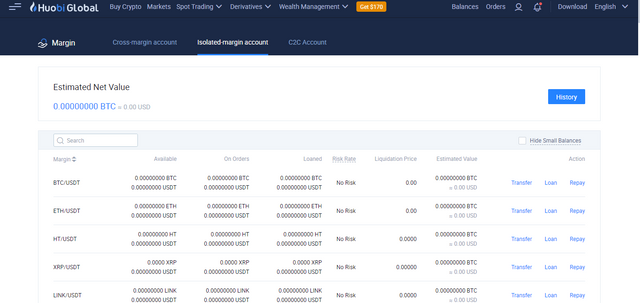

Isolated Margin

This margin requires trading an individual margin position with a fixed collateral amount. Non of the margin positions placed affect one another and if one of the positions placed go into liquidation, the margin set aside for other margin positions will not offset this loss.

Thank you for taking part in the Spotlight on Huobi Challenge.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit