To CEX or to DEX?

Most of us bought our very first cryptocurrency on Centralized exchanges (CEX) such as Binance, Huobi and Kraken as they are the main providers of fiat-cryptos exchange services. CEXs offer the usual advantages of ease-of-use, high liquidity, and regulatory assurances. However, the ceaseless reports on rugpulls of CEXs since the Mt. Gox Fraud in 2014 have rendered investors generally wary of CEXs.

As the saying goes: Not your (private) key, not your money. Technically your crypto assets kept on CEXs are completely at the mercy of whoever holding the private keys of the CEXs’ storage wallets. The only thing that keeps the CEX owners from coveting your cryptos is really just legal regulations. Unfortunately, legal regulations literally remain only on paper when it comes to cryptos rugpulls. Countries where a CEX is registered can hardly take any actions against CEX owner(s) absconding investors’ cryptos when they are physically living in a non-extradition country.

To circumvent the reliability issues with CEXs, decentralized exchanges (DEXs) were created to remove the requirements for any authority to oversee and authorize trades within a platform. This allows users to trade cryptocurrencies with each other directly from their wallets through smart contracts without intermediary, thus eliminating the risk of rugpull.

DEXs also provide new DeFi projects with more ease in listing their tokens/coins. Listing a new coin/token on large reputable CEXs usually incurs very high listing fee (above $50K USD) unaffordable by most dev teams. On the other hand, listing new coin/token on smaller CEXs can be risky in the event of rugpull. DEXs circumvent both the issues of high listing fees and potential rugpull for new coin/token listing. Anyone can create a liquidity pool on a DEX simply by providing two coins/tokens in the trading pair.

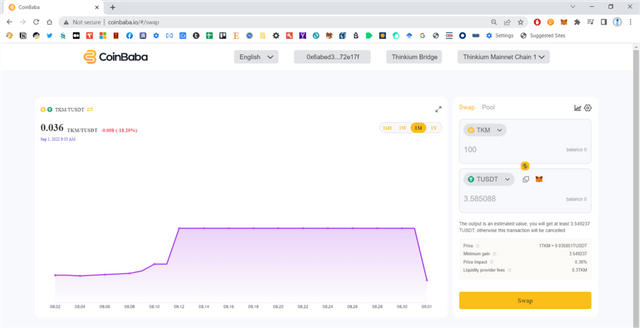

CoinBaba: The First Native DEX on Thinkium

Thinkium is an all-around public blockchain network, which achieves unlimited scalability at a linear cost by running through a multi-layer multi-chain structure. Thinkium blockchain currently have 370+ nodes, which is 29 times larger than Binance Smart Chain (BSC). There are 20+ full time developers and 300+ part time developers working on it. There are already more than 30 blockchain projects based on Internet e-commerce and communities on Thinkium, with more than 10,000 active monthly users.

Until July 2022, TKM, Thinkium’s native coin, was only tradable on Hoo Exchange, a CEX. Unfortunately, many users couldn’t withdraw their TKM coins from Hoo Exchange starting from May 2022. While it has not been confirmed that Hoo Exchange has rugpulled, having millions of TKM coins inaccessible to their rightful owners is definitely detrimental to the ecosystem.

The Thinkium Foundation has launched the initiative to create a Thinkium native DEX in March 2022. As a result of months of continuous efforts, CoinBaba DEX, Thinkium’s first native DEX, was launched on Thinkium Mainnet in July 2022. CoinBaba DEX has currently three coins and tokens listed: TKM, TUSDT and TSS. As the Thinkium ecosystem grows, more tokens and trading pairs will be added.

Contact us at:

E-mail: [email protected]

Facebook: https://facebook.com/CoinBabaDEX

Telegram: https://t.me/CoinBabaDEX

Twitter: https://twitter.com/Coinbaba18

LinkedIn: https://www.linkedin.com/mwlite/company/coinbabadex

Medium: https://medium.com/@CoinbabaDEX

発佈人

Sook Jin GOH,

Community Manager 社群經理 @ Glitter.Finance ,

Regional Ambassador for Malaysia 馬來西亞區域大使 @ Nutbox.io ,

CEO @ Nanyang Global Scientific Research Centre 南洋國際科研中心

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit