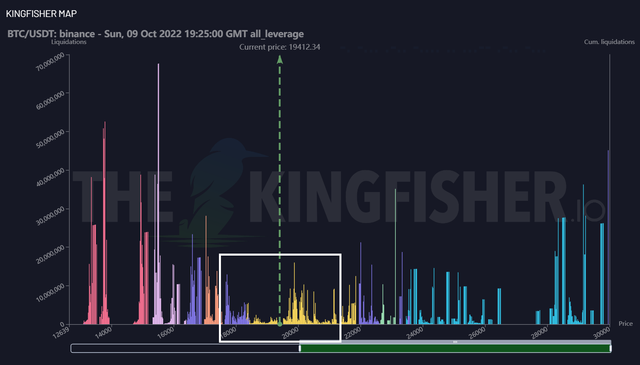

We always have big peaks in the north except that they are not close to the price, 99% of the time we will not look for them on a Daily candle of -20% to -30% that rarely happens in the event of a crash, so it will be easier for the exchanges to go higher close to the price to liquidate the shorts with large leverage between 20K to 20.5K,

If the shorts with the big leverages won't capitulate, then the price will continue to look for their liquidations to the north, but I think once we liquidate the shorts today or tomorrow towards 20.5K, the turn of the longs will come to the south!!!

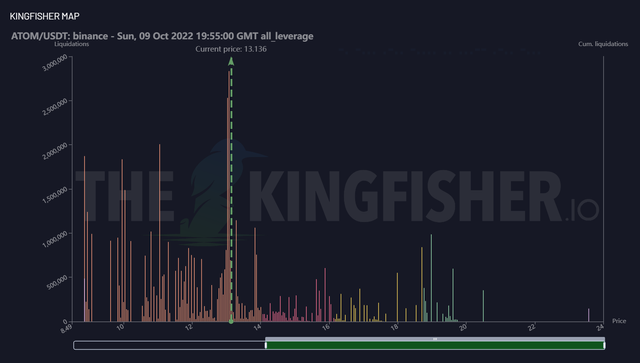

I closed my long position on ATOM once I saw the mass of longs to be liquidated to the south.

I would wait until tomorrow to see if I would take back the long position on ATOM, provided that the longs will be liquidated, and especially with a BTC which has not yet sought the liquidations of the shorts in the north, which means that the rise can still continue on ATOM at least until Thursday or until BTC clears the shorts train to the north.

The 2nd scenario is that BTC will quickly take liquidity towards 20.5K and then fall leaving a wick behind, so in this case I would open a short on ATOM to take advantage of the drop if inflation isn't as expected.

The problem with shorting now is that you can have a BTC going up and ATOM following it, or just the BTC not doing much and ATOM going down in speed to chase the longs and then the price will come back directly above, so I remain patient and I will wait to see which scenario will be validated and then I will make a decision.

Finally, no later than Thursday at 2:30 p.m., the inflation rates will indicate the hand of the market, either bearish or bullish?

Why ATOM?

Simply because I'm long term investor on Cosmos Hub Blockchain more than others projects, I can say I'm a Cosmonaute with my top 5:

ATOM / OSMO / JUNO/ SCRT / EVMOS

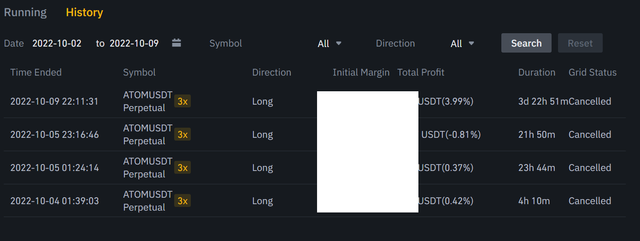

My Long position on ATOM in Grid trading has been since October 4th to today, so in 5 days I made a nice performance of 4%, it's almost 0.8% per day and in a dead market and without volatility, but what made me happy at least I took profits and automatically thanks to Grid trading.

I wouldn't hesitate to also share my losses and then try to understand the reason behind, to finally avoid making the same mistake.

- More details about Long ATOM/USDT with Grid Trading:

👉 Follow the links below to the best & Secured Exchanges that I use for trading & often gives rewards for using their platform like Learn & Earn Program, making deposit & Trading on spot or Futures, Trading Competition, ...etc.

📈 Bybit: Get up to 4030 USDT in rewards just by signing up!

https://www.bybit.com/app/register?ref=7Wgmj

📈 Binance: 10% discount on Binance Futures trading fees!

https://www.binance.com/en/futures/ref/38451215

📈 FTX: Sign Up Bonus of 5% fee discount on all your trades.

https://ftx.com/referrals#a=1768923

📈 Phemex: Up to $180 in welcome bonuses waiting for you.

https://phemex.com/register?group=718&referralCode=BAR9K

📈 Kucoin: Rewards for users Up to 10 million USDT

https://www.kucoin.com/ucenter/signup?rcode=Kvyf2d

📈 Bitmex: Up to 80 BMEX Tokens Welcome Offer.

https://www.bitmex.com/app/register/xXePh3

👀 Follow the Links bellow to my Telegram channels:

☑️ English: https://t.me/tradingwithbinance

☑️ French: https://t.me/Adaminssane1