As the Bitcoin (BTC) price attempts to climb above $66,000 following a correction, institutional crypto funds have seen a massive $600 million exit.

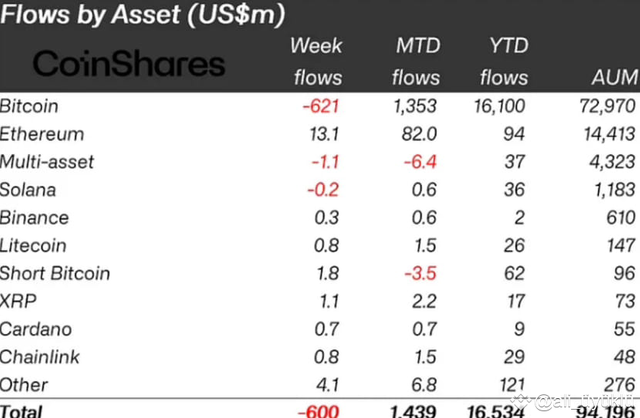

According to data shared by CoinShares, institutional crypto funds experienced the largest outflow in three months with a $600 million exit, following an inflow of $2 billion just two weeks prior.

Institutional interest in Bitcoin had reached high levels after the approval of the spot Bitcoin ETF. Last week, Grayscale funds closed with significant losses, while interest in other ETF issuers remained low. Despite a total of $600 million inflow into digital asset products, the five-week inflow streak was broken.

Ethereum continues to attract interest following approval from the U.S. Securities and Exchange Commission. Despite the large outflow from Bitcoin last week, Ethereum saw an inflow.

In institutional crypto funds, Bitcoin (BTC) led the way with a $621 million outflow.

On the other hand, Ethereum (ETH) received a substantial inflow of $13.1 million.

Massive Investment in LIDO

As institutional investors entered Ethereum, Lido DAO (LDO), Cardano (ADA), Chainlink (LINK), Ripple (XRP), and Litecoin (LTC) also saw demand.

Interest in Solana decreased with a $200 exit. Meanwhile, LDO received a $2 million investment, Chainlink $700,000, Ripple $1.1 million, Cardano $700,000, and Litecoin $800,000.

While institutional investors typically invest in various altcoins, the inclusion of Lido DAO in this list with a $2 million investment was a notable highlight.

Stay tuned for more updates.