Hype, the label behind BTS, is the latest K-pop company to make video games and though some fans are unhappy about it, we should expect to see more in future

The gaming market is larger than the music one in South Korea, so ‘K-pop labels can rack up huge profits once they make a successful game,’ says one expert

By Dong Sun-hwa

“It’s weird that a K-pop label like Hybe is obsessed with games,” reads one online comment from a BTS fan.

Similar comments criticising the company for its “infatuation” with the gaming business can be found everywhere on the internet, where fans have been venting their discontent since the label behind BTS dived into game development.

The K-pop powerhouse took its first steps into gaming in August 2019 when it acquired music game developer Superb, which recently became its new subsidiary, Hybe IM.

In 2021, the company tapped Park Ji-won, the former chief executive of Korean gaming publisher Nexon, as its new CEO.

Hybe has released a series of games including BTS World (2019) and Rhythm Hive (2021) by using the intellectual property (IP) of its singers.

Hybe joined forces with Netmarble – a game company that has produced some of the most popular games in Korea, such as Lineage 2: Revolution and Seven Knights – for BTS World, a video game in the style of a visual novel in which players assume the role of the K-pop group’s manager.

It has been downloaded 12 million times and has become one of the bestselling K-pop-related games.

Hybe has more games in the pipeline. One of them is BTS Island: In The Seom.

Members of the boy band took part in its development and the mobile puzzle game will hit the global market later this year. According to Hybe, as of April it has already exceeded 1 million registrations.

So why is the company dedicating its blood, sweat and tears to develop games? Experts say the potential profitability is one big reason.

“The size of the domestic gaming market is far larger than that of the music market, so K-pop labels can rack up huge profits once they make a successful game,” says Ko Jeong-min, a professor at Hongik University’s graduate school of arts and cultural management.

The total sales of the domestic gaming market stood at around 18 trillion won (US$14.1 billion) in 2020, compared to about 6.1 trillion won for the music market in the same year, according to Korea Creative Content Agency.

Hybe is not the only K-pop record label that has been mesmerised by games.

YG Entertainment, home to A-list stars like Blackpink and BigBang, has formed a strategic partnership with the world’s largest cryptocurrency exchange, Binance, to create a metaverse game.

SM Entertainment, which houses NCT and Aespa, released a rhythm game titled SuperStar SMTown in 2014.

The fact that entertainment companies are setting foot into the non-fungible token (NFT) and metaverse market should also be noted, Ko says.

“There are various game platforms that can be used to sell K-pop-related digital content and merchandise,” he says.

“Singers can even stage virtual concerts on these platforms by creating their virtual characters. Even if they go on a hiatus for some reason, they can still take [to] the stage in games. They can also expand their fictional universes and engage their fans.”

Wi Jong-hyun, president of the Korea Game Society (KCGS) and a professor in the business administration and economics department at Chung-Ang University, echoed this sentiment.

“A game can provide a comprehensive platform, as evidenced by the case of online video game Fortnite,” he said.

“American DJ Marshmello and hip-hop star Travis Scott recently played virtual concerts on Fortnite and attracted a large number of viewers.

It is pretty natural for K-pop labels to join forces with game companies, given that they always seek different ways to utilize their stars’ IP.”

Game publishers are hopping on the K-pop bandwagon as well, with some of them are going beyond developing K-pop games.

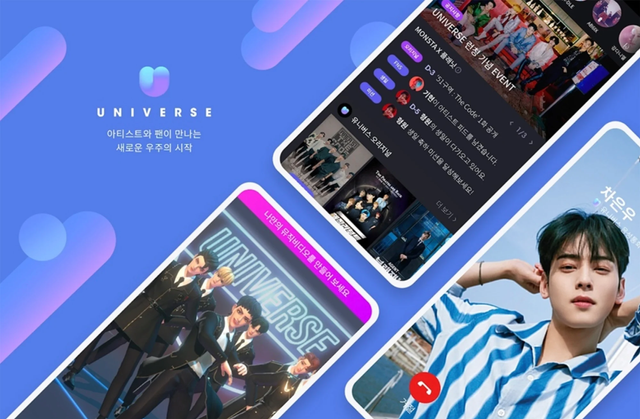

Last January, NCSoft launched K-pop fan community service “Universe”, which enables fans to receive messages from their favourite singers, like Kang Daniel, Monsta X and (G)I-dle, and to have “private calls” with their AI-rendered voices. It hit 12 million downloads in December 2021.

Partnering with K-pop agencies also helps game companies reduce risks.

“People in the game industry pour a lot of time, effort and money into developing a new game, but this does not guarantee success,” Ko explains. “But when a game features a K-pop act, the risk goes down significantly, as the group often has loyal fans, who will … buy the game or some paid items.”

Since game publishers do not tend to be experts on K-pop, they often choose to team up with K-pop labels, Wi says.

“The world of K-pop is utterly different from that of games,” he says. “So game publishers often opt for collaboration in the beginning to get a glimpse of the entertainment scene. This is the same for K-pop companies.

“Hybe, for instance, joined hands with Netmarble in the beginning and then created its subsidiary consisting of some 80 game experts.”

The collaborations between K-pop and games are likely to increase in the future, but the professors pointed out that there are challenges to tackle.

“The two industries need to remember that they are different in almost all aspects,” Wi says.

“The way that K-pop labels promote their singers is different from the way that game companies promote their games. So if they want to create synergy, they need to understand these differences to avoid conflicts and work in harmony.”

Ko underscores the significance of quality, saying: “So far, the majority of K-pop games have not been of superior quality, as they put too much emphasis on the K-pop stars.

“If K-pop labels and game companies want to garner more players in addition to K-pop fans, they should endeavour to lift game quality so that more diverse players find it entertaining.

“Maybe they can first start with a casual game to attract K-pop fans as well as young female players. I believe they should not ‘exploit’ K-pop fans just because they are loyal.”