Sometimes in trading it is very important to understand some key zones, which give us an idea of the direction of the market and entry and exit points. Today we will discuss some important zones on the chart of Pyth Network which can make your trading decisions easy and profitable.

Weekly Timeframe Analysis

In this chart, we highlight the "1W Rejection Zone" and the "1W Demand Zone."

Rejection Zone means that area where the price often stops and starts falling down.

Demand Zone is the area where the price moves upward due to excess of buyers.

These zones help traders understand which area of the market will face more resistance or support.

Daily Timeframe Analysis – Entry Opportunities

In this chart "1D Zone" and "0.3 Level" have been mentioned which is considered for a good entry.

Entry at 0.3 level can be a good opportunity if the price reaches there and remains stable.

If the price is close to the "1W Rejection Zone", then that could be a potential sell area.

This chart shows us helpful zones for entering trades on a daily basis and you will easily understand in which zone the entry and exit points will be.

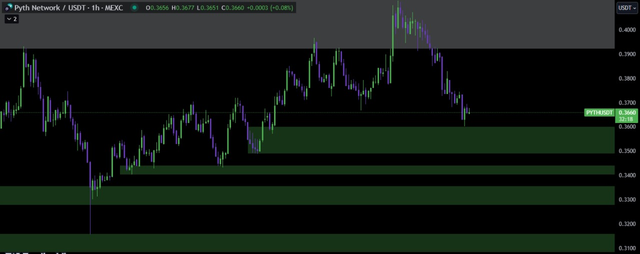

Hourly Demand Zones

In this hourly timeframe chart, multiple demand zones are shown in green color which are important for intraday trading.

These demand zones are those areas where the price can bounce back and are useful for short-term trades on an hourly basis.

By looking at the hourly demand zones you can understand at what time there can be buying pressure in the market.

Entry Point Confirmation

In this chart, a specific entry zone has been marked at 0.3450 which is in the demand zone.

It is written here that "Only enter if certain criteria are met," meaning if some conditions are fulfilled then this can be a good buying point.

The rejection in the red area makes us understand that if the price reaches there, the market can resist there and come down.

Summary

These zones and levels can prove helpful in your decision making while trading:

Rejection Zone : Those areas where the market faces resistance and sell signals are received.

Demand Zone: The area where buyers are more interested and the price remains on support.

0.3 Level and 0.3450 Level: Potential entry points if specific criteria are met.

This analysis will help you take trade decisions in a structured approach. You can analyze these zones even better using tools like TradingView.

https://x.com/ShyraNet_/status/1852319069191737696

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@theentertainer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit