Spotlight On Huobi

My first review on the Spotlight on Huobi challenge, in celebration of their 7th anniversary. Congratulations by the way!

Let's talk about margin trading.

______________________________________________________

HUOBI

is a Seychelles-based cryptocurrency exchange. Founded in China, the company now has offices in Hong Kong, South Korea, Japan, and the United States. In August 2018 it became a publicly listed Hong Kong company.

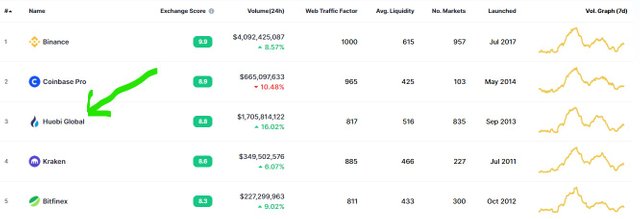

According to wikipedia

Huobi being the cryptocurrency exchange with the 3rd highest traded volume daily means it has outstanding features that encourage users to adapt to the exchange, despite its numerous competitors. I'll be outlining the ones that stand out to me.

_______________________________________________________

Favourite Feature #1 - Margin Trading

Margin trading is a system, through which a broker or exchange leverages your account balance to help you open trades bigger than your account. With a little bit of cash, you can open a much bigger trade in the crypto market. and then with just a small change in price moving in your favor, you have the possibility of ending up with massively huge profits. Margin Trading is using borrowed funds from an exchange to trade a digital asset. This becomes the collateral for the loan. Huobi offers up to 3x leverage for their traders.

_________________________________________________________

Margin Trading Tutorial on Huobi

Step 1- Requesting for margin/loan

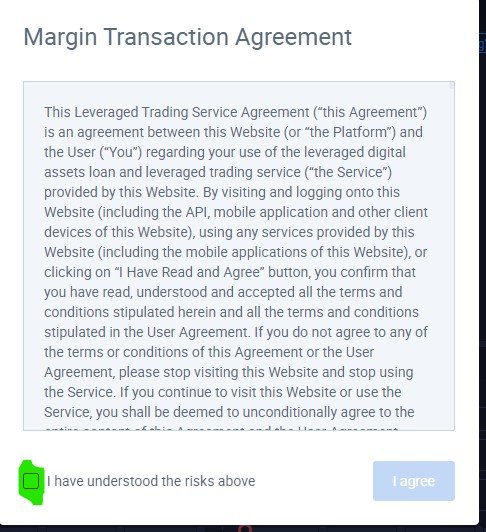

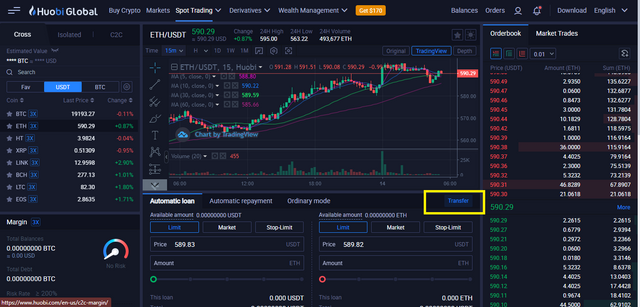

i. Login to your HUOBI account and move the mouse to spot trading, on the appearing sub-menu select margin, and switch margin type to cross, accept the terms that pop up, as shown below.

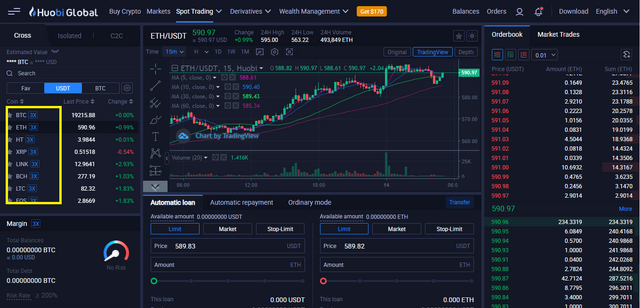

ii. Select a trading pair

iii. Click on TRANSFER. you can use any supported token to fund the margin account.

iv. A dialogue box will appear, input, and verify the details of the funding transaction.

v. Once your transaction is successful, you can proceed by selecting loan on the trading platform.

vi. A dialog box will pop up, the maximum available loan amount based on the principal balance will be shown. Make sure to select an amount within the available loan amount, and the loan will be accepted if the principal is adequate. in the image below, BTC is the token to be borrowed using USDT transferred into the Margin Account.

PS:

Every token has a minimum and maximum loan amount, specific to that token. If the principal is lower than the minimum loan amount, the available loan amount is 0. To rectify this, top up the principal on the Margin Account.

_______________________________________________________

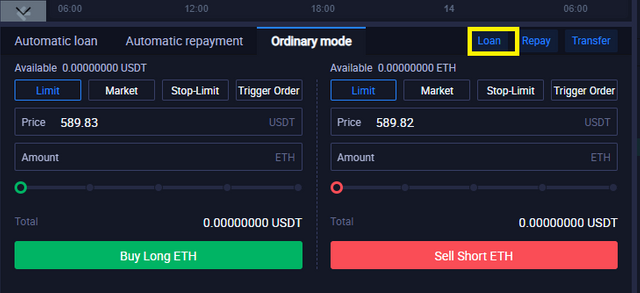

Step 2 - Margin Trading

You can now buy long or sell short, this is simply buying at a low price and selling at a high price, after analysis. Margin trading uses little assets to earn a bigger profit. Although accurate prediction of future price movements can allow you to earn a higher profit, if the market moves in the opposite direction, the loss will also be bigger. Therefore, small capital traders should avoid taking on highly leveraged trading positions to avoid losing substantially.

Buying Long:

If your analysis is that a token's price will rise, transfer funds to your margin account, borrow a token, buy the token at a lower price, and sell at a higher price. Repay loan and loan interest and earn the price differential. To Buy Long, borrow USDT to purchase the token, say ethereum at a low price and sell at a higher price to earn a profit. Select Market to sell at market price. Buy at a low price and sell at a high price, repay the loan and interest on the loan, and earn your profits.

Selling Short:

If your analysis forecasts a fall in the token's price, transfer funds to the margin account, borrow token, sell the target token at a higher price, buy back a lower price, repay the loan and loan interest and earn your profits.

Watch this video tutorial to learn more.

TUTORIAL ON PLACING TRADES

________________________________________________________

Step 3 - Repaying a Loan and interest

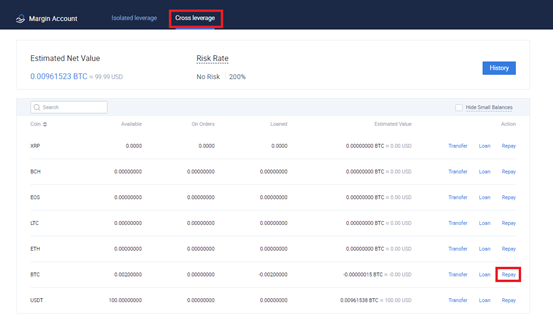

i. After working with the loan, to pay back, click Balances on the top corner of the page, select Margin account sub-menu option and click the Cross Leverage tab as shown below to see outstanding loans.

ii. Click on the ‘Repay’ button on the right side to access the Repay dialog box, input the quantity to repay, verify and input amount and click the Confirm button. If there is insufficient token quantity to repay the token and interest, it is necessary to top-up transfer into the ‘Margin Account’ the differential amount to successfully return the loan.

source

Conclusion

I hope this post helps you navigate the Huobi website better. Remember to place trades wisely and do not over-leverage your account. I would love to get feedback from you.

-----------------------------------------------------------------------------------------

CC;

@steemitblog

@steemcurator01

@steemcurator02

All images were designed by me or screen snipped from the Huobi website, unless otherwise stated.

--------------------------------------------------------------------------------------------

THIS POST IS SET TO 100% POWER UP.png)

.png)

Thanks for promoting Steem by sharing you post on twitter

( If you no longer want to receive notifications and upvotes from us, reply to this comment with the word

STOP)Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TWEET

@steemcurator01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking part in the Spotlight on Huobi Challenge.

And thank you for setting your post to 100% Powerup.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit