Introduction

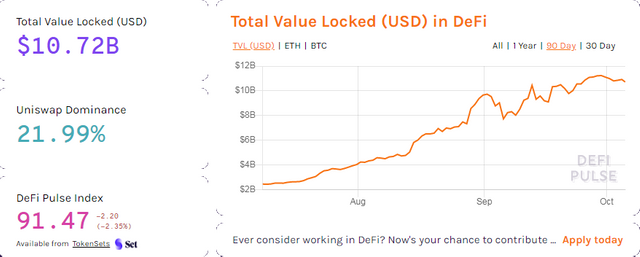

The defi space has been bubbling over the last few months, with most assets already posting more than 100% increase for the last few months. Coins like link, Maker, Compound, NEXO, and NUO have all had a great year with huge profits and returns for investors. In early 2019, there was only $275M of crypto collateral locked in the DeFi economy. By February 2020, that number had grown to $1B, and it has continued to grow impressively throughout the year, hitting $4B in July and is currently sitting on a whopping $10.7b. This growth is possible due to the huge interest from the crypto community and heavy investment in the space because of its unique nature.

What is Defi: DEFI-Decentralized finance could be simply defined as a crypto ecosystem made up of financial apps designed on leading blockchain platforms. These apps are known as Dapps and they operate independently without a centralized authority like the traditional financial system.

Defi, in short, is the use of blockchain technologies (including smart contracts, decentralized asset custody, etc.) to replace all “intermediaries” with program codes, therefore maximizing the efficiency of financial services and minimizing costs. These digital assets are created and operated on the Ethereum network, this is possible due to the nature of the Ethereum network that supports the creations of decentralized apps(Commonly known as Dapps). These programs are automated and runned by financial smart contracts in the Ethereum blockchain.

One of the most amazing features in the defi space how the returns scheme works. Investing in defi projects arms and an investor with two options:

They could either stake their tokens (e.g. Ethereum,Tron) as collateral and take a loan in the form of stable coins like DAI, USDC, Tether, etc at an annual interest rate.

Or users can loan out their tokens (e.g. Ethereum, DAI, tether, etc ) and earn an annual interest rate.

However, in order to specifically use a defi application to gain more interest on crypto or a stable coin, the user will have to utilize a tokenized version of the asset WBTC, renBTC, hBTC, sBTC, imBTC, tBTC, and pBTC,Wtrx, Or they can swap their token to a listed ERC-20 token.

Unlike in centralized exchanges where assets are staked and a 30day interest rate of 0.8% to 8.5% depending on the platform chosen( Coinlist, Cred, Blockfi, Bitfinex, Crypto.com,)is paid to the investor at the end of the month while the funds are held in custodial fashion.

However, leveraging with a defi application allows for lending and earning yields by providing liquidity, they can transfer the funds they want to use into Ethereum (ETH) or an ERC20 and Trx or a TRX20. If the investor wants to gather yield off of BTC they can swap the coins for ETH tor TRX and again swap for something like WBTC, renBTC, or hBTC.

Now, most of the tokenized bitcoin assets today can be used on nearly any defi liquidity or lending provider built on Ethereum.

The Tron Defi Ecosystem

TRON Foundation was established in September 2017 by current CEO Justin Sun and had its mainnet launch in June 2018, to which it migrated all the TRX (ERC-20) tokens that previously circulated on the Ethereum blockchain to its native asset(TRX, TRX20). And since then Tron has become a better Ethereum project in a number of ways despite its infancy when compared with Ethereum. The Ethereum network has served as a home to any defi apps and other blockchain projects created on the network and powered by smart contracts. However, Both the Tron and Ethereum network leverage concepts like decentralized finance (defi), decentralized apps (dapps), and permissionless systems for token creation (ERC20 & TRC20)network is offering the same features and services of Ethereum and even better. This is why I can rightly call the Tron network a better Ethereum

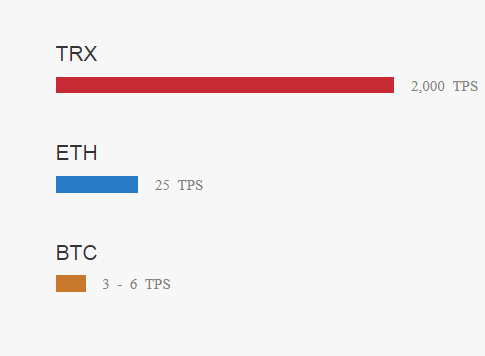

The Tron network has been able to improve some of the shortcomings of the Ethereum network, One of the major limitations of the Ethereum network is scalability. On February 7, 2020, Coin Metrics data shows the BTC chain processed roughly 333,000 on-chain transactions. ETH saw a total of 626,000 transactions in the 24 hour period while TRX did around 816,000 on a 24hours timeframe. While ETH has been consistently above BTC transactions per day, TRX has also been consistently above ETH’s daily average. The Tron blockchain is noted to be one of the scalable blockchain networks in the world.

TRX outperforms Ethereum and Bitcoin in Tps

Both Ethereum and Tron have tokens that represent the stablecoin tether (USDT), Statistics from Tronscan on 1st October 2020 shows a whopping $4 billion USDT held on the Tron network. The fees on the Tron network is much lower when compared with other blockchains. The Tron Foundation and Justin Sun have been able to land impressive deals and mergers this year with famous exchanges and brands, including the social media-based platform-Steemit, Samsung keystone wallet inclusion, BitTorrent, Tron TV, Poloniex exchange, Bidao, USDT-TRC20 Token, and Dlive.

A tweet from @justin sun on twitter

My Favorite Defi Project on the Tron Blockchain-JUSTSWAP

The Tron foundation on the 18th of August launched a project that will revolutionize Defi on the Tron network. JustSwap is the first decentralized token exchange protocol on Tron (TRX). It allows users to exchange TRC20 tokens as well as earn trading fees and mining rewards at the same time.

Justswap allows users of the protocol to become liquidity providers. As part of their efforts in providing liquidity in the network, these liquidity providers also earn trading fees and mining rewards thus providing incentives for more TRX and TRC20 holders to use JustSwap rather than going through the regular crypto exchanges that charge trading fees. Justswap also supports Wbtc, BTC, and USDT transactions.

Furthermore, JustSwap is a central gateway for the Just (JST) DeFi project’s ecosystem. Users of Just use TRX as collateral to borrow USDJ. When paying the debt, users repay the USDJ in addition to a stability fee paid with the JST token. The latter two tokens are TRC20 tokens and JustSwap will be the perfect decentralized token exchange for Just (JST) users. Also, the JustSwap will is acting as a solid foundation for the Just defi project,

Conclusion

The Tron foundations had made a lot of progress within the Defi project and its by fat a better hosting ground for defi projects. We hope to see more defi related projects launched on the Tron network. following the huge success of the many projects launched on the Tron network the JUST, and JUSTSWAP projects are by far the best I have seen in the block.

I actually feel that the Defi economy has come to stay and i am very positive about its future in the crypto firm.

@whitestallion

Very informative post.How did you broaden your knowledge in cryptos??? I am curious to learn about USDT.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks mate. Researching about a desired crypto or protocol is the best way to learn. You can try it out sometimes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations you are one of the winners of the Steem Crypto Challenge Month...

Thank you for taking part

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much for this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's an important information. will love to know more and learn as well.

thanks for sharing.

£onepercent £nigeria

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steemit 1st Steps for New Users

https://steemit.com/hive-142140/@punicwax/steemit-1st-steps-for-new-users

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

YOUR TEXT IS VERY MUCH INFORMATIVE , I GOT SUPER INFO WITH THIS TEXT

#onepercent

#pakistan

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am very happy to add to the value of content in steemit. Thanks for reading through my post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So much details and food to take home from your post on crypto and how it functions. I will personally want to learn more from you. I will inbox you on that. Thanks for sharing.

#twopercent #cameroon #minnowsupport

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am always happy to help. You can hit me up and we talk. Have a nice time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit