Foreword:

This is my entry to @steem.leo's weekly writing contest. Once again I am taking this chance to thank @steem.leo for selecting my entry as one of the winners in the previous contest. Here goes...

If you are anticipating a rah-rah post on how I have gone all-in to cryptocurrencies and explaining why everyone should do the same, then you might be in for a disappointment 😅. While I am quite heavily invested in cryptocurrencies, they certainly are not my only investments. In this article, I will share a little about the asset classes that I invested in. They will be ranked according to weight with my heavier investments ranking first.

Cryptocurrencies

A bulk of my portfolio is in cryptocurrencies. I mentioned in one of my earlier posts that I first got into cryptocurrencies because I was fascinated by the technologies and believe that they will be the future. Along the way, I got greedy and wanted quick gains. In the end, more haste and less speed.

Those failed investments really got me thinking. At a certain point, the thought of capitulating and selling all my cryptocurrencies did cross my mind. But I did not leave. In fact, I read up more. And the more I read, the more conviction I get that cryptocurrencies can be an alternative to our current financial system.

Not only did I read up on cryptocurrencies, I also read up on our current financial system. How central banking had failed us time and again. Recently I was reading about the great inflation/stagflation in the 1970s, a period when the world lost its gold standard. There are quite a few parallels that can be drawn between then and now. Nixon vs Trump. Burns vs Powell. Huge US budget deficits then and now.

All these got me thinking and started to worry about a possible period of high inflation. If you are not invested in alternative assets such as gold and cryptocurrencies, then you are grossly underestimating the risks.

Equities & Derivatives

I am almost equally heavy on equities & derivatives as compared to cryptocurrencies. I do want to point out that my equities & derivatives portfolio is actively managed. I typically do not hold a particular stock for more than a year and I often make use of options to hedge my positions. Hence, I do not want you to wrongly think that I am heavily longing the stock market now.

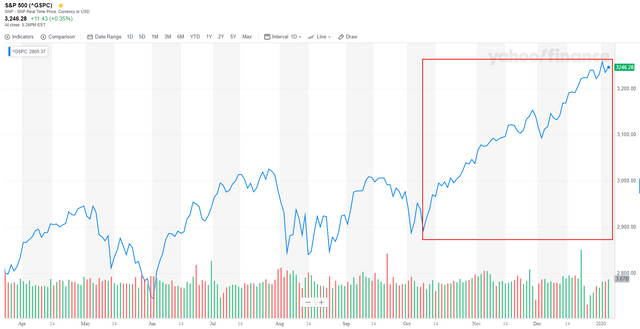

Since we are on this topic, I just want to give some quick thoughts on the current stock market price. Since October last year, the stock market has been on a tremendous run.

Source

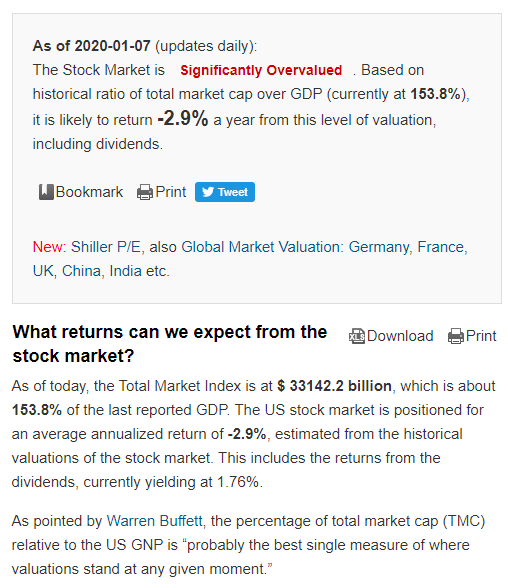

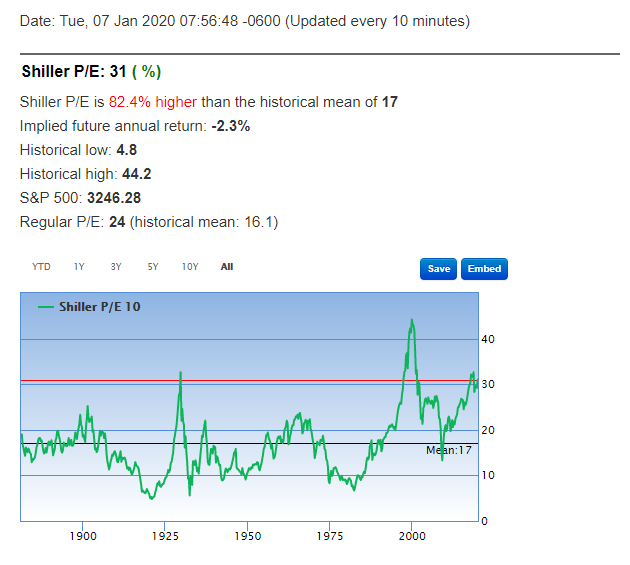

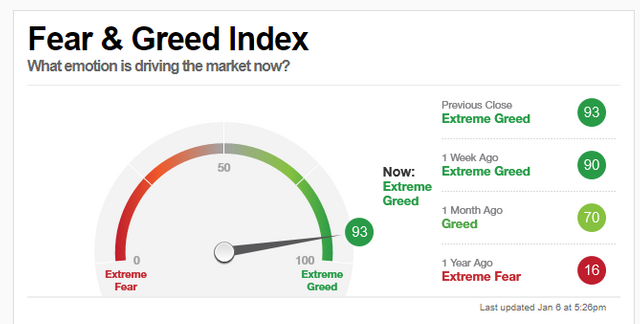

However, various indicators are flashing warning signals. The Buffett Indicator, Shiller's PE and even the fear/greed index are all showing extreme euphoria and greed.

Source

Source

Source

It therefore remains to be seen how much higher can the stock markets continue to run up without a correction. I am personally not very optimistic... Hence, you can probably guess what my equities & derivatives portfolio will look like 😎.

Bonds

Bonds constitute a much smaller stake in my overall portfolio. I am just treating them as long term savings instrument rather than an active investment.

Digital Collectibles

Last but not least, I also own some digital collectibles such as Gods Unchained cards and Splinterland cards. They do not worth much now, but I believe in digital ownership and if there are sufficient adoption of those games, then these collectibles might just prove to be the best investment I ever made 😂.

Conclusion

Overall, I consider myself quite a risk taker when it comes to investments. However, I always do my due diligence and research before entering into any position. So there you go. These are my investments and I would love to know about yours too. So do consider submitting your entry for contest.

10% of post rewards goes to @ph-fund and 5% goes to @leo.voter to support these amazing projects.

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

It's good to have a diverse portfolio. While crypto is interesting to follow and cold have huge returns there is still a lot of unknowns in the sphere. I have a pension fund and a little in silver as well. Had a few shares but too slow to do anything with them and big fees so sold them off.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wise choice. Especially silver 🙂. I think they might do better than gold if the stock market turns sour

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really, I admire your class of investments and do hope that you cash out big in the nearest future. As long as the recklessness of the present day financial system goes untamed, crypto assets will be a big deal in the years ahead. Cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! I also share the same belief on crypto assets but only on truly decentralized cryptos 😉

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @culgin! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congrats! on your upvotes from the IBT Community

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit