Inflation. A lot can be said about this. It is a very important metric no doubt about that.

Grinding numbers on the Steem blockchain for a long time now, and one can start to apricate the meaning of inflation.

Steem is a unique blockchain that distribute its rewards in quite a unique way and allows ordinary people to earn something. More on Steem inflation distribution in this post STEEM Overall Inflation Distribution | Authors, Curators, Witnesses, DAO | Who are the top earners from each category.

Inflation is something that attracts new users and gives incentives. At the same time, it can put pressure of the price of the asset as giving away free things always ends up depreciating the asset.

Interesting case to look at are the Splinterlands cards. There are two sets of cards. The once you buy from the packs, and the once you receive as free rewards cards from your playing (daily quests). The reward cards are far cheaper on the market and are struggling to maintain their price, while the once that are bought, usually do much better in terms of price. Even though in many cases, some of the reward cards have better stats and usability than the cards from the packs.

The tribe tokens are another interesting case to look at on the Steem Blockchain. Their inflation rates are different but in most of the cases they are quite high with double digits. When this inflation is distributed to a limited number of users, (in the range of 100 to 1000) the pressure on the price can be significant as we can notice. All the tribes are struggling to maintain their price at the moment cause users constantly receive free tokens.

Finding the balance of the inflation is a hard subject. A whole science revolves around it. Usually there is no right solution but just oscillating between numbers.

1.Bitcoin BTC

The coin that started the crypto movement and the one that we need to be greatfull. Without Bitcoin no other crypto would be in exitance today, including Steem.

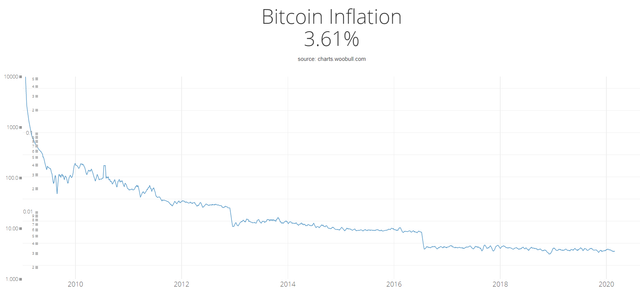

Since this is the big boy lets take an overall look at its historical inflation.

source

The bitcoin inflation was more than a 100% in its first years 2009 and 2010. In 2011 it dropped under 100%, somewhere around 60%, then in 2012 to around 30%, and its has been going down ever since to a 3.61% that we have today in March 2020. The halving is this year and Bitcoin inflation will go to 1.8% after May 12, 2020. This is lower than most of the central banks inflation that is around 2%.

Method of distribution. Bitcoin is a proof of work (PoW) blockchain and its method of distribution is mining. Miners gets the rewards from the bitcoin inflation.

- Bitcoin inflation 3.61% (1.8%)

- Method of distribution – Mining

2.Ethereum ETH

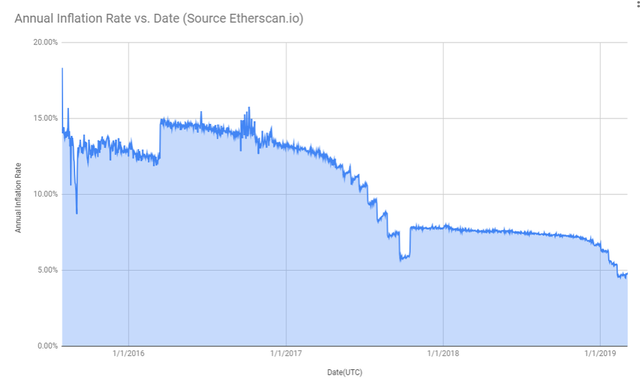

The blockchain that introduced the smart contract concept. Here is a chart of its historical inflation.

source

Ethereum was launched in 2015 and it started with around 20% inflation. Then the inflation went down to 15% and these days the inflation rate for Ethereum is somewhere around 4.5%.

Ethereum as well as Bitcoin is a proof of work blockchain and the inflation is distributed to miners. There are intentions however for Ethereum to become a hybrid between proof of work and proof of stake blockchain in the future.

- Ethereum inflation 4.5%

- Method of distribution – Mining

3.Ripple XRP

Ripple has a bit of controversial status in the crypto world and it’s been criticized for its centralization and corporate structure. Ripple doesn’t need miners to run their blockchain. They are doing it buy them self. I’m not totally familiar with how their technology works.

Since they don’t need people voluntarily to run the blockchain, but it’s done on a corporate level, there is no need for inflation rewards. However, they have coins locked up in an escrow and they are selling them at their will. The inflation in this case are the coins locked out from the escrow and put on the market.

According to viewbase.com the XRP inflation at the moment is 27%. This is quite high, and it means they have been locking out some coins recently. In the previous years the inflation of XRP is somewhere around 6% to 8%.

- XRP inflation 27%(6% to 8%)

- Method of distribution – Escrow release

4.Litecoin LTC

Well Litecoin is the second crypto out there and in many ways mimics the bigger brother Bitcoin. This means it is a proof of work blockchain and its inflation goes to miners. The same as Bitcoin it has halving events that decrease the inflation. Litecoin had its halving in August 2019 when the inflation went down from 8.4% to 4.2%

- Litecoin inflation 4.2%

- Method of distribution – Mining

5.EOS

The Steem younger but bigger brother EOS. The third blockchain of Dan Larimer after BitShares and Steem. EOS as Steem is a proof of stake blockchain, or more precisely delegated proof of stake (DPoS). This means that there is some mechanism to reward the stakeholders

EOS has a 5% fixed inflation that is distributed in two reward pools. 1% goes to the block producers (20% of the total inflation), and 4% goes to a worker’s proposal system (80% share of the inflation) that will be used for future. The block producers are elected by the stakeholders, so basically the stakeholders decide who will get the rewards. I’m not sure do some of the BP share their rewards with the voters.

- EOS inflation 5%

- Method of distribution – Block Producers + Development Fund

6.Binance Coin BNB

Another of the corporate blockchains in the top 10. Binance has an interesting model and in its case, it doesn’t have inflation, but quite the opposite it is a deflationary coin, meaning it has a negative inflation. The blockchain run by the Binance exchange and they offer services trough it, like lower fees for trading etc. Binance uses 20% of profits to buy back and burn BNB, until 100MM BNB are burned. According to viewbase.com the deflation rate is around -2.35%. What this means if someone want a BNB coin there is no way to mine it or get reward from inflation but you need to buy it.

- BNB deflation -2.35%

- Method of distribution - NONE

7.Tezos XTZ

Tezoz is also a delegated proof of stake coin. The inflation goes to the stakers of the coin and the validators/block producers. The inflation is set at 5.5%

- XTZ inflation 5.5%

- Method of distribution – staking + validators

8.Cardano ADA

Cardano is under development in phases called Byron, Shelley, Goguen, Basho and Voltaire. I’m not sure about it inflation rate and it is something probably yet to be set. On the web there is a staking caclucator that gives 3.5% ROI.

- ADA inflation - unknown

- Method of distribution – staking + development

9.Monero XMR

Monero is the privacy coin among the top coins. It is a proof of work blockchain that means inflation is distributed to miners. The current rate of inflation is 2.86%.

- XMR inflation 2.86%

- Method of distribution – Mining

10.TRON

Another delegated proof of stake blockchain. Figuring it out the infation of TRON is a bit trickier since the rewards for the super representatives (block producers) is coming from a reward pool (fund) of already exciting coins that are locked by the Tron Fundation, as stated in the developers.tron.network.

1.Candidate Reward(Vote Reward): 127 individuals updated once every 6 hours will share 1,152,000 TRX. The reward will be split in accordance to the votes each candidate receives. Total reward for candidates will be 1,681,920,000 TRX each year.

2.Super Representative Reward(Block Reward): The TRON Protocol network will generate one block every 3 seconds, with each block awarding 16 TRX to Super Representatives. A total of 168,192,000 TRX will be awarded annually to 27 Super Representatives.

3.There will be no inflation on the TRON network before January 1, 2021, and the TRON Foundation will award all block rewards and candidate rewards prior to that date.

The viewbase.com calculates a 0.77% inflation. TRON super representatives share their rewards with their voters.

- TRON inflation 0.77% (Unknown)

- Method of distribution – Staking

STEEM

At the end our bellowed Steem. As for many things with Steem, calculating the exact inflation is complicated. This is mostly because of the SBD. We know that at certain point liquid STEEM stopes being printed and only liquid SBD is rewarded. SteemPower is rewarded all the time.

The rate that new tokens are generated was set to 9.5% per year starting in December 2016, and decreases at a rate of 0.01% every 250,000 blocks, or about 0.5% per year. The inflation will continue decreasing at this rate until it reaches 0.95%, after a period of approximately 20.5 years.

Here is a table announced way back in 2017.

| Year | Supply | Inflation | New supply |

|---|---|---|---|

| 2016 | 250,000,000 | 9.50% | 23,750,000 |

| 2017 | 273,750,000 | 9.00% | 24,637,500 |

| 2018 | 298,387,500 | 8.50% | 25,362,938 |

| 2019 | 323,750,438 | 8.00% | 25,900,035 |

| 2020 | 349,650,473 | 7.50% | 26,223,785 |

| 2021 | 375,874,258 | 7.00% | 26,311,198 |

| 2022 | 402,185,456 | 6.50% | 26,142,055 |

| 2023 | 428,327,511 | 6.00% | 25,699,651 |

| 2024 | 454,027,161 | 5.50% | 24,971,494 |

| 2025 | 478,998,655 | 5.00% | 23,949,933 |

| 2026 | 502,948,588 | 4.50% | 22,632,686 |

| 2027 | 525,581,274 | 4.00% | 21,023,251 |

| 2028 | 546,604,525 | 3.50% | 19,131,158 |

| 2029 | 565,735,684 | 3.00% | 16,972,071 |

| 2030 | 582,707,754 | 2.50% | 14,567,694 |

| 2031 | 597,275,448 | 2.00% | 11,945,509 |

| 2032 | 609,220,957 | 1.50% | 9,138,314 |

| 2033 | 618,359,271 | 1.00% | 6,183,593 |

| 2034 | 624,542,864 | 1.00% | 6,245,429 |

| 2035 | 630,788,293 | 1.00% | 6,307,883 |

We are somewhere around 7.5% at this point, if we excluded the complication with SBD.

In a recent analysis I made STEEM Overall Inflation Distribution | Authors, Curators, Witnesses, DAO | Who are the top earners from each category, the overall monthly inflation with SBD conversions at the price in that moment was around 2.1 million STEEM per month. If we add the rewards for proof of stake (VESTS), 15% more that number will be somewhere around 2.41 million STEEM per month, or somewhere around 29 million per year. That is a bit higher than the 26 million predicted from the table above. But take this number with big reserve since this is the beginning of the year and we are now seeing more SBD printed. With higher prices less STEEM will be printed.

The method of distribution for STEEM:

- 32.5% Authors

- 32.5% Curators

- 15% Steem Power Holders

- 10% Steem Proposal System.

- 10% Witnesses

STEEM has 5 reward pools 😊. Yep its complicated. For the purpose of the summary will put it in two methods, staking and proof of brain.

- STEEM inflation 7.5%

- Method of distribution – Staking + Proof of Brain

Summary

At the end here is the table at the coins analyzed here with their inflation rates at the moment and the method of distribution

| Coin | Inflation | Method of distribution |

|---|---|---|

| STEEM | 7.50% | Staking + Proof of Brain |

| Bitcoin | 3.61%(1.8%) | Mining |

| Ethereum | 4.50% | Mining |

| Ripple | 27% (6% to 8%) | Escrow release |

| Litecoin | 4.20% | Mining |

| EOS | 5% | Block Producers + Development |

| Binance | -2.35% | None |

| Tezos | 5.50% | Staking + Validators |

| Cardano | Unknown (3.5%) | Staking + Development |

| Monero | 2.86% | Mining |

| TRON | 0.77% (Unknown) | Staking |

From the above we can notice that Steem has the most unique and at the same time complex method of distribution of the inflation. It is the only coin that has the so called Proof of Brain system implemented, where users can earn from posting. This is a doubled edge sward where it put more coins in more people hands but at the same time it depreciated the value of the coin. If larger audience is not reached the coin has risk of loosing value.

With the HF21/22 the authors share was reduced, basically from around 56% to a 32%.

Here is the overview.

| Before HF21/22 | After HF21/22 | Diference | |

|---|---|---|---|

| Authors | 56.25% | 32.50% | -23.75% |

| Curators | 18.75% | 32.50% | 13.75% |

| Steem Power Holders | 15.00% | 15.00% | 0.00% |

| Steem.DAO | 0.00% | 10.00% | 10.00% |

| Witnesses | 10.00% | 10.00% | 0.00% |

The share of the inflation that is now given out for free is at 32.%. Its also worht noting the introduction of the superlinear reward curve, that basically gives more rewards to post with more larger voting stake.

It is worth noting that nowadays many apps and game are built on top of Steem using the powerful custom JSONS feature of the chain, and they are rewarding their users in a unique way as well.

Still Steem remains one of the unique coins in the top 100 that is rewarding users. Maybe because of this it has a special place in all the Steemians hearts, and they don’t want to give up easily on this chain.

All the best

@dalz

Disclaimer: Human errors are possible so double check the information above before taking a financial decision!

Posted via Steemleo

Steem surely is an interesting case with its inflation since it’s not only nodes that need to stake or dApps but individual users stake too to use the chain, get rewards and access resources!

I think that once we get more burn functionally going for say things like atomic swaps, content promotion, smart contracts, features on communities etc it will take even more inflation out of the game!

But for now I’m still thinking we need more liquidity especially with Justin Looking to get steem on more exchanges!

I think it’s the one chain that has so many uses for its inflation and it will only keep growing! We’re at the beginning and 7.5% is high imagine in 5 years from now when its at 5% or 10 years at 2.5% how hard it will be to extract 1 steem from the reward pool well think back to these days when earning one token was as easy as making a comment lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If STEEM is priced at 5$ you get liquidity automatically :)

Fact from the above presented!

Sure hope so.... and I hope to be around to see this :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Inflation is an interesting subject that is going to change over time. We are seeing the expansion of technology that is demonetizing things all over the place. This along with the need to fund even more technological progress, means money gets eaten up.

With crypto, it all comes down to the network effect. If the inflaiton rate is 50%, that does not matter if there is a doubling of the users each year. This more than offsets the extra tokens.

Crypto inflation exists to spur on growth. When it is going the opposite way, then problems exist.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes totally agree on this .... if more users are around, inflation will get eaten up fast. When not as much, we all feel the pressure. All we need is some bull run :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Tweet:

https://twitter.com/Dalz19631657/status/1233879611165024265

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @dalz!

You raised your level and are now a Dolphin!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From past experiance inflation rates between, 2%, 4%, 8% .... doesnt realy matters .... (it may have some influence if the inflations is 20%, 30% or higher .... once the buls are back, first BTC, then alts, everything goes to the moon :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!shop

$trdo

!BEER

for you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

View or trade

BEER.Hey @coininstant, here is a little bit of

BEERfrom @eii for you. Enjoy it!Learn how to earn FREE BEER each day by staking.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit