Some time ago I bought a big chunk of LEO mega miners. I wrote about this before but I want to share a bit more detailed my reasoning and my calculations. Maybe it turns out I have a big brain fart and nothing is true.

I dont remember the actual the amount but it was somewhat 3500 miners and was around 21k Steem.

I want to build a big stake in the Leo community.

Miners

Stake right away

I am not smart enough and/or way to lazy to get the numbers 100% precise and that is good enough for me.

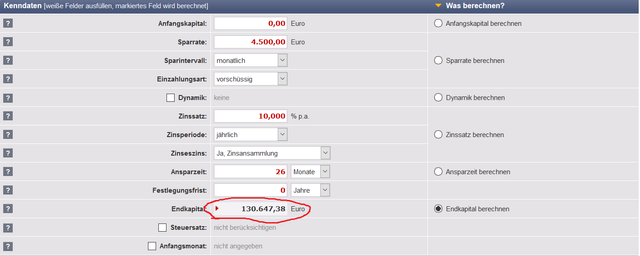

With my miners I get somewhat between 130 to 180 LEO day so I took the 150 daily and 4500 LEO monthly as an average.

This can change a lot as there are still a lot of normal miners on the market which cuts into my earnings the more get staked.

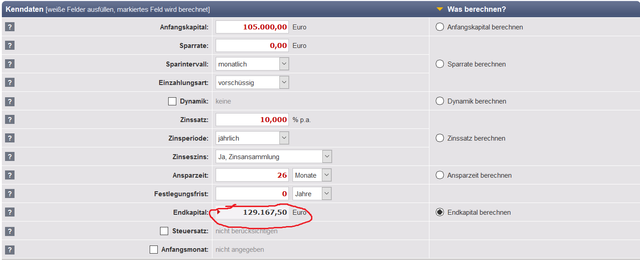

I used 10% interest for the curation rewards.

As you can see it takes roughly 26 months till the miners are on par with just buying Leo from the market.

One big difference was that there was no averaging in. You were able to buy miners from the market under the issue price of 6 Steem but not in the quantity I was looking for.

If you want to buy 105000 LEO without driving the price up significantly you better calculate in some time. If you in a hurry you better calculate in a huge premium which made the miners the more attractive option for me.

So the miners were a good way to get a lot of Steem into the LEO ecosystem quick.

If you have a timeframe over 2 years the miners were the better choice.

But the biggest advantage for the miners is the following.

After buying the stake and the miners result in the same LEO stake, I still have the miners. While the liquidity is not very high I could still power them down and sell them even if I would sell them to the price I bought them my LEO stake would be "free" (of course there is opportunity cost and no curation rewards I would have made while just working with the Steem I put into it the first place).

Both have up and downsides depending on your time horizon and what stake you are looking for to put into it.

The longer your gameplan is the better the miners are. The more Steem you want to move into LEO the better the miners are.

But as this many miners are still on the market it is of course not risk free and it might take longer but that you end up with 2 assets, even when they are highly correlated ( if LEO would go down tomorrow both would be worthless )I like the chances on that gamble more.

I have a some LEOs delegated to an alt-account to curate, some delegated to @spinvest-leo and some miners. I am very happy with #steemleo today and I see a great future to it.

!trdo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I sure hope they do.

I am considering delegating as well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have about 250 steem I am going to sink into LEO and I am not sure if I should just buy and stake LEO or do split it between LEO and LEOMM (or LEOM). It seems like have some miner tokens would be beneficial in the long run. Hmmmm.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LEOMM are sold out. You have to pay high premium to buy them. There are still 144,785 LEOM to be sold. Buying LEO and use them for curation will also earn LEO. One has to figure out in a long time frame which strategy is profitable.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LEO is quite cheap atm. So I would tend to buy LEO atm.

LEOM have already a 25% premium on it so this changes the numbers quite a bit but imo the longer the timeframe the better you are off buying miners.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As @dtrade mention the numbers are not true anymore as LEOMM are sold out and only LEOM left. They carry already a 25% premium compared to the LEOMM

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think #steemLeo still has lots of room to grow. It's probably the biggest and best branch from steemit. It may one day even make a stand-alone platform. I have a few Leo, but would like more. I better get buying before they become too expensive

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

that would be sweet

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

$trdo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @goldcoin, you successfuly trended the post shared by @flipstar!

@flipstar will receive 4.37706788 TRDO & @goldcoin will get 2.91804525 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@flipstar has earned 4283 LEO from miners in November 2019, according to the @leo.stats report ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

that is quite a bit less.

I calculated again with 4000 LEO monthly and with that it takes around 29 months then.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @flipstar, your post successfully recieved 4.37706788 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit