What is Coronavirus?

We have all heard the story. WHO is ringing alarm bells, people are getting quarantined but there isn't enough panic yet. For understanding what the virus, here is WHO. I am no expert on viruses so reading the above should give anyone a fair understanding of what it is.

Why does it matter?

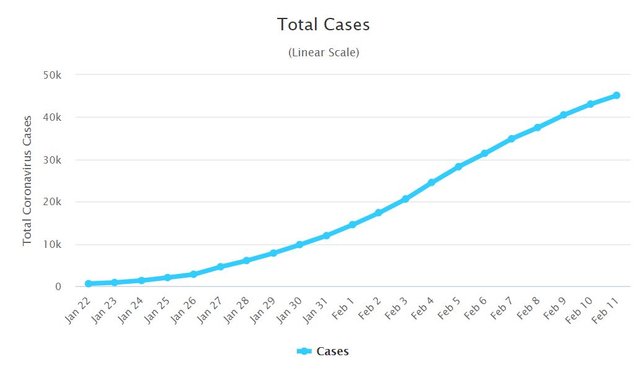

From the point of view of how scary is the virus, this chart is interesting -

Image source

In fact, the Image source also shows some other interesting stats. Since the virus was identified, there have been around 1,100 plus deaths and around 44,000 plus infected. That is more than SARs.

WHO, Governments, and even Central banks have all raised alarm bells over the virus.

The country largest impacted by this is China, registering the most number of infections and deaths, followed by neighboring South Asian nations.

Why does China matter?

Due to the spread of the virus, China has taken strong action. There has been criticism about China locking down an entire city but it's China and they can do that. Flights aren't going into China, many are pulling out of Mobile World Congress, and there is panic in China as Shanghai and Beijing have turned to ghost towns.

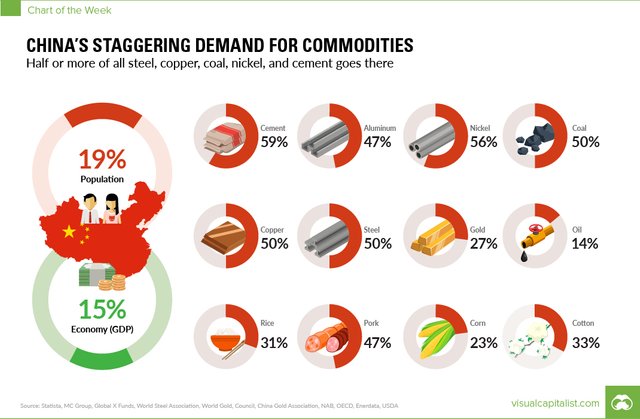

China also happens to be a pretty big economy and consumer of base metals. It's economy is about US$12 trillion. And consumption? Have a look below -

Image source

An old chart but helps paint the picture well

With China under lock-down, one can expect a gigantic supply shock, and also a demand shock. This article mentions just one story. However, think of any other industry and China will be big part of that industry's supply chain.

With all that is going on, and what I believe is a seriously serious situation, how are markets doing?

Here are a few charts -

Commodities

All have fallen sharply during the last few months

Precious metals

Doesn't show any safe haven demand, albeit Gold has rallied a bit after the scare. However, no as sharply as the correction witnessed in Commodities

Other Safe Haven assets - UST, JGB

US 10Y yields have fallen from ~1.9% to ~1.6%, showing increased demand for safety

So have JP 10Y yields -

And what are Equities doing?

I do not need a chart here but SP500 is at ATH! There is enough risk-off being demonstrated by commodity and bond markets, but equities don't seem to care. It's like when a kid finds candy and eats it until he/she is sick. That is the thing with Central Bank liquidity and Equities.

I'll throw in a chart anyway. Look at S&P mini futures and the recovery in Shanghai Composite after China decided to inject liquidity -

Now, Coronavirus is new. Trump did mention, what some Chinese official also said that the virus should be OK by April. We are in February. Can cities remain in lockdown for another two months? I don't know. But I think the economic impact of that is going to be massive. With no cure till now, and the virus spreading at the pace of a BTC rally, or rapidly, can the world afford an economic shock in China? This article says that Moody's and Barclays expect that global growth will take ~0.4% hit due to the virus. Look at it further, and you will see that estimates also include a 0% growth in China's GDP in March quarter. Frankly, it is impossible to assess. However, markets do not yet seem to be in panic because of this.

I think they will be in panic. For most in the financial world, this is still China's problem. When they realize it is a global problem, media will wake up and that will be followed by frenzy. Typically, risk off begins like this. Commodities - bonds - FX - then equities. Europe is already struggling. US is running a near 5% fiscal deficit when unemployment is at record lows. India is going through economic slowdown. China has been hit by Coronavirus and the impact of that hasn't been felt yet. Moreover given China's position in the global supply chain and it's position as a consumer of goods being the world's second largest economy and the most populated one, I think this rise in S&P and equities is ludicrous. One cannot short it because fighting Central Bank liquidity is impossible. However, for me, this quarter I think I will be long bonds, long duration, long precious metals, and long bitcoin.

Are you re-positioning your portfolio? Let me know in comments below

Posted via Steemleo

It absolutely does effect anyone's portfolio if invested in anything of widespread accepted value. Oddly enough since this has been going on, crypto has really spiked probably not a coincidence, especially altcoins, a lot. I have read and listened to people that any kind of serious slowdown, or the possibility of a worst case scenario is not at all being priced into markets, which I totally agree with when US markets are hitting all time highs in the middle of this. Millions of people that have access to this story regardless to how limited the information being spread about it are thinking twice about ordering anything from China at the moment. Even if this lasts for say another month or two that is a majorly affected fiscal quarter of the year gone for the Far East's number one economy and the physical producer of many of the planet's goods with any significant resource input. Yes, this will cause a stir and slow down at some point probably sooner than later when the excuse will be "It was a bigger deal than we thought." I will almost guarantee that being the explanation in markets across the world, especially in the US where we are in complete denial of economic reality.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

BTC rally is altcoin risk-on. And BTC has definitely behaved like a safe haven multiple times now. There is lot of institutional interest in it and may that is why it is behaving like safe haven.

The world should react soon, may be since equities are following Central Bank action, may be Central banks will react before equity markets wake up but it could definitely be a case of, as you said, "it was bigger than we thought".

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have just recently and finally started getting into the precious metals, especially silver. I am becoming quite a follower and am really curious to see where that ends up when the dust settles.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is quite insane to see equities continue to rally at a time like this. It's just so clear that the printing frenzy is not ending anytime soon..

With that said, I've positioned myself in some puts against the market. I still think I will be right in the near-term as we see some sort of correction... It's baffling to me that nobody seems to care about real data and instead are just looking at endless injections from central banks.

^ this would make a great meme 😂

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly, when oil corrected, I was expecting S&P to follow but it is up every single day. Nothing is impacting markets as of now. The printing frenzy is not going to end at all, and in fact I think, that central banks will respond to a crisis (or meaningful correction) with more printing. Look at this chart - the velocity of money flow and see what happened since 2008. At some point even the printing should become useless, when everyone is just a hoarder of cash.

Puts are good, but I think market can behave irrationally for longer, both safe haven assets and equities can rally, therefore long what I mentioned above.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The possibilities are high, especially as it may cause panic on the side of huge investors in the stock market who think that their investments are endangered. We have the news that in thickly affected areas, economic activities are reduced and that tells deep for stocks.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @karamyog

Thanks for sharing link to this post with me. It's a very interesting and scary topic. And I've already some strong opinions :)

Chinese economy has been already struggling lately. One-road-one-belt initiative seem to lost it's force. Trade was with US hit them really hard. Hong Kong protests brought wrong kind of attention. Pigs all over china were dying, causing food inflation. And current virus is such a terrible hammer. Straw that broken the camel back.

It's probably once-in-a-lifetime such a supply chain distrubtion. Something noone else ever experienced. Something noone is prepared for. So real economy will suffer.

At the same time financial economy is booming. Simply because US, UE and China are printing record high amount of new FIAT and pumping them right into assets markets (REPO, QE). So we're experiencing very unhealthy disconnection between real economy and financial one. Seeing some companies being heavily affected by situation in china, and witnessing stocks of those companies to grow ... it should never happen. But it does.

I also wrote my own post related to this topic: IS YOUR JOB THREATENED? Consequences of coronavirus in more way than you actually think. LET ME TELL YOU WHY .

Check it out.

Solid read. Upvoted already :)

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All absolutely right concerns, I haven't checked pork prices recently or whether china managed to sort out their local pork supplies. The trade deal with US did give the market some relief but part of it was to switch to US as supplier for some commodities, as opposed to LatAm. Which should put pressure on their currency. HK - people I think outside of Asia did not take enough notice as much as it derserved.

Yeah the money printing is insane. I mean yesterday's recovery in the US stock market. Not one day does the market want to print a red candle, or well a big one.

Let me read your post. Thanks for the support on both posts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely nightmare is ahead of us @karamyog

Resteemed and upvoted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 10/20 - need recharge?)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit