The Binance Coin (BNB) is benefiting from the general crypto boom. In the meantime, the decentralized competition remains on the heels of the industry leader.

Not only Bitcoin is currently breaking all records: The Binance Coin BNB is also chasing from one all-time high to the next. Within the last 24 hours (as of 10:23 a.m., February 18), the Binance Coin (BNB) was now able to gain 47.3 percent. BNB is currently trading at $ 193.03. With a market capitalization of $ 27.26 billion, BNB is now hot on the heels of Polkadot (30.43 billion) and Cardano (29.99 billion).

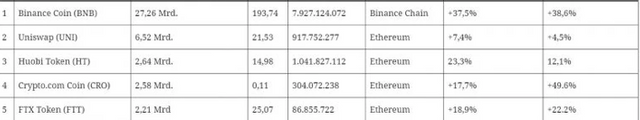

The tokens of other Bitcoin exchanges were also able to record strong price increases in some cases. According to data from the crypto tracking website Coinslate, these so-called exchange tokens now account for 3.4 percent of the total crypto market capitalization (at the time of going to press: 1.6 trillion US dollars) - a whole percent more than a week ago. The lion's share is accounted for by the Binance Coin (BNB), which set a new all-time high on February 18 at USD 138.03.

Exchange tokens according to market capitalization. Source: Coingecko

What is Binance Coin (BNB)?

The Binance Coin fulfills central functions in the Binance ecosystem. For example, traders who pay their trading fees in BNB pay 25 percent less. Furthermore, BNB is the native asset of Binance Chain, Binance's own blockchain platform. This not only forms the basis of Binance DEX, the decentralized exchange marketplace, but also the basis for Initial Exchange Offerings (IEOs) on Binance. Similar to an ICO, an IEO is the first public sale of a cryptocurrency. In contrast to the “wild west” of the ICOs, IEO projects undergo an audit at the exchange on which the project wants to start. While new tokens are usually exchanged for ethers in a classic ICO, the BNB is used for a Binance IEO.

BNB is currently benefiting in particular from the growing popularity of DeFi applications based on the Binance Smart Chain.

DeFi continues to boom

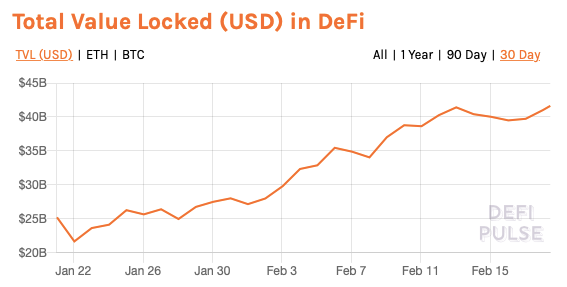

Meanwhile, high spirits are not only popular among Binance Coin holders, but also in the Ethereum-based DeFi sector. There, protocols now manage assets worth over 41.5 billion US dollars - almost twice as much as a month ago.

source: defipulse

The DeFi Pulse Index (DPI), a tokenized currency basket made up of ten DeFi coins, speaks a clear language:

source: tokensets

Should the DeFi sector keep up this pace, it is only a matter of time before the Binance Coin has to face a decentralized competitor.