In this clip from the LeoFinance podcast, we discussed Plan B's S2FX model in plain and simple terms.

This is a brief discussion about one of the most well-known models in the Bitcoin space called the Stock-to-Flow (S2F) model. The information here won’t teach you all of the nuances of the S2F and S2FX models. Instead, we offer a simple explanation from a bird’s eye vantage point and discuss the conclusion that is drawn from the models.

In a basic sense, S2F measures the incoming supply of an asset against the price of the asset over a given time frame. In this clip from the LeoFinance podcast, we talk about the potential future price of Bitcoin by utilizing the S2FX model (a second model published by Plan B) and break it down for a discussion about it in Layman’s Terms.

You can also find this guide on our LeoPedia resource at https://leopedia.io/bitcoins-stock-to-flow-model-explained-in-laymans-terms/

There are plenty of articles and content out there that talk about the hard math and data behind this model, but in this clip we just talk about the model in its most simplistic form and discuss its relevance to Bitcoin and the future.

“In this article I solidify the basis of the current S2F model by removing time and adding other assets (silver and gold) to the model. I call this new model the BTC S2F cross asset (S2FX) model. S2FX model enables valuation of different assets like silver, gold and BTC with one formula.” – Plan B

The Model:

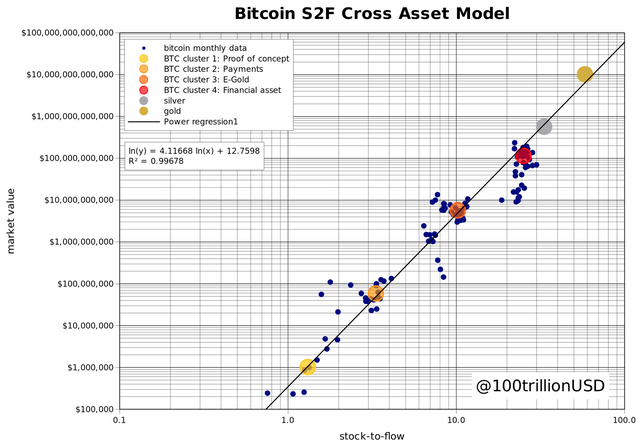

Below is the Bitcoin S2F Cross Asset Model. As promised, this written analysis (coinciding with the discussion we had on the podcast) will stay away from the more technical/mathematical end of the spectrum and instead focus on the conclusions that can be drawn from this model.

What you’re looking at here are 4 major clusters for BTC’s narrative over time. For the purposes of this article, don’t worry too much about these from a micro perspective. Instead, focus on the macro trend happening here — BTC’s narrative changing over time to reflect that of a more stable and secure asset to hold for the long-haul.

Moving up and to the right on that diagonal line, you’ll see two dots representing Silver and Gold.

“The S2FX model formula can be used to estimate the market value of the next BTC phase/cluster” – Plan B

“This translates into a BTC price (given 19M BTC in 2020–2024) of $288K.” – Plan B

Bitcoin to $288k Sometime in 2020-2024:

As we also mention during the podcast — this could be right. Nothing is guaranteed, obviously. What this model does is solidify some of the original ideas of the S2F model and it utilizes Gold and Silver to try and predict what BTC could become in the upcoming “fifth phase” of BTC’s lifecycle.

We’ve seen BTC go through the prior 4 phases and we see how the model place BTC (in terms of price) as we enter this fifth phase. Let this be simply another thing to consider when you think about the broader macro environment for Bitcoin.

Listen & Subscribe to the LeoFinance Podcast!

Links Mentioned:

- Plan B’s “Bitcoin Stock-to-Flow Cross Asset Model” – https://medium.com/@100trillionUSD/bitcoin-stock-to-flow-cross-asset-model-50d260feed12

- Plan B’s Original S2F article – https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25

Our Community

https://leofinance.io is an online community for crypto & finance content creators, powered by Hive and the LEO token economy.

- Blog & Earn LEO + HIVE Rewards at https://leofinance.io

- Trade Hive-Based Tokens on LeoDex at https://dex.leofinance.io

- NEW: Track Your Hive Account Statistics at https://hivestats.io

- NEW: Learn & Contribute to Our Growing Library of Crypto Educational Content at https://leopedia.io

- Delegate Hive Power to @leo.voter and earn a 16% APR paid daily in LEO tokens