Yesterday I posted Five Multi-Trillion Dollar Innovation Platforms | Part 1 - The Story is Already Written. In it, I discussed a few of the ideas presented by Cathie Woods in a keynote she gave in South Africa.

She started by laying the ground work of the five multi-trillion dollar innovation platforms that have emerged and are just beginning to take up some real estate on the global economy. Some of these technologies are very primitive in their early forms while some have already begun to have major impacts on the economy (and human behavior, for that matter) on the global stage.

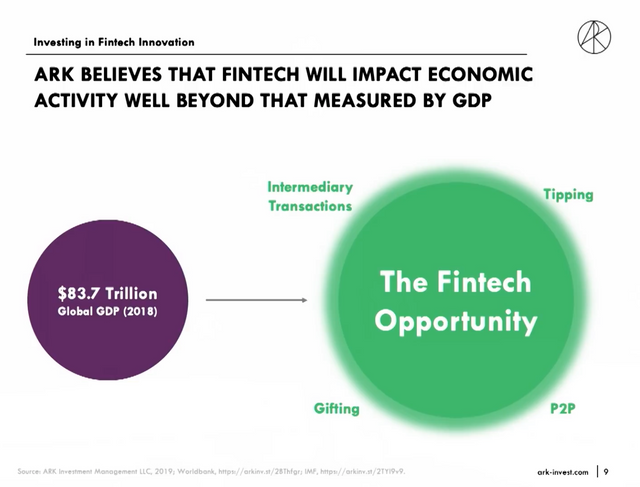

The Fintech Opportunity

In case you don’t know, Fintech stands for financial technology and refers to the new-age business models around providing services that compete on a fundamental level to those of traditional finance.

Companies like Alibaba and Amazon have had an enormous effect on the world by leveraging Fintech to make online and mobile payments easier than ever. This has cause them to directly compete with businesses that were stuck in the old mediums of exchange. We’ve seen many such businesses fall into the ether (i.e. retail stores & shopping malls) thanks to financial technologies leverage by these startups-turned-global mammoths.

It’s Just Getting Started

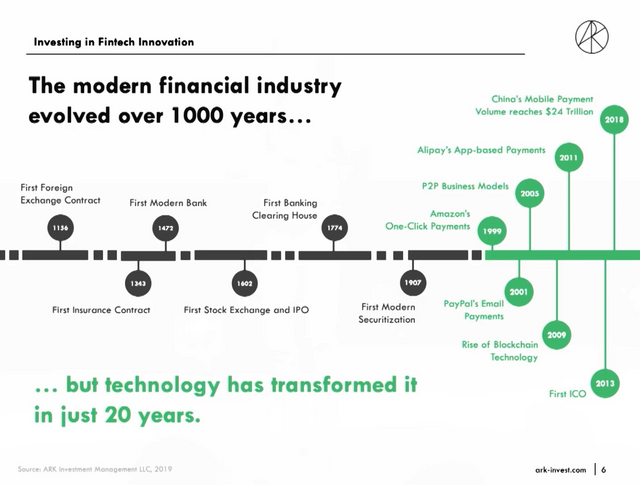

Finance has been evolving throughout the entire history of human civilization. We probably started somewhere trading primitive tools for some meat or maybe there was even a cave-man era real estate agent giving regular cave showings.

Over the last 1000 years, we can see the “modern” systems of value transfer and the other deeply entrenched financial systems that we use today. Follow the timeline and you’ll see that it all started with simple contracts and moved on toward exchanges handling larger volumes of those contracts to full-blown securitization of assets.

Eventually we see it reach 1999 with Amazon’s One-Click Payments. This is when the online fintech revolution (as we know it today) began. Amazon and other internet startups like PayPal emerged with the idea of leveraging the **information superhighway” to create mass economies of scale.

In 2009, we saw the emergence of Bitcoin. Shortly thereafter, the first ICO occurred and in 2018, China’s mobile payment volume reached $24 trillion (2x their entire GDP in the same year).

The opportunity of Fintech has been closely tracked by many. You can see it evolving here in the above chart. The amount of value that has been created out of this emerging platform is mind-boggling.

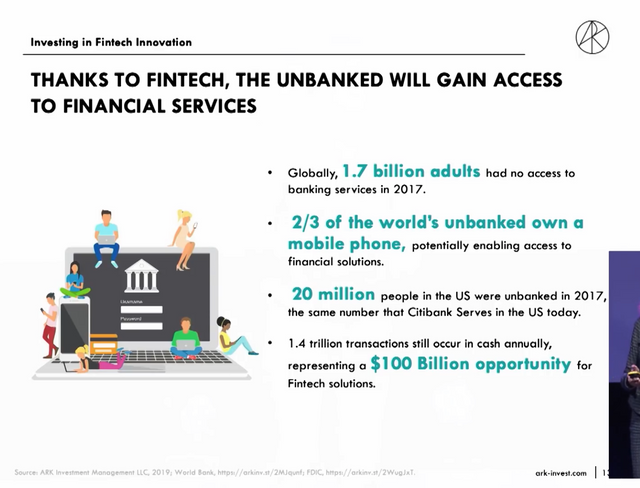

If I were to draw out this chart to 2025, I would add quite a few things. Namely the emergence of a “bank in everyone’s pocket”. Andreas Antonopolous gave a famous talk titled “A Swiss-Bank In Everyone’s Pocket”.

In that talk, he described this opportunity for everyone in the world to have instantaneous and unencumbered access to a global set of financial tools & resources. I believe that by 2025, we’ll see that in the hands of the average individual on a global scale.

That means that people in Venezuela, Africa, Europe, the U.S. and (pretty much) everywhere that has internet (which could be everywhere if Elon Musk gives us Starlink) will have access to a “Swiss-bank in their pocket”.

Just imagine the explosion in resources that would occur. Imagine the explosion in the amount of value that is transferred each year… it will make China’s $24 trillion in mobile payment volume in 2018 look like child’s play.

Blockchain’s Role in The Fintech Revolution

Blockchain is obviously going to be at the center of the stage of this Fintech revolution. Payments via a network that is peer-to-peer, decentralized, borderless and resistant to local governments is going to become more and more valuable as these technologies develop and become easier for the everyday person to use.

Steem has a massive potential in this landscape as well. A lot of us come here to make content, read content, invest, curate, etc… but there is this whole economy for Steem.

With apps like https://shop.steemleo.com, we can transfer value instantaneously in exchange for products & services. The potential for Steem to be leveraged as a platform for exchanging value, unbanking yourself, investing in digital assets, etc. is enormous.

I think the timing of Bitcoin, Blockchain, Steem, and Fintech more broadly couldn’t be better. It is all emerging at a time when governments are growing “data power hungry”, the internet is maturing on a global scale, the power of the individual is rising…

We are living in the best time imaginable for a Fintech revolution. Just like the internet did in the early 2000’s, these financial technologies are going to engulf the traditional industries even faster than most can imagine.

Posted via Steemleo

Time will tell. And it will tell what we are all talking about here.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

100% agree. We'll see who ends up on the right side of history

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great collaboration. It thrills me to know that @Steemleo is leading this revolution to partnerin order to create more use cases for our tokens.

Go #leoshop!

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Go shop go! :)

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The role of the Blockchain in The Fintech Revolution is relevant. I think It will further accelerate the Fintech development processes.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree. It's arguable at the very center of the entire fintech revolution itself. We're seeing a massive shift into immutability and decentralized cooperation. It's just the start of what's possible with these industries

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

so many valid points in this post...

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @khaleelkazi!

You just got a 13.13% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@khaleelkazi wonderful writeup.....

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit