Welcome to the weekly edition of Steemleo stats. This is no.28 @leo.stats report.

If you want to know a bit more about the Steemleo platform and dig into the numbers, this is the place to be.

The following topics will be covered:

- Issued LEO Tokens

- Top LEO Earners

- Rewards to SP delegators trough the leo.bounties program

- Daily stats on tokens staking

- Share of tokens staked

- Top Users that staked

- Daily stats on tokens burned

- Number of Steemleo users

- Posts and comments activities on the platform

- Posting from Steemleo.com inteface

- Votes from the @leo.voter account

- Price Chart

Issued LEO Tokens

Let’s take a look into token distribution, inflation and how it is distributed.

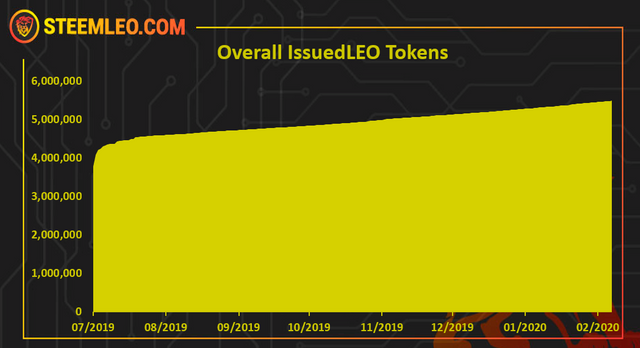

Below is a chart that represents the cumulative issued LEO token.

A total of 5.45 M issued LEO tokens.

We can notice that the LEO token doesn’t have a large inflation compared the base supply and its slowly increasing its supply. Note that burnings are not taken into consideration in this chart. That will be presented below.

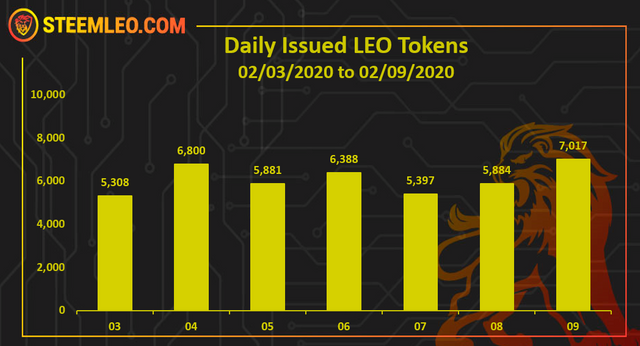

Next the issued LEO tokens from last week. Here is the chart.

Issued tokens are claimed token that are put in circulation. They are different from the inflation.

Steem-Engine have implemented automatic claiming on the SE tokens and the chart is now more stable on the daily issued LEO tokens. On average 6k LEO tokens were issue daily in the last week with a total of 42,674 tokens issued.

Automatic daily claiming is overall a good thing that will prevent the lag between issued and claimed tokens going forward.

Let’s see how these tokens were distributed.

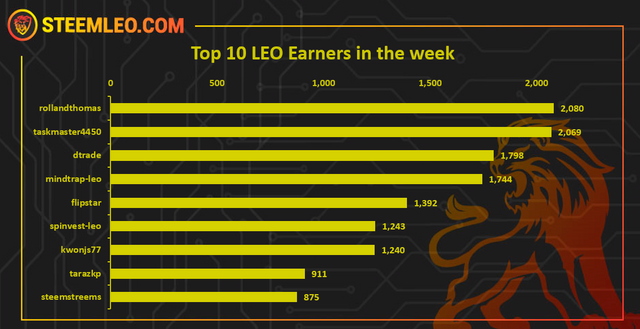

Below is the chart of the top 10 LEO earners in the week.

@rollandthomas and @taskmaster4450 are in close fight for the first place with around 2k earned, followed by @dtrade.

Note: The @leo.bounties account is excluded from the list above. Bellow is a separated data on the tokens transferred from @leo.bounties to the delegators. A total of 4500 LEO tokens were issued to the @leo.bounties account in the last week.

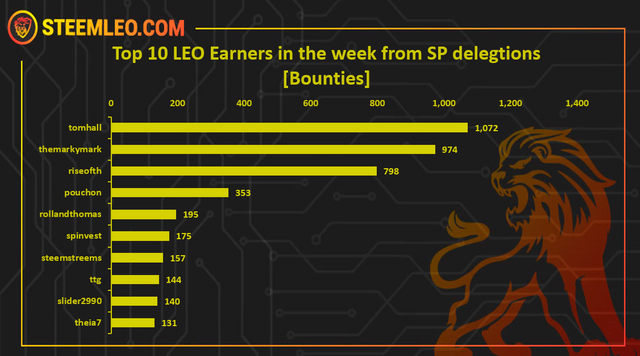

Reward to SP delegators [Bounties]

The LEO platform has a reward mechanism for SP delegators to the @leo.voter account. Users who delegate their SP to the @leo.voter receive daily LEO tokens. The amount of LEO tokens depends on the LEO price.

Having more SP to the @leo.voter account provides incentive to users to use the platform and grow the userbase.

The account @tomhall is on the top of the list with 1072 LEO tokens rewarded, next is @themarkymark followed by @riseohth.

A total of 5269 LEO was rewarded to SP delegators in the last week.

Note that this are not all newly created tokens, but tokens transferred from the @leo.bounties to the delegators. This reward pool is a mix from tokens from leo official accounts, tokens from the market and new tokens are issued for this purpose.

Staking LEO

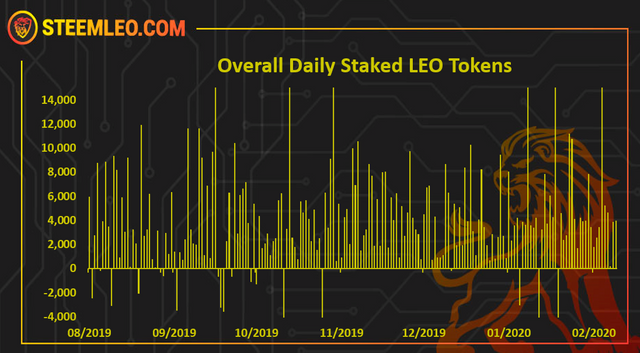

Below is a chart that represents the daily movement of staking/unstaking of the LEO token.

July 2019 is excluded from the chart for better visibility. Those are the first days and there are a lot of tokens staked.

The LEO token has a great statistics on tokens staked. This trends still continues.

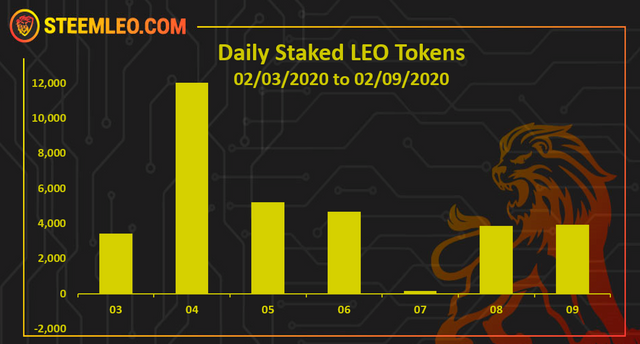

The chart for the last week looks like this.

All of the days of the week with positive net staking.

Here is the table.

| Weekly Data | LEO |

|---|---|

| Staked | 47,082 |

| Unstaked | 4,976 |

| Diference | 42,106 |

A total of 42,106 more LEO tokens staked last week.

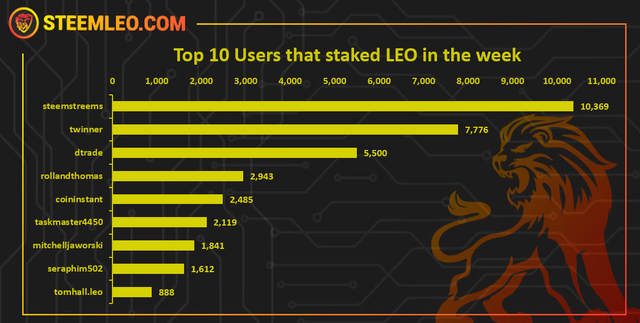

Below is the chart of the top 10 users that staked last week.

On the top is @steemstreems with a 10k staked in the last week, followed by @twinner, and @dtrade.

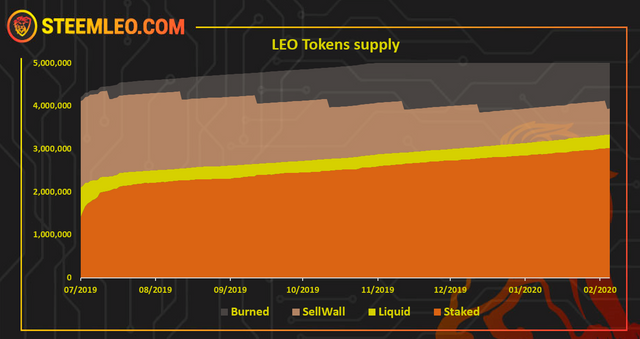

Here is the overall chart on LEO tokens supply.

We can see that the staking is increasing over time, the liquid supply is going down. The burnt tokens also are taking a bigger share with the monthly burns from the sell wall, showing the big drops.

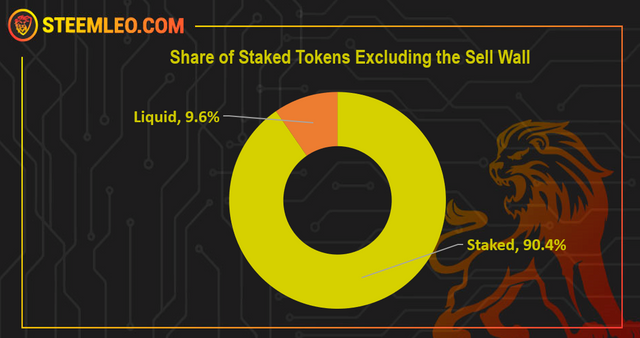

Below is a chart of the ratio staked/unstaked tokens, excluding the tokens reserved for burning (sell wall), at the moment with around 0.6 M tokens.

90.4% tokens staked!

The share of the staked LEO is a long time around the 90%, and it the last weeks is just above that. The liquid LEO tokens are around 320k.

Out of the current supply 3.9 M tokens, 3.02 M are staked, 0.6 M are set to burn and 0,32 M are liquid.

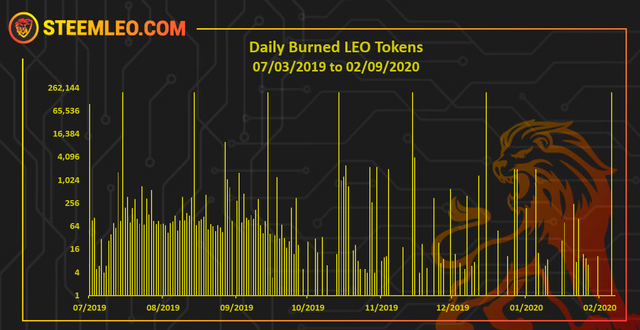

Burning LEO

Burning tokens is an important metric as in a way it is a anti inflationary measure and it shows the use cases for the token or sinks. LEO is having huge regular monthly burn and also all the burns that comes out of its sinks.

The vertical Y axis is on a logarithmic scale for better readability.

Now there is million and a half LEO burnt, or 1.55M. The large share of this 1.5 M tokens is due to sell wall burn.

The rest of 55k tokens are from the sinks for the LEO token.

The LEODEX is bringing more burns lately for the exchange listing fee of 2000 LEO per token.

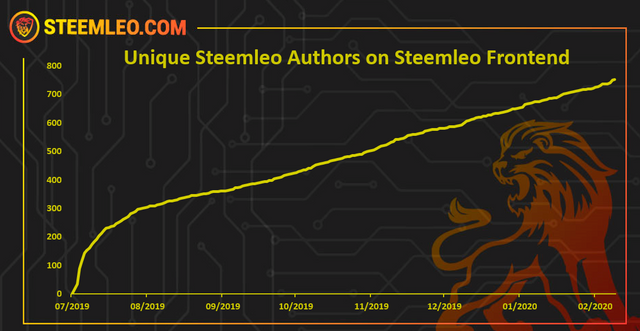

Steemleo Users

Below is a chart with the number of unique users that posted on Steemleo frontend.

A total of 752 unique user have posted from the Steemleo frontend.

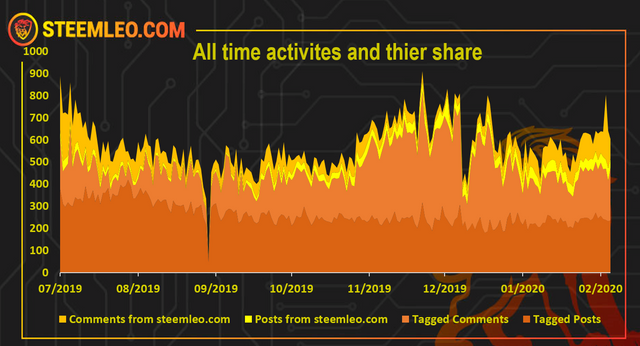

Activities on Steemleo

Below is a chart of the Steemleo activities, including posting and commenting from the Steemleo interface and posting and commenting with the Steemleo tag.

Lately the number of comments made from Steemleo, seems to be increasing as well.

In the last period Steemleo is trying to incentivize users to post from the Steemleo interface rewarding authors who use the interface with vote from the @leo.voter.

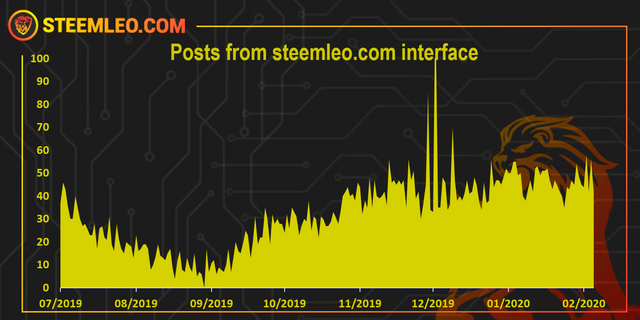

Here is the chart only for posts from steemleo.com interface.

There is an increase in the number of posts coming from the steemleo.com web. This is mainly due to the increase in the SP of the @leo.voter that now holds around300kSP and its rewarding user for posting from the Steemleo frontend.

Using the steemleo frontend is important for the project and the users are encouraged to do so.

Weekly Activities

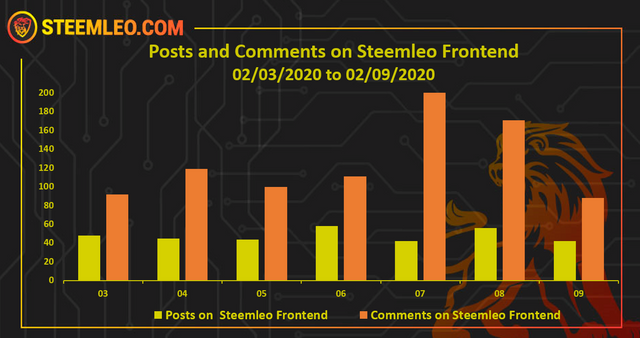

This data is also showing the activities coming only from the Steemleo native interface.

Data for each day of the week was collected and presented on this graph.

These are all the posts and comments posted from the Steemleo frontend.

The total number of posts on Steemleo in the week is 335 and 975 comments.

Votes from @leo.voter

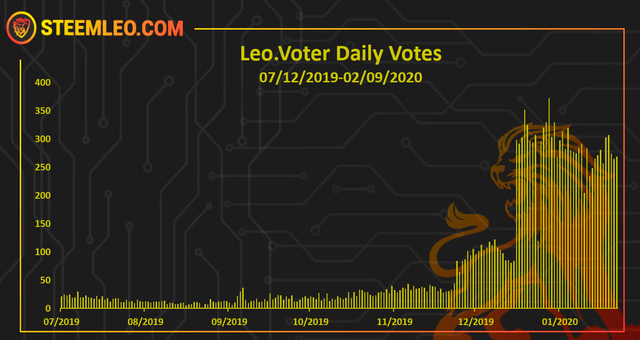

The @leo.voter account is being converted from a bot to a rewarding accounts to users who use the Steemleo.com interface. Here is the chart.

We can see that there is increase in the voting since now it’s being used to reward users who use the Steemleo interface.

More than 21k STEEM rewarded to authors and in the last week an approximate 650 STEEM is rewarded to the authors.

Price

All time LEO price

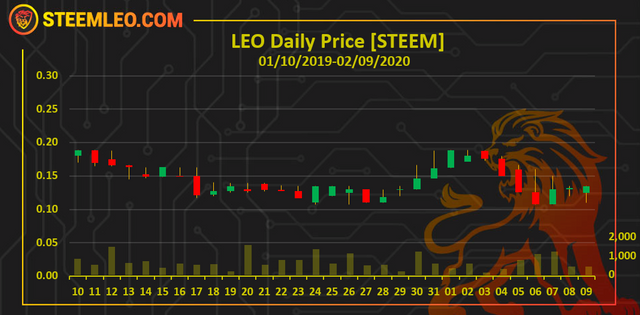

Here is the price chart with proper daily candles.

The LEO price has been on a rise in the las week.

The above is LEO price in STEEM. How about the dollar?

LEO Price in dollar value

Compared to the STEEM chart the dollar price has even sharper increase.

Last 30 days LEO price

Here is the price in the last 30 days.

#steemleo - A Next-Generation Community for Investors

Report by @dalz

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love the chart expressed in terms of USD...we have to get away of expressing Leo in terms of Steem because pricing in terms of Steem is misleading.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well we may put just the dollar price in the future.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really have a long way to go before I start having a mention in this stat list. Kudos to all!

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well congrats!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It just shows you can effectively manage inflation of a small user base if you have the right mechanisms. I'll keep stacking my leo, I think tribes will be where I focus if the steem price starts to move away from being easy to stack organically. I think tokens will make up a big part of the steem economy in future as steem takes a back seat for with SMTs and becomes more of utility token to distribute and acquire chian resources while tokens will be for rewards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One of the biggest issue of the LEO token was the large airdrop beneficiaries that dumped a lot and at once. A multiple sales of large ammounts at once.

This may be a good thing as well.... they helped distribution ....Yet we are here and looks like not much left to dump :).

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With what frequency are coins obtained when acquiring mining, I mean LEO Miner and LEO Mega Miner coins?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit