Summary

- Valuation metrics in financials and real estate.

- Evolution since last month.

- A list of stocks looking cheap in their industries.

- This idea was discussed in more depth with members of my private investing community, Quantitative Risk & Value. Get started today »

This article series provides a monthly dashboard of industries classified by sectors. It compares valuation and quality factors relative to their historical averages in each industry.

Executive summary

Consumer finance and mortgage REITs are the most attractive financial industries: they are underpriced relative to historical averages in 3 valuation ratios and above their baseline in profitability. Capital markets are moderately overpriced. Commercial banks, thrifts/mortgage and real estate management have mixed metrics: they look good in price/earnings and profitability, but the price/sales and price/free cash flow are bad. Insurance is the less attractive industry in finance.

Since last month:

- P/E has deteriorated in equity REITs and is stable elsewhere.

- P/S has deteriorated in mortgage and equity REITs, and is stable elsewhere.

- P/FCF has improved in consumer finance, capital markets, real estate management and deteriorated in insurance, equity REITs.

- ROE has improved in capital markets and is stable elsewhere.

- The real estate Select Sector SPDR ETF (XLRE) has outperformed the SPDR S&P 500 ETF by 1% and the financial Select Sector SPDR ETF (XLF) has lagged it by 3.3%.

- The 5 top momentum stocks in this period in the S&P 500 financial and real estate sectors are: American Tower Corp. (AMT), Crown Castle International Corp. (CCI), Goldman Sachs Group Inc. (GS.PK), Healthpeak Properties Inc. (PEAK), S&P Global Inc. (SPGI).

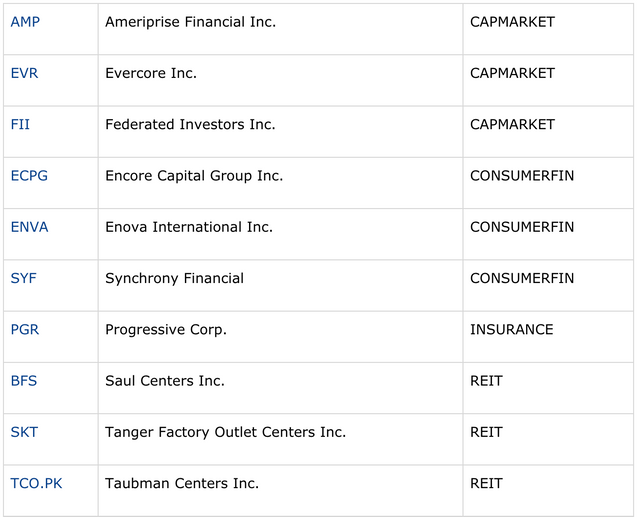

Some cheap stocks in their industries

The stocks listed below are in the S&P 1500 index, cheaper than their respective industry factor for price/earnings, price/sales and price/free cash flow. The 10 companies with the highest return on equity are kept in the final selection. Quantitative Risk & Value Members have an early access to the stock lists before they are published in free-access articles. The list was published for subscribers at the beginning of the month based on data available at this time. This is not investment advice. Do your own research before buying.

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @fredpiard

Twitter: @fredpiard

Seeking Alpha Account: Fred Piard

Steem Account Status: Unclaimed

Are you Fred Piard? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.