Summary

- These two stocks are likely to miss earnings expectations according to our new Earnings Distortion Scores.

- We measure earnings distortion using a proprietary human-assisted ML methodology.

- Our goal is to help investors combat increasingly material levels of earnings distortion.

- Looking for more stock ideas like this one? Get them exclusively at Value Investing 2.0 . Get started today »

Intuitive Surgical Inc. (ISRG) and GATX Corporation (GATX) are in the Danger Zone. These two stocks are likely to miss earnings expectations according to our new Earnings Distortion Scores.

We measure earnings distortion using a proprietary human-assisted ML methodology featured in a recent paper from Harvard Business School (HBS) and MIT Sloan. This paper empirically shows that street earnings estimates are incomplete and less accurate since they do not consistently and accurately adjust for unusual gains/losses buried in footnotes. By adjusting for earnings distortion, we create a measure of core earnings that's more predictive of future earnings.

Our goal is to help investors combat increasingly material levels of earnings distortion. Earnings for the S&P 500 were distorted by an average of 22% in 2018, and we expect that trend to continue.

Stocks Likely to Miss

Earnings season won’t get into full swing until February, but there still are plenty of stocks that report earnings in January. Of those stocks, ISRG and GATX both stand out for their positive earnings distortion – i.e. their earnings are overstated because reported GAAP earnings are above our core earnings.

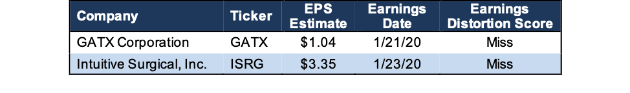

Figure 1: Two Stocks That Should Miss Expectations – ISRG and GATX

Sources: New Constructs, LLC and company filings.

Intuitive Surgical, Inc. (ISRG)

Most of our Danger Zone picks have falling profits and a low return on invested capital (ROIC). ISRG, on the other hand, has rising profits and a top-quintile ROIC of 53%.

However, ISRG’s earnings distortion is rising, which means earnings are increasingly overstated. As earnings become more overstated, the likelihood that ISRG misses estimates increases because these estimates are artificially propped up by unusual gains. Even with rising core earnings, a company missing estimates can cause a rapid drop in its stock price.

Figure 2 shows ISRG’s earnings distortion is the highest it’s been in the history of the company.

Figure 2: ISRG Earnings Distortion Jumps Significantly Since 2017

Sources: New Constructs, LLC and company filings

In 2018, ISRG had nearly $120 million (2% of assets[1]) in earnings distortion that caused earnings to be overstated. One of the notable unusual gains included $80 million in interest and other income driven by higher interest rates and higher cash and investment balances.

Over the trailing twelve month period, ISRG’s earnings distortion has increased to $171 million (2% of assets). Notable unusual gains include:

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @davidtrainer

Twitter Account: NewConstructs

Steem Account Status: Unclaimed

Are you David Trainer? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.