Summary

- Structural economic issues including demographics and debt continue to degrade global growth, leading to lower interest rates and lower net interest margins for lending institutions.

- A world with anemic growth has low rates and flat yield curves, a disaster for regional banks that depend on lending and net interest income more than larger banks.

- Total bank loan growth is declining as excessive Treasury issuance, monetary policy, and banking regulations hit a brick wall.

- Looking for a portfolio of ideas like this one? Members of EPB Macro Research get exclusive access to our model portfolio. Get started today »

Regional banks in the United States (KRE) are facing both structural and cyclical economic headwinds, including lower interest rates, faltering economic growth, and flatter yield curves. These structural and cyclical economic factors are translating to lower net interest income "NII" growth, weakening loan growth, and falling net interest margins "NIMs."

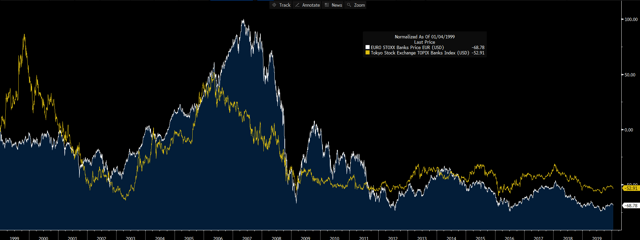

The combination of these factors already has unfolded similarly in both Japan and Europe, several decades ahead of the United States in regard to the deterioration in demographics. The result in both Japan and Europe has been a decimation of the banking sector, collapsing under lower (and negative) short-term interest rates, persistent flat or inverted yield curves, and economic stagnation.

Long-only strategies should likely avoid KRE and regional banks in favor of more defensive assets. More tactical strategies should stay underweight or short KRE.

Europe and Japan Banking Index:

Source: Bloomberg

Structural economic fundamentals argue that economic growth will continue to trend lower over time, capping the growth rate of each cyclical upturn and dragging interest rates lower.

From a cyclical standpoint in the United States, economic growth is still in a downward trend, exerting a depressing force on both short-term and long-term interest rates.

Lower interest rates and a flat yield curve is an unprofitable combination for any business that's heavily dependent on a model of "borrowing short and lending long."

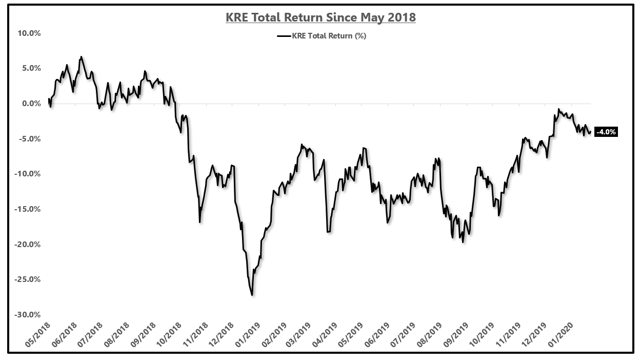

Regional banks in the US have deeply underperformed the broader stock market for the past two years.

Regional banks have been a short position in the EPB Macro Research "Tactical" portfolio since May 2018 based on the thesis that a continued decline in both long- and short-term interest rates would erode the profitability of lending institutions.

It should be noted that this thesis does not apply to large money center banks such as JPMorgan (JPM) with much more diversified revenue lines. Regional banks are far more sensitive to lending conditions and interest rate spreads. I have never made a direct bet against any large money center banks.

KRE Total Return Since May 2018:

Source: Bloomberg, EPB Macro Research

A cyclical upturn in economic growth will only improve the profitability of a lending business temporarily. Due to excessive levels of unproductive debt, constricting the velocity of money, economic growth will trend lower over time, causing conditions to revert back toward lower interest rates and flatter yield curves.

Regional banks are likely to continue underperforming the broader market in the coming quarters.

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @ericbasmajian

Twitter: @EPBresearch

Seeking Alpha Account: Eric Basmajian

Steem Account Status: Unclaimed

Are you Eric Basmajian? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Posted via Steemleo