Summary

- The S&P 500, SPY, Nasdaq 100, as well as other major stock market indexes put in a textbook blow-off top a few trading sessions ago.

- Almost 60% of SPY and the S&P 500 is composed of just 3 sectors, technology, financials, and healthcare.

- The leaders in the recent melt-up that elevated SPY by about 45% over the last 13 months are likely to lead the market substantially lower when the meltdown occurs.

- Numerous fundamental indicators are suggesting that the economy is likely to slow further, and 2020-2021 growth and earnings estimates are likely too optimistic.

- I'm not buying the recent rebound, SPY and stocks in general need to correct, as I see more downside risk than upside potential in equities right now.

- This idea was discussed in more depth with members of my private investing community, Albright Investment Group . Get started today »

Image Source

Blow-Off Top Could Send Stocks Lower From Here

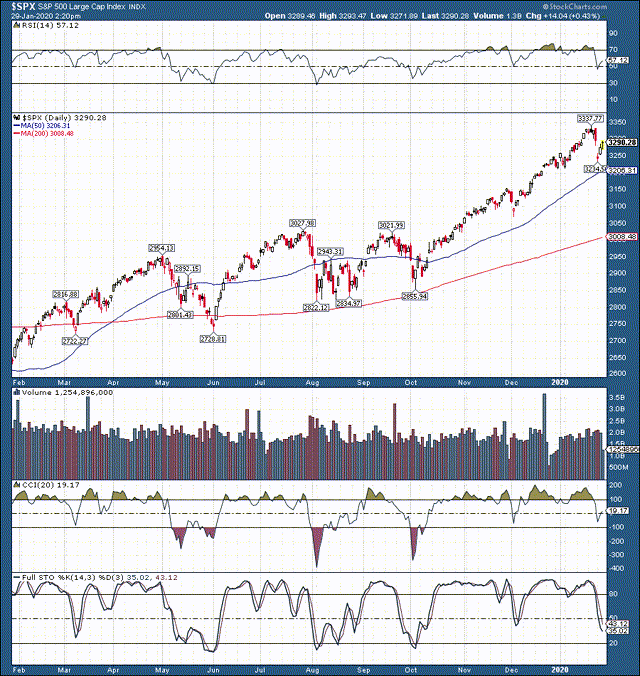

The S&P 500 (SP500), SPDR S&P 500 ETF Trust (SPY), and other stock market indexes and major averages are coming off extremely strong gains achieved throughout 2019. S&P 500/SPY gained roughly 30% in 2019 alone. In addition, the S&P 500/SPX was up by roughly 3.5% in the first several weeks of 2020 alone, before the recent correction began.

S&P 500 1-Year

Source: StockCharts.com

Generally, stocks have done extremely well over the past year or so. Since our 2018 December 26th “Watch List” or buy list article was released, some of the names on the list have appreciated dramatically over the last 13 months or so.

For reference, since the December 26th call:

Apple (AAPL) has surged by 117%

Tesla (TSLA) is up by 90%

Nvidia (NVDA) has gained roughly 90%

Facebook (FB) is up by about 75%

Netflix (NFLX) and Alphabet (GOOG) (NASDAQ:GOOGL) are each up by around 50%

Financials, including Goldman Sachs (GS.PK), JPMorgan (JPM), Citi (C.PK), and KeyCorp (KEY) are all up between about 38% and 56% over the last 13 months.

Also, if we look at major stock market indexes/averages since the December 2018 bottom (trough to peak):

S&P 500/SPY: were up by about 43-45%

DJIA: was up by 35.5%

Nasdaq 100 (QQQ): has surged by 59%

Russell 200 (IWM): gained 37%

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @victordergunov

Seeking Alpha Account: Victor Dergunov

Twitter Account: @victordergunov

Steem Account Status: Unclaimed

Are you Victor Dergunov? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Posted via Steemleo