Summary

- The Fed believes that 2% annual inflation equals “stable prices.” Yet that small amount adds up over time—to almost 50% in 20 years.

- Prices have risen dramatically more than average for some of life’s basic necessities. And wages, while up a bit, aren’t keeping up with the living costs.

- The November jobs report showed much stronger growth than we’ve seen in a while. That’s good to see and suggests we might postpone recession past 2020.

- But merely avoiding recession isn’t enough. Another year of sub-2% growth (which is my base case) will be another year of suffering for the millions whom this weak recovery hasn’t helped.

- 80% of the income pyramid is anxious and depressed. And they are increasingly willing to embrace radical solutions.

The Federal Reserve System is supposed to be independent. But it’s not. And as much as Donald Trump doesn’t like it, the Fed shouldn’t follow the president’s orders.

The Fed operates under a legal mandate from Congress. Its monetary policy role is “to promote maximum employment, stable prices and moderate long-term interest rates.”

So how is it doing?

Long-term rates are certainly moderate. Employment is historically high, though wages and job quality aren’t always great.

As for that “stable prices” part… it depends on what you are buying.

CPI Doesn’t Reflect Real Inflation

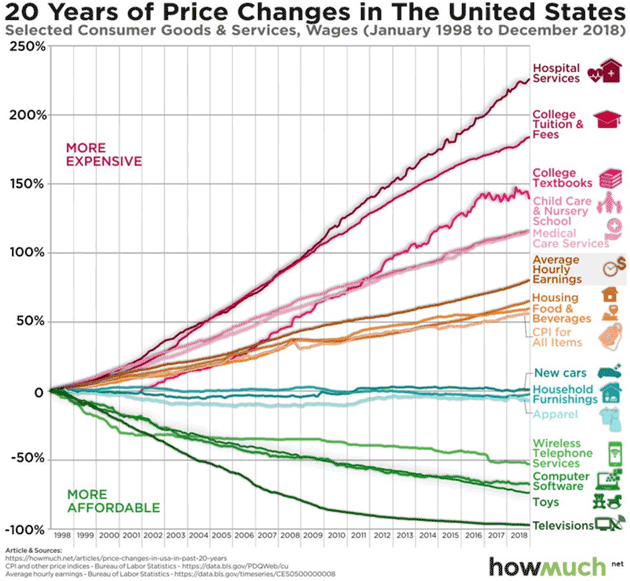

As you see below, for many goods the price is nowhere near “stable.” Unfortunately, if you are in the bottom 60–70% of the income brackets, these are some of the things you buy the most.

Source: Sebastian Sienkiewicz

The Fed believes that 2% annual inflation equals “stable prices.” Yet that small amount adds up over time—to almost 50% in 20 years. Which is about where CPI lands in this 20-year chart, so the Fed is succeeding by that yardstick.

But CPI doesn’t reflect real-life spending for most people. Prices have risen dramatically more than average for some of life’s basic necessities.

While Fed officials may think they have tamed inflation, their ZIRP and QE actually drove real-world prices considerably higher than CPI or PCE show. It showed up mainly in asset valuations, like stocks and real estate.

These, in turn, drove up other prices like housing. Aggregate inflation isn’t higher because technology and globalization reduced manufactured goods costs and the shale revolution kept energy costs low.

Try to look at this like an average worker. Your rent keeps rising, your kids can’t go to college without racking up debt, your health insurance is astronomical, and your wages, while up a bit, aren’t keeping up with your living costs.

Meanwhile, the people who are supposed to be looking out for you keep talking about how the economy is improving thanks to their brilliant policies.

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @johnmauldin

Twitter: @johnfmauldin

Seeking Alpha Account: John Mauldin

Steem Account Status: Unclaimed

Are you John Mauldin? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

https://steemit.com/steem/@spoon.justdice/amato-oshi-satan-k-donald-trump-iraq-sucky-your-roku-sucky-oroku-saki

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit