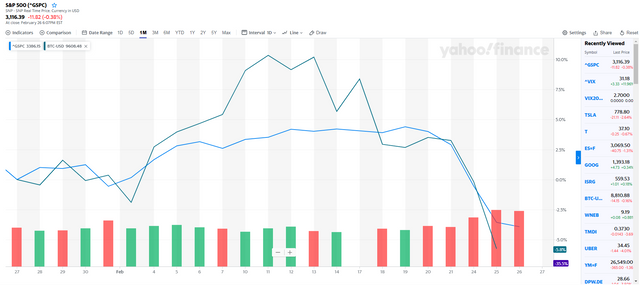

A lot of people are surprised that equities and cryptos are falling at the same time.

But this fits perfectly with my thesis that I've been talking about on discord for a while.

Exchange-crypto (as opposed to crypto that is used for real transactions) are treated as a highly speculative asset class for trading.

The big money trading on BTC futures (or whatever) are not ancaps in their basement. They are financial institutions with play money trying to generate a point of alpha.

The consequence of this is that when their equity positions get liquidated and the margin calls start coming, what are they going to sell to raise cash? It's going to be that crypto portfolio.

I have no proof at all to support this, but it's just what makes sense to me.

Posted via Steemleo

There also could be the uncertainty factor. Investors hate that and when there is a great deal of it, cash is the place they head to. Speculative assets, like cryptocurrency tend to be sold off quickly.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's true too.

But your average retail investor isn't going to be big enough to move markets. I think what we are seeing now is institutional money selling off.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love the thesis, makes perfect sense.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi. I see you are interested in trading.

Check this new community i created for traders share their knowledge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you are right on this one. All we can do is wait and see..

Kind regards,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never thought of it this way. This would also explain why it crashed at the same time but not as significantly due to all the HODLers 😂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit