Sam Zell, who received his bachelor's and law degrees from the University of Michigan, began to buy distressed properties, fix them up, and rent them to students.

In 1969, Zell and his partner Robert Lurie formed Equity Properties Management Corp. to centralize Zell's rapidly diversifying investments in real estate. In the mid-1980s, U.S. real estate crashed, and Zell swooped in to acquire office and residential properties at fire-sale prices.

Same Zell's fame and $5 billion net worth ultimately originate from his ability to connect the dots in the real estate world, but more importantly his dedication to turning around troubled and distressed properties.

Sam Zell is now buying distressed assets as the U.S. oil sector sees a slowdown. He’s bought assets in California, Colorado and Texas from companies that are raising cash to stablize their shrinking cash reserves. Sam is comparing the state of the oil industry in the US to the real estate industry in the early 1990s, where there were empty buildings all over the place, nobody had cash.

A swathe of highly indebted companies face an incipient funding shock and risk being shut out of the capital markets as the COVID-19 epidemic mushrooms into global crisis, Standard & Poor’s has warned.

There are mounting risks of a credit crunch in vulnerable sectors of the corporate bond market, potentially rocking an unstable financial edifice with record levels of debt and set off a dangerous chain reaction.

“Could this be the straw that breaks the camel’s back?” asked Paul Watters, S&P’s head of credit research for Europe and the Middle East.

Sam was on CNBC yesterday and said he added to his positions, including one in the energy sector. However, Sam admitted that people don’t see the bargains in this sector as very little money is coming into the space as he gave the example of winning a bid for a bankrupt company where he was the only competitor, competing against himself for the company.

Today oil fall to multi-year lows as OPEC’s allies rejected additional production cuts proposed by OPEC on Thursday. The meeting between OPEC and its allies, known as OPEC+, concluded with no deal on additional production cuts.

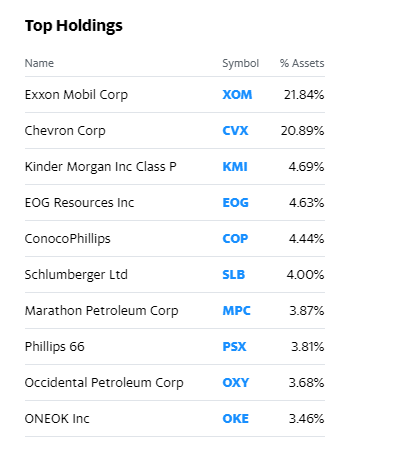

The Energy Select Sector SPDR Fund (XLE) seeks to provide investment results that based on the performance of publicly traded equity securities of companies in the Energy Select Sector Index. Top holdings include:

Exxon Mobil Corp. is down more than 4% and Chevron Corp. is down more than 3%. According to Josh Graves, senior market strategist at RJ O’Brien & Associates, the collapse of this deal means we’re going to see oil test $40 a barrel. This the chart of the XLE suggests price is heading down to the monthly demand at $35.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

"Same Zell's fame and $5 billion net worth ultimately originate from his ability to connect the dots in the real estate world, but more importantly his dedication to turning around troubled and distressed properties."

another evidence that investing in real estate is a great form of investment,i would love to see a kind of real estate projects on the blockchain though...@rollandthomas

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great points, there will be many real estates projects on the blockchain in the future as a means to document and transfer ownership.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I, for one, think this is a very smart move.

Zell knows oil is not dead. The need for energy is growing at too great a rate. Even with all the renewable energy being installed across the world, oil and coal will still continue to grow as the grow rate, overall, is larger than just renewable can provide.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not catching that fallen knife, but I'm also not a billionaire, so it's hard to argue against him buying in the depressed space.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit