Earlier this year, Morgan Stanley’s named Uber their top U.S. internet stock pick for 2020 and predicted a 57% rally in the ride-hailing giant’s stock on improving profitability and the potential for additional growth in ride-sharing services. At the time, Morgan Stanley had a $55 price target on Uber’s stock.

About one month ago, Uber supported that thesis by reporting a loss of 64 cents per share in the fourth quarter of 2019 which was a decrease year over year. But the highlight of the earnings report was the better-than expected bottom-line performance with the company’s position of seeing profits by the fourth quarter of 2020. Previously Uber expected to achieve EBITDA profit for the full year in 2021.

Earlier this week, Uber’s CEO, Dara Khosrowshahi said will take a small hit due to the outbreak of the coronavirus, but Uber Eats will like benefit. Dara believes because of the many businesses that Uber is involved with and their independence from supply chains / logistic challenges, the company is well-positioned to handle the spread of the virus and should bounce back quickly and reiterated the company's profitability target on an adjusted basis by the end of 2020.

It worth noting that a Lyft Inc. executive made a similar statement and believes the COVID-19 may cause more people to rely on ride-hailing services instead of public transportation.

Both companies may have a point…only because of what the financial media has been putting out there. According to the dictionary, news is newly received or noteworthy information, especially about recent or important events. However, I think news is all about abnormal events. Think about it, we hear about people winning the lottery, murders, hurricanes, etc. In the case of COVID-19 as it pertains to the Lyft’s executive comment, we have heard a lot about the cruise ships in recent weeks.

The entire Diamond Princess ship was quarantined where passengers were confined to their cabin. However, over 600 people got infected during those two weeks, including two passengers that have since died.

Holland America Line Westerdam cruise ship which had roughly 2,000 passengers and crew aboard and once was stranded at sea because Japan wouldn’t let them dock in the country. Fears of COVID-19 has prompted four different countries to deny them entry despite no one on board being diagnosed with COVID-19. Finally, Cambodia told the ship they can dock in their country.

And last week, we got word that 21 people aboard the Grand Princess cruise ship, which has been since docked in California have tested positive for the virus. Of the 21 people who tested positive, 19 were crew members of the ship and two were passengers.

All this news is ultimately scaring Uber and Lyft drivers as well.

Many Lyft Inc. and Uber Technologies Inc. drivers have seen a bump in business from the spreading coronavirus, but they’re also weighing the risks of staying safe versus continuing to earn a paycheck.

A study to be published Friday shows that more than half of ride-hailing drivers said they were now “very concerned” about reduced earnings as a result of the virus and 41% said they’ve modified their driving strategy as a result. These changes include reducing hours, refusing airport rides and halting driving entirely.

The fear among drivers comes just as more passengers seem to be seeking rides or ordering food delivery in an effort to avoid crowds. But for those drivers willing to take the risk, wages increased 6% during the study period, according to Gridwise, due to fewer drivers competing for rides and more surge pricing, which increases prices during peak demand.

In light of concern's by the drivers, Uber said it will offer drivers and delivery people 14 days of paid sick leave and will receive compensation if they fall ill with coronavirus or are placed in quarantine. However, only time will tell how the spread of COVID-19 will continue to affect not only consumers, but drivers as well.

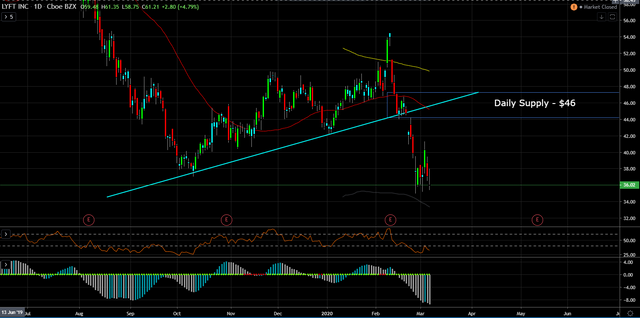

Although in the last month Uber is down about 20%, Lyft traded as low as $35 this past week. As a result Brad Erickson of Needham upgraded Lyft to a buy with a price target of $48 based on the thesis that at current prices the stock is offering investors a favorable risk-reward profile for the first time.

Levels to monitor on Uber are the weekly demand / supply zone.

Levels to monitor on Lyft is the daily supply at $46.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo