The billionaire investor and founder of Omega Advisors shared his guidance about the stock market earlier this week. Cooperman to be patient and that he and he had faith in the health official’s ability to contain the virus and thought we will avoid a recession. Cooperman also said to be patient, but one believed the virus would spread out of control and Markets are headed into a recession to step aside, meaning stay out of the Markets.

Cooperman was the first in his family to earn a college degree and after earning his CMBA from Columbia Business School, Cooperman joined Goldman Sachs. Cooperman spent more than 25 years at Goldman Sachs and during his tenure Cooperman was voted the number one portfolio strategist in the Institutional Investor "All-America Research Team" survey for nine straight years.

What sets Goldman apart from other investment banks is their leadership, their people and their culture. Just a few of the people who worked for Goldman before moving on to do other things include:

Steve Mnuchin, who is the 3rd Treasury Secretary that use to work for Goldman. The other two are Hank Paulson, who headed the department from 2006 to 2009 and Robert Rubin, who was the Tresury Secretary from 1995 to 1999.

William Dudley, president of the New York Fed and vice-chair of the Federal Open Market Committee (FOMC) since 2009, came from Goldman Sachs as well.

Malcolm Turnbull, a former partner of Goldman Sachs, became the prime minister of Australia in 2015.

After leaving Goldman Sachs, Cooperman started Omega Advisors, Inc. Recent investments Cooperman’s company has made include DuPont De Nemours, Diamond Back and Mr. Cooper Group.

Personally, I don’t agree with any of his calls as all three stocks are impacted by either the price of oil or interest rates.

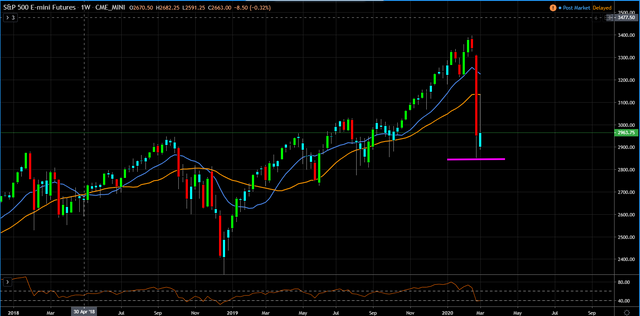

Jim Bianco of Bianco Research thinks the S&P 500 could fall to 2,500 before we see the bottom as the delay in the telling economic data fuels uncertainty. That would imply a 20% decline from Wednesday’s closing level of 3,130.

“In mid-February, we were trading at a forward P/E ratio of 20,” he said. “To get to that point, we needed to assume phase one of the trade deal was done. We were going to have globalization. We were going to have low inflation. We were going to have low interest rates driven by low inflation.”

“Then this thing comes down, and I ultimately think that there's a high probability that we're going to have a recession either in the first or second quarter because of economic disruptions coming,” he said. “We could possibly have a backlash coming out of this of de-globalization, which would mean bringing manufacturing back to the U.S., which would raise its cost, which would be more inflationary.”

Today, we got non-farm payroll numbers for February. The February jobs report was much better than expected and the unemployment rate was back at a 50-year low. However, the numbers were reported before COVID-19 really kicked into gear.

Once again, I was looking at last weeks lows to see how we were going to end the week. A break of the lows into the close would of signaled the equity markets were going lower next week. However, towards the end of the day, the Markets rallied off the lows and not only closed above last week's low, but sightly above the closed last Friday as well.

So have we reached a bottom, I don't know, but the way the Markets closed today was a great sign that we are near a bottom?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo