This past weekend, the U.S. State Department made an announcement urging people with health conditions to avoid going on cruise ships. And if you happen to set sail, many countries have screening procedures and/or some have denied port entry rights to ships and prevented passengers from disembarking and/or allowing passengers on shore, but they are limited to quarantined areas.

Carnival is the largest cruise company in the world, with more than 100 ships on the seas that attract over 12 million travelers each year across brands that include its namesake Carnival Cruise Lines, along with Holland America, Princess Cruises and Seabourn in North America; P&O Cruises in the United Kingdom and Australia; and Aida in Germany Carnival Corp.

Late last week, it was reported Carnival’s Grand Princess had 21 people infected with the virus as was stuck at seas for about five days. Recently, the ship docked and was in the process of getting all 2,500 passengers off the ship where most will be transferred to the Travis Air Force Base for 14 days of quarantine, while the remaining American passengers will be flown to other military bases in Georgia and Texas.

Carnival is increasing its safety and health measures to in an effect to minimize the spread of COVID-19. Carnival is also doing thermal scans and taking the temperature of every passenger on board and isn't allowing any people who recently traveled to highly infected areas on its ships.

All the public cruise ship companies have taken it to the chin over the past several weeks will all of the major companies losing about half their value. For example, Carnival shares suffer worst day in 19 years, close at 11-year low and Royal Caribbean’s stock suffers biggest loss in 11 years last week. And the carnage continued into this week.

John Buckingham has seen just about every type of stock-market environment in his three decades as a money manager. As a rule, he urges long-term investors to be patient.

But he’s also quick to enter pockets of the market that have been hit especially hard during the spread of the Covid-19 strain of coronavirus.

Buckingham, 54, says the cruise industry is one such opportunity, despite its obvious difficulties as the virus spreads. That is because of the increasing popularity of cruises among an aging population.

“Redeployment of Asian ships can work for a while, then you cut pricing and people are unlikely to go. So you may have one or two quarters where you have much lower revenue,” Buckingham said during an interview Feb. 28. “The question is three to five years from now. In the fullness of time, my belief is people will get back to cruising.”

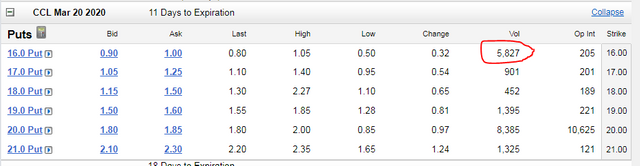

Not so fast, John as the Smart Money want to squeeze out a bit more profits to the downside. Today I noticed the Smart Money bought close to 6,000 of the March 20 put option with a strike price at $16.

Well, price has just breached the monthly demand at $25 today, so the chart suggests, the Smart Money will be right...once again.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

This is very interesting.....I eventually want to scoop up some cheap shares in my IRA, but may go lower than I was expected based on the option activity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit