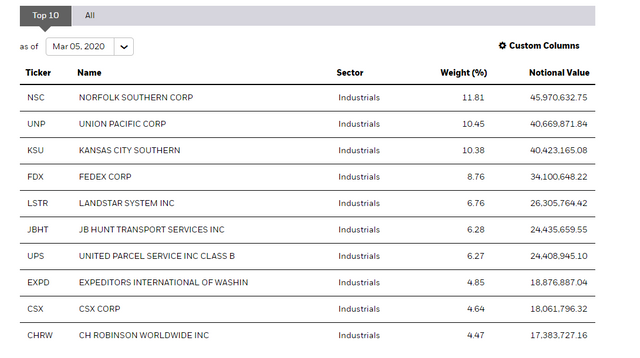

Transportation companies are the engines of the economy, ensuring that producers can get their goods to companies and consumers on demand. But as the economy slows down due to COVID-19, potentially impacting corporate earnings, less goods will be need to be delivered to companies and consumers because of a collapse in demand. The iShares Dow Jones Transportation, IYT, is exchange-traded fund that is highly correlated to the Dow Jones Transportation Average. The index includes companies within the trains, planes and automobile. Top holdings within the ETF are the following:

Over a year ago, I was seeing the chart on the Transport topping out on the monthly chart. Specially, price broke the up trendline that was established in 2016 and saw negative divergence and since that time, a lot of selling pressure near the $200.

The second top holding in the EFT is Union Pacific. Union Pacific Corporation, through its subsidiary, Union Pacific Railroad Company, engages in the railroad business in the United States. It offers transportation services for agricultural products, petroleum, liquid petroleum gases, and renewables; and industrial chemicals, plastics, etc., as well as intermodal and finished vehicles. Union Pacific mainly serving the Western and Midwestern regions of the United States.

China is the manufacturing hub of the world. For the month of February, the Caixin/Markit Manufacturing Purchasing Managers’ Index showed China’s factory activity contracted in February, coming in at a record low of 40.3. And the official manufacturing PMI from China’s statistics bureau showed February manufacturing activity in China shrank to 35.7, the fastest pace on record.

How how will China manufacturing situation affect the railroad companies in North America?

"I would not be surprised if we see another two, three, four weeks of ramp up before we ... get to the point where we were four months ago," said Keith Reardon, senior vice president of the consumer product supply chain for Canadian National (NYSE: CNI).

Not only do Chinese manufacturers need to ramp up production, they also need to get the country's supply chain from the plants to the ports back in order, Reardon said Thursday at a Barclays investor conference.

Union Pacific (NYSE: UNP) CFO Jennifer Hamann said one outcome from the coronavirus outbreak is that the second half of 2020 could still see "stronger" rail volumes, although there would be an extended period of slowness first followed by a spike in volumes.

"It may push things to the back half of the year more so than we thought," Hamann said at the Barclays conference.

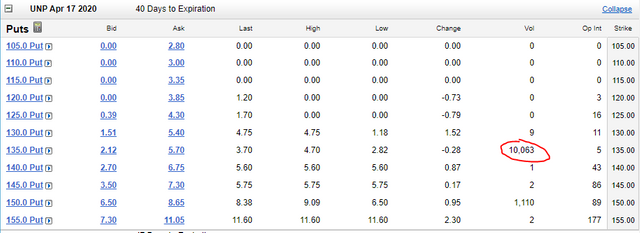

On Friday, I noticed bearish unusual options activity in Union Pacific. The Smart Money bought over 10,000 put options with a strike price at $135 that expires on April 24.

I personally would of been in this trade had I seen it during the Market open. I may or may not jump in with the Smart Money on today. However, if the Smart Money is going to be right, prices must breached the support/resistance line at $150.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

the Union Pacific Corporation recently in my own opinion have not been doing so well,all thanks to the lack of improved development happening to the world transport sector which was caused by the decline in the global economy,i will not want to invest with the company for now until everything is calm and settled....@rollandthomas

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great point and totally agree.

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit