Central banks are starting to see a crisis brewing right before their eyes. The unfortunate thing for this is the crisis is themselves.

In short, their effectiveness depends upon the confidence the majority places in them. As it stands now, the markets are saying there is no confidence in whatever the central banks are doing.

After a decade of easing, there is a total economic mess on our hands.

Make no mistake, before the coronavirus, there were major issues. The virus simply is the mechanism that toppled the apple cart. It was going, virus or not.

The central banks have been following the same playbook for a long time. Unfortunately, the result has not been what they expected.

Was last night the apex of their misguided notions?

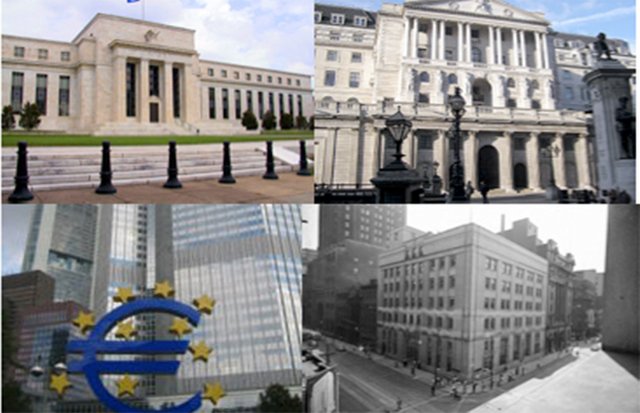

After an emergency meeting, the United Stated Federal Reserve dropped interest rates to zero while also opening up the easing bag to the tune of $700 billion. This was instantly met with a drop in stock market futures.

This carried over into the market, once again causing a pause in trading. As I write this, the market is off near 10%. I presume this was not the reaction the Fed was looking for.

The misguided notion is the belief that central banks have the ability to "manage" the economy. Over the decades, they repeatedly failed at this quest. Each time they failed, the negative impact was worse than before. We might be nearing the end.

Lowering interest rates does nothing when confidence is gone. People will not borrow money when they are not optimistic about the future. All the easing the world does little if the banks are not willing to lend. In short, they have to start lending on commercial paper.

Banks proved over and over they hoard the money and do not lend. They will never help the economy, only themselves. The Fed needs to take the money directly to corporations, where an impact can be felt.

As bad as the Federal Reserve is, the ECB is in much worse shape. The next leg in this entire process might well be the collapse of the European banking system. Even before this, they were riding on very shaking ground. Now, they are going to be in a bigger mess when defaults start to mount.

The next couple years are going to see the crisis for the central banks like they never saw before. Their inability to "manage" the economy is becoming obvious.

At this point, they are essentially out of ammunition. Ultimately, they are going to have to admit that supporting companies over governments is their only option.

This is not financial advice.

If you found this article informative, please give an upvote and resteem.

Posted via Steemleo

If interest drop, at least we can buy toilet paper on our credit cards at a lower interest rate.......The Fed Wins

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mortgage rates hit 3%....everyone can refi their homes and buy TP even cheaper (and in bigger quantities).

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm waiting for the 2.5% rates to filter through, given the traditional 1.5% over the 10 year note being the mortgage rate standard

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this is a bad news and it could really affect the global economy so much...@taskmaster4450le

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @taskmaster4450le! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit