Now that the coronavirus, or fear of, has nuked the global economy, we are going to see the impact of that. As this unfolds over the next few months, everyone is going to step up to try to help.

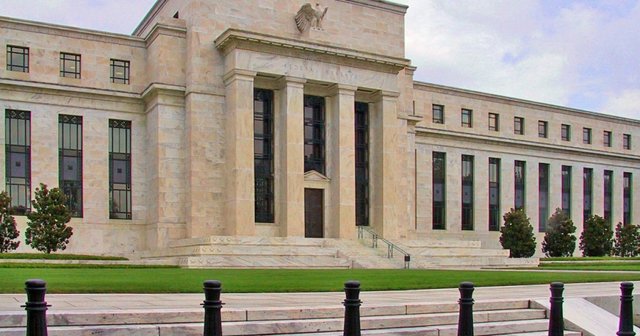

The United States Federal Reserve are already taking steps to alleviate what is taking place on the financial front.

There are two fronts that the central bank needs to operate. The first is with regard to the economy. It has to be concerned about trying to stimulate things when this mess is over. At the same time, and even more urgent, is offering liquidity to markets.

This was a problem even before coronavirus. The overnight repo market was freezing up in early December. Banks were afraid to lend to each other over fears of exposure to European banks. Thus, the Fed was the only one offering liquidity in an effort to keep short term rates from going through the roof.

At the top of challenges the Fed finds itself facing is the fact they are running out of bullets. Since central banks around the world have been stimulating for a decade, the impact is severely diminished. This means that, without room in interest rates, there are few choices when it comes to the economy.

After looking at the options, there is only one choice left. The Fed is going to have to massively expand the balance sheet, probably to a degree never imagined.

Entire industries are in jeopardy of collapse. There are many, such as the airlines, which the country cannot handle. In other words, they became utilities since we cannot go without the airline industry. There is no viable substitute.

Dropping interest rates to zero will have little impact since, in times where confidence is lacking, nobody wants to borrow. At the same time, banks are not likely to lend since the risk of default is elevated.

For decades, many have questioned whether a central bank could stimulate demand. As we move closer to full blown economic crisis, it is becoming evident that it cannot. Central banks are not in control of the economy. For more than half a century, the theory was to buy government paper in hopes that would stimulate things.

As I write this, I feel it showed itself to be a failure. As we saw with investors, the move is going to be private debt. Thus, the Fed is going to have to get into the commercial paper market in a much bigger way. Fortunately, this should provide a much greater result since businesses, not governments, are the ones who actually drive economies.

Sadly, it is going to take a couple years for all this to pan out. As I keep writing, many long held beliefs are going to be obliterated as we proceed forward. A lot of them are going to crumble under the weight of technological advancement. This situation, however, is the result of misguided notions over decades, resulting in crushing debt levels along with monetary policies that were ineffective.

As more of the economy gets eaten up by technology, a deflationary system, the problems with the central banks approach will be exposed. The balance sheet is going to have to expand in an enormous way to keep things going.

The crisis will be forgotten shortly after it passes. What I question is whether the Fed and other central banks understand the new reality they are operating in.

Lifelong economists might be the last ones to figure it out (with the exception of politicians).

If you found this article informative, please give an upvote and resteem.

Posted via Steemleo

I have a cousin, who works at a bank. Her branch is closing tomorrow due to the "coronavirus" but, she is telling people to pull money out of the banks and hold cash as the banks will soon be closed, and those who do not have ATM cards will not have access.

They don't know how long their bank will be closed.

So if the banks close... how do we get our $$???

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit