Hello friends!

I am pleased to send in my application for the individual Challengers of the Engagement challenge season 20. I am happy to be privileged to apply. I look forward to get a positive response and believe that my Topics will be considered.

My journey with Steemit started in January, 2023 when I got a job as a Receptionist with Mindset Computers at No. 15 Ikpa Road, Uyo, Akwa Ibom State. I came in contact with very wonderful people @bela90 and @manuelhooks who introduced me to the platform and also served as my coach to guide me through. I must say that ever since I joined this platform my life has experience a drastical improvement in a positive direction. My writing skills has improved and I was able to secure a teaching job at NCI Early Learning Center through an essay writing with all thanks to Steemit that helped improved my writing skills.

Though I have also had a fare share of life experience. I worked so hard and was rewarded many times through my writings but lost my steems to @roqqulovesteem when I wanted to convert my steem to real cash to benefit like everyone else in this platform do. Due to my own mistake they refused to credit my wallet. Despite these challenges I have not been discouraged though some life challenges made me to be inconsistent in the platform few months ago. I have been able to take care of my personal challenges and I am fully back to be consistent and dedicated in this platform. Even in my inactive state I was still talk to people to join the platform and on 20th August, 2024 I registered a new member @goodnessok and I am still promoting steem anywhere I go to in my community.

I have learned and unlearned so many things on this platform, and I am grateful for all my experiences. I have meet very wonderful friends such as @ngoenyi, @goodybest @wakeupkitty, @patjewel, @eliany and uncountable amazing friends who have been a source of inspiration and motivation to me and this experience will linger a long time in my memory and I am grateful for all of it.

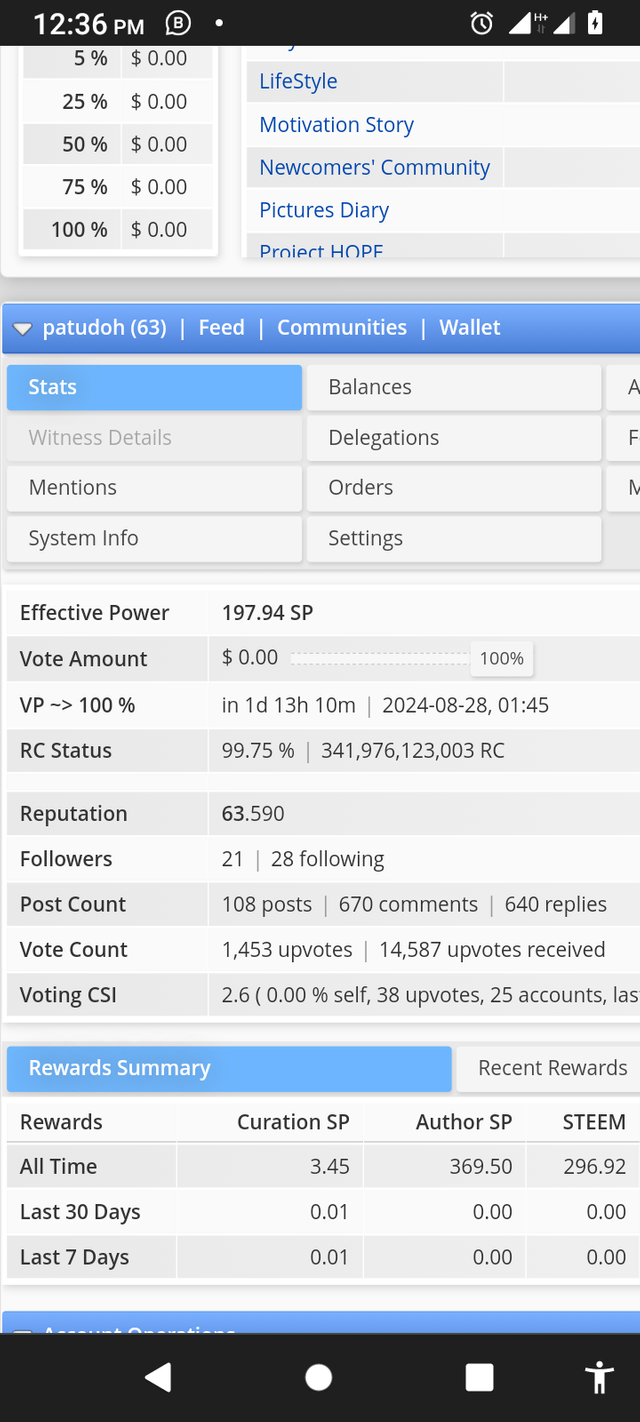

| Username | @patudoh |

|---|---|

| Reputation | 63.590 |

| Steem power | 197.941 |

| Club Status | Club5050 |

| Voting CSI | 2.6 ( 0.00 % self, 38 upvotes, 25 accounts, last 7d ) |

I am a hard working woman, full of life who has gotten experience in different works of life. I am an entrepreneur, a teacher, a Data analyst, MD/CEO of Enviro Waste Management Services and also a business coach. I have special interest in grooming ideas into a full fleshed solution that solves social problems and in turngenerates revenue. I hold BSc. in Communication Technology from National Open University of Nigeria.

Life has taught me so much lessons that I have determined not to fail or give up in life but to persist, focus and remain consistent in all I do.

Week One

Financial Literacy

Ever since we were born we have constantly witness inflation, and when prices of things go up they don't easily come down but can easily go up. This has left many in abject poverty as they can no longer provide for their families and loved ones because their income is no longer enough. Even in the biting economy you also see other families live in financial affluence and you tend to wonder what could be the secret.

It can affect many businesses negatively while others boom as a result. If you may wonder what could be the reason it is possible that most of the people or businesses negatively affected by inflation lack financial literacy.

Effective money management helps us cope with unexpected emergencies and prepares us to take advantage of future opportunities.

Now what is Financial Literacy?

Financial Literacy can be defined as knowing how to process the skills and confidence to manage one's finances.

Questions

From the definition given how do you best describe the following phrase and words? (Write in your opinion)

- "knowing how to"

- "Skills"

- "Confidence" in financial literacy.

In your own opinion write for or against this statement,

"Only business people should have financial literacy" If you are writing for, why? if against why not?

- Is it right for a business owners to take out money from their businesses to do personal things at any time? Back up your answers with reasons.

Week Two

Importance of Financial Literacy

Financial Literacy is a skill that everyone must learn to be able to survive in a world full of chaos and economic uncertainties. Hence it's importance is stated as follows:

- Teaches people concepts of money and how to manage it wisely.

- Offers basic skills related to earning, budgeting, saving and borrowing.

- Makes people become more informed about financial decision-making so they can plan for and realize their goals through setting financial goals, saving with a purpose and investing wisely.

- Enables proper record keeping of financial transactions so that income and expenditure can be managed wisely.

Questions

What is the right age to learn about financial literacy and why?

Is it right to set yearly financial goals? If yes why if no why not?

Do you set financial goals for yourself. (Back up your answers with examples.

What is your financial goals for this year? What level of the goal are you by now?

What are your plans in achieving your financial goals before the year ends?

Week Three

Benefits of Financial Literacy

Financial Literacy has numerous benefits such as:

- Ability to make better financial decisions

- Effective management of money and debt.

- Better equipped to reach financial goals.

- Reduction of expenses through compliance with regulations.

- Less financial financial stress and anxiety.

- Increase in ethical decision-making selecting insurance, loans, investment and using a credit card.

- Creation of a structured budget

Questions

What financial decisions have you made in the past the cost you lost and how much was involved. Write in details.

What is your opinion in this statement?

"Life is full of risk so I can risk my money in any business whether genuine or not."

Do you prepare yearly budget for yourself? If yes can you share example of your budget with us? If no state your reasons.

Have you ever experience financial stress and anxiety before? If yes can you share your experience. If no share your experience as well.

Week Four

Principles of Financial Literacy

Principles are fundamental truths or guidelines that form the foundation of beliefs or actions. Financial Literacy has its own principles that everyone must adhere to most especially if you are running a business.

Here are principles of Financial Literacy:

- Always pay yourself first and always save a portion of your income before spending the rest.

- Start saving today

- Do not borrow what you cannot pay

- Always budget your money and learn to stick to your budget.

- Always list your financial goals and work towards achieving them.

Questions

Is it right to donate your business capital to a church or religious organization believing that a miracle will happen for a double return? If yes, why? if no, why not? Back up your answers with real life examples.

How often do you borrow money and where do you borrow from?

Do you always pay back borrowed money? If yes give instance and state your reasons, if no what are your reasons for not paying back borrowed money.

Week Five

How Financial Literacy Enhances Business Growth

Lack of financial literacy is one of the major hurdles that affect business growth in many countries.

What is business growth?

Business Growth is a stage where a business enterprise experiences continuous increase in profit, staff strength, capital base, market share etc.

Your ability to use sound financial management skills is vital in growing your business enterprise. Inability to fully utilize literacy skills can deprive your business of growth. Lack of financial literacy can lead to cash flow crises, inability of the business to meet it's daily financial obligations, wrong investment or financing decisions, lack of trust, poor reputation and other negative issues.

Below are ways financial literacy can enhance business growth:

- Develop a budget and ensure to follow the budget.

- Open a business account and ensure it is used by all customers.

- Be on a salary.

- Be very disciplined about keeping company or business records.

- Save for the business.

- Borrow only when necessary.

- Pay back loans as at when due.

- Have a specific cash amount that must be in the office. Any excess amount should be deposited into the bank.

- With sound financial literacy, your business will maintain adequate cash flow to guide against liquidity crises.

- Your businesses will have sufficient cash to buy stock and produce more goods, you will experience increase in sales and profit.

Questions

Do you have a business you are running or are you a civil servant?

If your answer is yes to question 1 above , are you on salary? If yes, why? If no, why not?

Do you access loans for your business? If yes, why? if no, why not? Do you pay back your loans as at when due?

Do you keep your business or company records? If yes, why?(show a proof) if not what are your reasons?

Does your business have a special account or you use personal account for your business? If yes why if no why not.

Week Six

Accounting and Book Keeping

Basics of Record keeping: Record keeping is an act of documenting your business financial transactions within a particular time frame. Keeping up-to-date records of your business transactions will help you to spot financial crises on time and lead you to needed solutions.

What is Accounting?

Accounting, on the other hand is the process of collating, classifying, recording, analyzing and reporting financial information of an organization.

Bookkeeping which is also known as record keeping is an aspect of accounting. It is the transaction recording aspect of accounting.

Accounting is much broader than bookkeeping because it extends to analysis and interpretation of records and their importance to various user

Record keeping therefore entails documenting business transactions while accounting goes further to analyze and report the documented data.

Importance of Record Keeping:

Record keeping helps to ascertain the performance of the business over a period; to know if the business is making profit or loss.

It also enables you ascertain whether the business has sufficient cash to run successfully.

Record keeping helps to know the level of indebtedness of the business

To ascertain the value of the business

To assist in future planning e.g forecasting and budgeting.

With good record keeping it is easier for you to access business loans and grants, because this boosts investor's confidence in your business.

Good record keeping helps you to know the amount of tax to pay to the relevant agencies.

With record keeping, you can analyze and compare the performance of your company to competitors in your industry.

Questions:

Is record or book keeping a waste of time or not? If yes, why? If no, why not?

What are the types of financial records a business or organisation can keep.

Do you keep records of your business if yes, why? and if no, why not?

Has your business or organisation received grants before? If yes, give examples

Does your business pay tax? If yes, to who, if no why not

My Telegram: Patience Victor

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saludos amiga gracias por compartir tu postulación con nosotros, además de todo lo que te paso continuaste en Steemit. Te deseo mucho éxito en tu postulación.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your review and kind words.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great to see your application I felt happy you did but next the confusion started...

It was a long scroll (phone user) to figure out what exactly you are teaching. It's something with money, money business and business money but altogether it confuses me because I see you already gave the answers to questios meaning there is no need to join or room for me to think, adapt it into my personal situation.

I've been thinking..

Why not start with the lessons you have to offer and drop your info at the bottom because to be honest I am interested in what you teach not in knowing everything about you.

It was a long scroll on my phone and I thought about giving up and I don't know where to look.A fitting hashtag about what you like to teach can be a help as well. ☹️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, good observations noted, once the application is approved it is subject for corrections and adjustment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also if follow up carefully you will see that the answers to the previous week questions are actually given at the beginning of a new week contest. My main focus is to help people identify where they have not been doing well in managing their finances and also practice what ever lessons they have learnt from here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also if follow up carefully you will see that the answers to the previous week questions are actually given at the beginning of a new week contest. My main focus is to help people identify where they have not been doing well in managing their finances and also practice what ever lessons they have learnt from here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit