image source

WELCOME TO DAY 2 OF THIS CONTEST.

FEATURES OF POLONIEX EXCHANGE

Major features of Poloniex exchange

Poloniex provides users with 2 major products on its platform:

• Poloniex exchange trading platform : in exchange you can swap between coins, you can also buy and sell currencies. Get a basic order book that holds transaction history and many more

• Poloniex marginal trading platform : if a user is looking to borrow crypto coins from other participants, they can set a loan rate depending on the market condition of lending. For today's contest we would be explaining Poloniex marginal exchange.

Poloniex Marginal Trading

Margin trading is simply trading with a borrowed fund, when a margin order is placed, the money you are using is borrowed from other users offering their funds as peer-to-peer loans. The funds in your margin account is used only as collateral for these loans and to settle debts to lenders.

General Overview

Lending simply means a way to earn passive income on your funds without actively needing to trade. It therefore form an integral aspect of exchange.

Primary, lending on Poloniex is peer-to-peer margin lending. When you lend to margin traders on Poloniex, you’re loaning to people who are attempting to boost their trading and investing earnings by using their existing Poloniex account balances as collateral to borrow more cryptocurrencies which can still be reinvested.

Accessing from our traditional financial markets, marginal lending is often dominated by the stockbrokers who create the trading platforms. In the cryptocurrency galaxy, platforms like Poloniex allow peer-to-peer margin lending, where margin loans don’t originate from the platform owners, but from other users of the platform. Lending to margin traders in Poloniex marginal lending can be a lower risk way to earn a significant return on otherwise idle funds.

Technicalities Involved In Marginal Lending

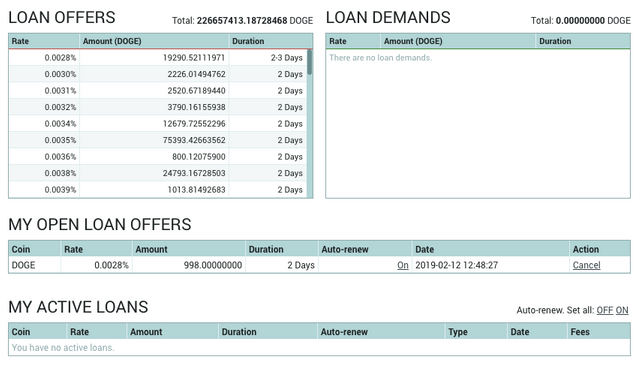

Poloneix platform is already user friendly and the process in trading on marginal platform is easy. The individual lenders deposit their funds into their respective accounts and transfers balances to the lending accounts and create loan offers form for interested marginal traders using Poloniex loan order book.

The loan offers are then organized according to the hierarchy of rates and duration. Loans offers with lower rates and longer periods are given priority than those of high rates and shorter duration.

Upon request from the lenders to borrow funds, the poloniex marginal lending platform matches their request based on the best available orders. The loan is then keep open until the marginal trader closes the trade or until the maximum duration is reached.

At the end of a successful trade, the interest on the trade is paid from the margin trader to the lender. The interest is calculated based on the agreed upon rate and the duration of the loan.

Marginal Interest Fees

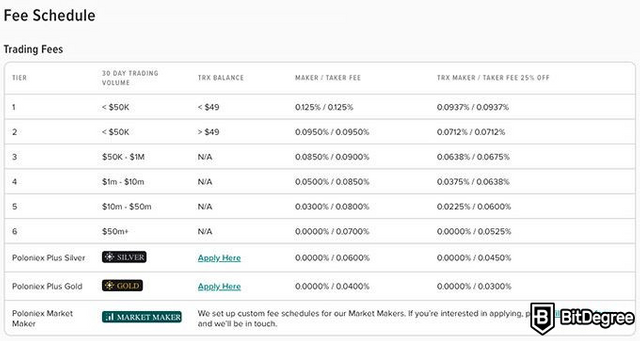

Margin traders pay interest to their lender based on the amount they loan. The interest rate is specified in the loan offer and is charged once your margin position has been closed

Future Trading Fees

Maker: - 0.026%

Takers: 0.75%

Lending Fees

15% of the interest earned by a lending customer will be collected by Poloniex as a lending fee.

Nevertheless, if there is high demand of traders who want to borrow currencies for speculations, when the supply of lenders are few it could cause a rise on the lending fee since traders will struggle for the available lendings. Too many supplies of lendings and less lending demand orders could also cause the lending fee to fail

Advantages of Marginal Trading

Using P2P lending, customers can earn interest on their crypto by lending it to other customers.

When you lend money on Poloniex platform, it is impossible for the borrowed fund to leave the platform.as soon the borrower closes their trade, the funds are returned to the lender automatically.

Furthermore, Poloniex is able to implement strict risk controls for borrowers, where the borrower's loan is auto-liquidated if their available collateral drops below a certain region.

Risk Involved In Marginal Trading

In cases where a borrower defaults, once the duration of your loan has ended, your lending account will be credited with the initial amount lent to the borrower, plus interest, minus the fees due to Poloniex on interest you have earned. As stated, the only instance where this would not happen would be if a borrower defaults on a margin position and is unable to repay the debt owed to you.

If a borrower does default on their loan, the margin platform has a liquidation procedure in place that will liquidate borrower positions as necessary in an attempt to ensure there are enough funds left to repay outstanding debts owed to you as lender. However, as lender, you should be aware that the ability of the borrower to repay their loan is not guaranteed: market volatility, liquidity conditions, and order book activity may lead to borrowing accounts not having enough collateral to pay back their loan. While the system is designed to protect lenders, there is still risk of loss. This risk is assumed by the lender per the User Agreement.

Conclusion

Marginal trading is very attractive and effective if not for the risk involved, the surge in cryptocurrencies value and other. It is therefore advised that you trade with caution and be wise.

For more information visit link

Thank you for reading through,

Next article loading...

Thank you for taking part in the Spotlight on Poloniex Contest.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit