It has being a wonderful contest all through, thank you to all have participated and the entire steemit team. Cheers.

What Are Leverage Tokens

A leveraged token is a financial derivative that enables you to gain exposure to a leveraged trading position in a digital asset without having to deal with margin trade, liquidation, collateral, funding rates. Due to its simplicity, they have got a lot of attention since their appearance.

A leveraged token maintains notional exposure to -2x or -3x of the daily returns of a crypto asset like Bitcoin and Etherum.

What Are FTX Leverage Token On Poloniex?

According to Poloniex, leveraged tokens provide leveraged exposure to crypto assets without having to worry about collateral, margin, liquidation prices, or anything else that you’d need to manage with regular margin trading.

How It Works/Calculations

Leveraged tokens provide a simplified way to get leveraged exposure to crypto assets. These tokens are issued and redeemed by FTX and can be traded on Poloniex.

Basically, each leveraged token has a net asset value (NAV) and an underlying position. TAKING ETHBULL (3x long ETH) as an example. If ETHBULL has a NAV of $300, it would have an underlying position of $900. That means that when ETH goes up 1%, ETHBULL goes up 3%; and when ETH goes down 1%, ETHBULL goes down 3%. There are +3x (BULL) and -3x (BEAR) LTs.

When markets move, the leverage of each leveraged token changes and the tokens need to rebalance in order to return to their target leverage. So if ETH increase by 5% in 24 hours, the profit for the underlying position would be $45.

That is the original VAV of ETHBULL was $900ETH price change: the profit is $9005/100=$45.

ETHBULL’s NAV would then be $345 and the leverage would be $900*105%/$345=~2.74x, the underlying position of ETHBULL will be increased by FTX.

To ensure each leveraged token returns to 3X leverage for the second day, FTX will rebalance the tokens at 00:02 UTC each day. As per this example the underlying position in ETH would be $1035. So ETHBULL will buy the additional $135 of ETH.

If the daily movement of the leveraged token causes the leverage to be 33% higher than its target, there will also be an intraday rebalance.

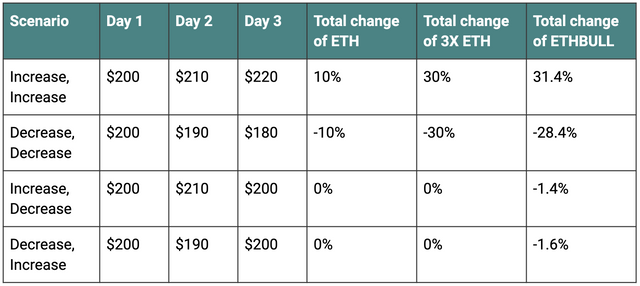

Since leveraged tokens rebalance at 00:02 UTC each day, within a day starting at 00:02 UTC, the price movement of the leveraged token should mimic their target leverage times the underlying asset’s move. However, a 5% move over two days is not the same as a 10% move overall, meaning that over longer periods of time, the rebalances mean each leveraged token’s movement is not necessarily the target leverage times the movement of the underlying. Typically, leveraged tokens over perform during periods of momentum and underperform during periods of mean reversion.

Leverage Tokens Available On Poloniex

There are currently 16 token available for trading on Poloniex:

BULL: 3X Long Bitcoin Token

BEAR: 3X Short Bitcoin Token

TRXBULL: 3X Long TRX Token

TRXBEAR: 3X Short TRX Token

BSVBULL: 3X Long Bitcoin SV Token

BSVBEAR: 3X Short Bitcoin SV Token

ETHBULL: 3X Long Ethereum Token

ETHBEAR: 3X Short Ethereum Token

BCHBULL: 3X Long Bitcoin Cash Token

BCHBEAR: 3X Short Bitcoin Cash Token

EOSBULL: 3X Long EOS Token

EOSBEAR: 3X Short EOS Token

XRPBULL: 3X Long XRP Token

XRPBEAR: 3X Short XRP Token

LINKBULL: 3X Long Chainlink Token

LINKBEAR: 3X Short Chainlink Token

Benefits of Trading Leveraged Tokens

Leveraged tokens can provide some peace of mind if a trader doesn’t want to worry about liquidation on positions. They are also much better during strong trending periods, due to the daily rebalancing and compounding effect, which would otherwise need to be done manually in order to achieve the same result. There are multiple aspects why traders should use leveraged tokens but the four main ones are highlighted below.

• Zero hassle: Traders don’t have to worry about managing funding rates, borrowing costs, and/or monitoring positions for risks of margin calls.

• Daily rebalancing: Each token rebalances daily to ensure constant leverage ratios of the underlying assets are always maintained. It prevents the token holder from getting liquidated as is the case when leverage is used for futures and perpetual swap contracts.

• Tradability: The tokens are listed on the leading crypto exchanges such as the Bitcoin.com Exchange, making it easier to enter and exit positions on the secondary market.

• Reduced Liquidation Risk: When losing money leveraged tokens reduce exposure, thus greatly reducing the chance of liquidation. It would require a 33% 24-hour change in price for liquidation to occur.

Risk Involved In FTX Leverage Trading

Leveraged tokens are higher risk than other spot markets and potentially more volatile. They may gain or lose large amounts of their value in a day. These tokens will perform differently than regular leveraged exposure. With their rebalancing process, the target leverage will be achieved each day but not necessarily sustained over the long-term.

Wow wonderful explanation from you.

In leverage trading we get good profit with in short period at the same time very risky too.

Need to understand Market Condition forthis trade,other wise we lost our money with in short period some times.

Nice post from you

#affable #india #twopercent

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking time to go through.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking part in the Spotlight on Poloniex Contest.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit