Terra's rise to fame was as spectacular as its crash - no one had seen it coming in a magnitude of that sort, as LUNA fell from an all-time-high (ATH) of $119 to virtually $0 over a meagre few days, wiping out billions of dollars of investments. My cryptocurrency portfolio is a diversified mix of stablecoins and cryptocurrencies that I deem worthy of holding - regrettably, LUNA and UST were on the list, albeit not in a stupendously significant portion. As the cryptocurrency market laments and wails over the Terra fiasco - and understandably so - I have been spending the past few days pondering upon a few important learning points that I have acquired from this humbling experience of losing money, that has perhaps ever so slightly enriched my investment journey.

1.) As beauty lies in the eyes of the beholder, so does value in the eyes of the investor.

There was once a coin by the name of LUNA which sparked awe in almost every cryptocurrency enthusiast, given it's incredible performance in 2021 of having gained 13,800% of its value, outperforming most of the leading cryptocurrencies during the time. LUNA surged to its all time high of $119.1 on April 5, alongside a deluge of interests surrounding Terra DeFi apps. In fact, the name 'LUNA' and the iconic symbol of the coin itself was held with such great awe and admiration, as it kept outperforming itself and hitting new ATHs - much to the excitement of the cryptocurrency community. I had, for one, FOMO-ed into the market frenzy, scooping up fractions of LUNA along the way. Indeed, no one would have thought that what was once held with such awe and reverence would lose almost the entirety of its value in a single day! What with the massively diluted market cap and deflated value of the coin, one can never look at LUNA the same way anymore, can they?

2.) HODLing may not be the best strategy; always take profits/ stop losses

If you have been investing, chances are that you would probably have encountered the term HODL, which is perhaps as a catchy a lingo as it is a bane to language purists! The term, a misspelling of ‘hold’, traces its origins back to 2013 with a post in the Bitcointalk forum, which was written by a drunk, semi-coherent user ranting about his poor trading skills and determination to simply hold Bitcoin from that point on. Little would he know that the price of Bitcoin, having been HODL-ed from that point on, would have surged to its ATH by more than 60,000%! As such, HODL-ing has been widely acclaimed to be the preferred investment strategy for the investor, given that it is difficult to time the market.

However, is HODLing suitable for everyone? Apparently not quite. If you are a trader, HODLing might not be the best strategy; if you are an investor and believe in the value of a coin, you can buy and HODL it for years, resisting the temptation to panic sell when the price slumps in the interim, as the price may after all appreciate in the long run.

Is HODL-ing suitable for all coins? Perhaps Bitcoin is more suitable to be HODL-ed long-term, as history has shown time and again that altcoins (apart from Ethereum) have the tendency to heavily correct and lose a significant portion of its value during a bear market, in contrast to Bitcoin which comparatively does better. LUNA being an exception has gone out of the way to prove this point, having lost almost 100% in value over a short span of a few days.

As such, what is a suitable strategy? This varies according to individual investment appetites and risk tolerances; but always have in place a reasonable take profit/ stop profit target. Remember, what goes up, must come down; the converse on the other hand may not always be true - hence the importance of capital preservation by means of stopping losses as needed, especially in a unilateral market as exhibited by the downfall of LUNA.

3.) More isn't always better

While we are naturally inclined towards offerings that are more rewarding, it is perhaps important to take a step back and look at the risk vs reward ratio - is it one worth taking? Looking back with perhaps a certain degree of hindsight bias, one could critically point out flaws and imperfections in the algorithmic design of the Terra ecosystem, such as an unrealistically high yield of the Anchor protocol, which would have been unsustainable in the long (apparently short) run as it will likely run out of ANC tokens with which to incentivize borrowing, following which more tokens would then have to be issued hence devaluing those in circulation. A sound investment portfolio as such needs to be sustainable; if a project offers returns that sound too good to be true (which nonetheless is not entirely impossible in the space of DeFi), always think twice and thoroughly do your own research to determine the worthiness and reliability of such an investment, as it is your hard-earned money that is at stake!

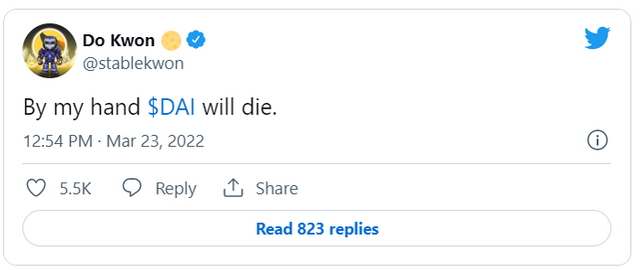

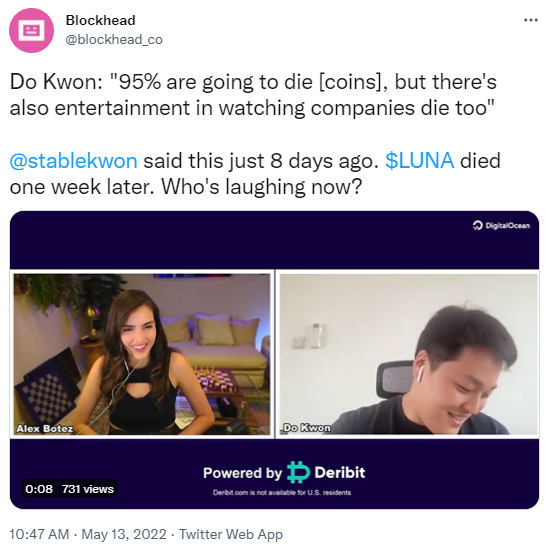

4.)Always be humble!

Do Kwon, the CEO of Singapore-based Terraform Labs has been the talk of the town for all the wrong reasons - not so much for the obvious failure of the Terra ecosystem - but due to his (untimely) arrogance which has unleashed the wrath of the Twitter community, backfiring on himself. A series of conceited and pompous tweets of Do Kwon in the past belittling other entities and cryptocurrencies were dug up and sensationalized, adding to the fury of the already bereaved netizens. Always remember that a little humility goes a long way to success.

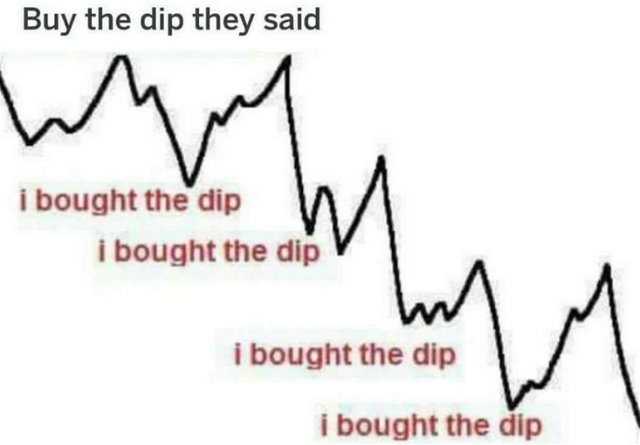

5.) Do not catch a falling knife

Never underestimate what cryptocurrencies can do - volatility is their middle name. Even with the best of knowledge in technical analysis, one can never predict the bottom of a market - dollar cost averaging is the strategy to go if you believe in the long-term feasibility and potential of a coin - buying the dips in small amounts and averaging your entry prices as you go along; after all, timing the market is difficult, as nobody has a crystal ball to peek into the future. No one would have thought that LUNA was able to accomplish the feat of eradicating almost the entirety of its value over the space of a meagre few days - buying these dips along the way would have been tantamount to burning hard-earned money. Perhaps a better way to buy the dips, apart from doing so in small amounts, is to buy on the recovery arm of the momentum, rather than the dipping part of it - as one can never tell if the dip will still continue. Always bear in mind that it is better to earn less from buying later, than to lose more from buying too early. Retrospectively, in the case of the LUNA fiasco, it would have been better to adopt a wait-and-watch approach as the dip progressed over the gloomy red days.

6.) Money lost can be earned; time lost is forever condemned

I read with regret the news of investors taking their own life after having lost their entire life savings to the depegging of UST, which was meant to be a stablecoin maintaining a 1:1 parity to the USD. While it is indeed easier said than done especially from a third-person point of view, life is worth so much more than what money can quantify - family, friends and the many little things in life that matter. As time is indeed the ultimate currency, what materialistic assets lost can always be rebuilt and reacquired albeit with painstaking effort; whilst time or life once wasted away, is condemned forever. It is as such important to stay level-headed in this journey of investment, which will definitely be filled with ups and downs - which leads us to the next point.

7.) Never put all your eggs in one basket

Always maintain a diversified portfolio at all levels, from the choice of your cryptocurrency token, to your playground (DeFi/ CeFi), to the secure storage of your digital assets (cold/ hot wallets). No single investment is fool-proof; only time can tell. I was lucky to have escaped the temptation of confining my entire stablecoin collection to UST in the wake of a higher APR, which would have otherwise spelled absolute disaster. The majority of my crypto portfolio is invested in stablecoins mainly USDC (and USDT to a limited extent) and some in the fallen UST, in a variety of CeFi platforms that generate passive cashflow for me, in the hope of hedging against the depreciation of my ailing native fiat currency. A new algorithmic stablecoin, USDD is quick emerging in popularity these days, that promises a similar mechanism yet different approach in achieving the algorithmic peg, to LUNA.

A Silver Lining Behind Every Cloud

LUNA's downfall has been a true eye-opener in every sense of the word; while I mourn the loss of my investments, I also constantly remind myself to look up, pick up these valuable life lessons and continue on my exciting journey of investment. After all, learning is a lifelong journey; what doesn't kill you, indeed makes you stronger!

Hi @cyberyy nice to greet you, I'm @wilmer1988 and on behalf of the entire steemit team I want to welcome you to steemit, a digital universe that allows you to share everything that you are passionate about and be part of a world of possibilities.

I want to invite you to join Newcomers'Community, a place where new users can officially introduce themselves and thereby meet achievement 1.

It is important that you know and be part of the #club5050, for this you must maintain a balance during each month by turning on no less than 50% of your withdrawals and transfers, in this way you will be contributing to the platform and you can be considered for support from the steemit team, learn more here

I recommend you follow the @steemblog account, which is the official channel of steemit, here you will find all the current information regarding the platform, contests, events, updates and others that will surely help you a lot.

I advise you that your publications have less than 300 words that allow the reader to understand the content you want to share

I don't want to say goodbye without first inviting you to the form part of the largest movement in steemit such as The Diary Game #thediarygame.

On behalf of the steemit team, I say goodbye wishing that all this information could be of help to you.

Greetings

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @wilmer1988 for the warm welcome and helpful information! Great to be a part of the community here :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit