Introduction

The Bank of England (BoE) plays a pivotal role in shaping a country's economy, and one of its most crucial tools is the determination of the base rate. The base rate, often referred to as the "Bank Rate," influences borrowing costs throughout the economy and has far-reaching effects on businesses, consumers, and financial markets. In this article, we delve into the intricacies of the Bank of England base rate, its significance, and the mechanisms by which it affects various sectors.

What is the Bank of England Base Rate?

The Bank of England base rate is the interest rate at which commercial banks and other financial institutions can borrow money from the central bank. It serves as a benchmark for setting interest rates across the broader economy, influencing lending rates for mortgages, personal loans, and business loans. The base rate is a key tool used by the central bank to achieve its monetary policy objectives, primarily centered around maintaining price stability and supporting economic growth.

Monetary Policy and the Base Rate

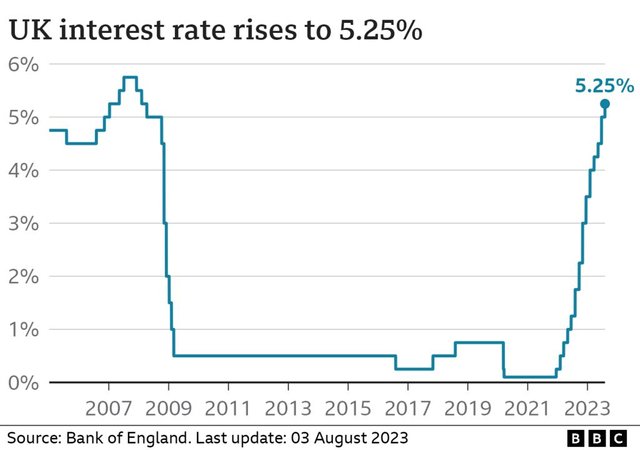

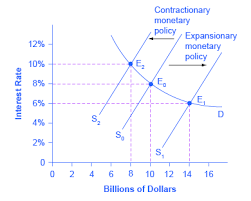

The BoE utilizes the base rate as part of its broader monetary policy toolkit to control inflation and stimulate or cool down economic activity. When the economy is growing too quickly and inflation is rising above the target, the central bank may decide to increase the base rate. This makes borrowing more expensive, which reduces consumer spending and business investment, ultimately helping to curb inflation.

Conversely, during times of economic slowdown or recession, the central bank might lower the base rate. This move makes borrowing cheaper, encouraging businesses and individuals to take out loans and spend more, thus boosting economic activity and aiding recovery. By adjusting the base rate, the BoE seeks to strike a delicate balance between supporting growth and maintaining price stability.

Impact on Consumers and Businesses

Changes in the Bank of England base rate have a direct impact on the finances of consumers and businesses alike. When the base rate rises, interest rates on existing variable-rate loans, such as mortgages and personal loans, tend to increase. This can lead to higher monthly payments for borrowers, potentially impacting their disposable income and spending habits.

On the other hand, a lower base rate can translate to reduced borrowing costs. This can provide a favorable environment for businesses to expand operations or invest in new projects, and it can make homeownership more accessible for potential buyers.

Financial Markets and Investor Sentiment

The Bank of England base rate also influences investor sentiment and financial market dynamics. When the central bank announces changes to the base rate, it can trigger fluctuations in bond yields, currency exchange rates, and stock prices. Investors closely monitor these announcements and adjust their portfolios accordingly to capitalize on potential opportunities.

Global Implications

Changes in the Bank of England base rate can reverberate beyond the country's borders. Given the interconnectedness of the global economy, shifts in interest rates can impact international capital flows and exchange rates. Other central banks might also respond to changes in the BoE base rate, creating a chain reaction of monetary policy adjustments worldwide.

Conclusion

The Bank of England base rate serves as a linchpin of the country's monetary policy framework, wielding significant influence over economic activity, consumer behavior, and financial markets. As the central bank carefully navigates the complexities of maintaining stable prices and supporting sustainable growth, its decisions regarding the base rate remain integral to shaping the economic landscape of the United Kingdom and beyond.

Thank you for publishing your post a warm welcome from @crowd1, thank you for your delightful and lovely article, you have good writing skills✍️. Join our vibrant steemit community for engaging discussions, valuable insights, and exciting contests! Connect with fellow steemians and unlock endless possibilities. Let's grow together! JoinOurCommunityCrowd1

Crowd1 booster community

Happy writing and good fortune🤝

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for your support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit