Hello Steemians,

Hope you all are doing well.

This is my 4th post about “Applying Markdowns" in NEWCOMERS COMMUNITY

For explain this I am choosing a topic ALTCOIN.

Let’s start,

ALTCOIN

Altcoins are cryptocurrencies other than Bitcoin. As a name Altcoin is the combination of two words “Alt” and “coin” refers to the entire alternative crypto currencies to Bitcoin.

Steem is also one of the Altcoin.

Basic framework of Altcoins and Bitcoin are same but there are several differences between them. Bitcoin is among the first iterations of a cryptocurrency and its philosophy and design set the benchmark for the development of other coins. Most of Altcoin are developed for cater some shortcomings of Bitcoin.

Following are some limitations / shortcomings of Bitcoin.

- Consensus Mechanism.

- High Volatility

Below are mention types of Altcoins which conquer above limitations, It is possible for an Altcoin to fall into more than one category.

1. Based on the Consensus Mechanism.

- Proof of Work (PoW)

- Proof of Stake (PoS)

- Proof of Space (PoS)

- Proof of Personhood (PoP)

- Proof of Authority (PoA)

Proof of Work (PoW) and Proof of Stake (PoS) are explain below.

Proof of Work (PoW)

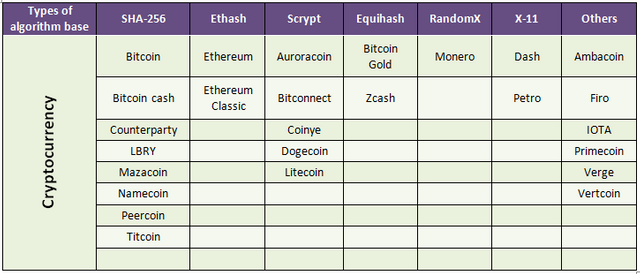

Below are mention some PoW algorithms and cryptocurrencies base on that algorithm.

Major drawback in PoW system is a 51% attack.

51% attack is an attack on a blockchain by a group of miners who control more than 50% of the network's mining hash rate. Attackers with majority control of the network can interrupt the recording of new blocks by preventing other miners from completing blocks.

Proof of Stake (PoS)

The Proof of Stake (PoS) concept states that a person can mine or validate block transactions according to how many coins they hold. This means that the more coins owned by a miner, the more mining power they have.Source

Proof of Stake (POS) is seen as less risky in terms of the potential for miners to attack the network, as it structures compensation in a way that makes an attack less advantageous for the miner.

The Steem cryptocurrency is working on PoS concept.

Along with Steem below mention crypto currencies are using PoS concept.

| Following Cryptocurrencies are working on Proof of Stake (POS) |

|---|

| Steem |

| Tron |

| Cardano |

| EOD.IO |

| Gridcoin |

| NX |

| Peercoin |

| Polkadot |

| Tezos |

2. Stablecoin ( For solve High Volatility )

A stablecoin is a new class of cryptocurrencies that attempts to offer price stability and are backed by a reserve asset. Stablecoins may be pegged to a currency like the U.S. dollar or to a commodity's price such as gold. Stablecoins achieve their price stability via collateralization (backing) or through algorithmic mechanisms of buying and selling the reference asset or its derivatives. Source

There are 4 types of Stablecoin cryptocurrency.

Commodity-backed cryptocurrency value is fixed to one or more commodities and redeemable for such (more or less) on demand.

Digix Gold Tokens (DGX) is example of Commodity-backed cryptocurrency.Fiat-backed cryptocurrencies value based on the value of the backing currency.

TrueUSD (TUSD),USD Tether (USDT), USD Coin, Diem are examples of Fiat-backed cryptocurrencies.Cryptocurrency-backed stablecoins are backed by other cryptocurrencies. for example MakerDAO’s DAI is pegged against the U.S. dollar and Havven backed by nUSD which is a stablecoin.

Non-collateralized (algorithmic) stablecoins don’t use any reserve but include a working mechanism, like that of a central bank, to retain a stable price. For example, the dollar-pegged Basecoin uses a consensus mechanism to increase or decrease the supply of tokens on need basis.

This is basic information about ALTCOIN. Thank you for reading my post and Special thanks to the @cryptokannon for creating this achievement task to educate us on Markdowns.

Thank you

@logical-crypto

Very informative. Good work...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

curator note: 3

You can continue to the next achievement task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have been upvoted by tarpan, a greeter from STEEM POD Project and we are voting with the Steemit Community Curator @steemcurator03 account to support the newcomers coming into steemit. You may now proceed to the next achievement task.

Keep following @steemitblog for updates.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit