5 years ago I made some money on this platform. Today it could be a completely different amount of cash. Reflection is a very terrible psychological effect that destroys the present. You can't avoid this feeling if you faced cryptocurrency in 2016…

My example is very illustrative. 5 years ago, having sold all steem coins that I had, I earned about 2.2 BTC. In June 2017, when the BTC rate rose to $ 2,500, I sold it. In December 2017, I could earn $ 40,000.

Do I regret? Of course, all I did in 2017 was count the money I didn't have anymore. But, having honestly talked to myself, I realized that I needed those $ 5,000 right then, and I became happy again.

After 5 years, I achieved some success in my career, which gave me financial stability (Not sure, could I achieved this without 2.2. BTC). Thanks to this, when I logged into my steem account few weeks ago and saw $ 450, I looked on these money with completely different eyes…

As you may have guessed, I am not an experienced trader who makes thousands of dollars in cryptocurrency playing on currency volatility, analyzing trade patterns, and tracking news feeds. But I have free $ 450 in crypto.… What am I going to do? Oh, of course "engage in investing".

Investing is too big a word for my actions. Rather, it is an experiment based on systematized information.$ 450 today can turn into $ 45 by itself, without any actions. Can they turn into $ 4,500 without any actions? Unlikely.

Warning! I am ready to lose this money. This is an experiment, not a ready-made case. You can observe, criticize, give advice, but it is better not to repeat it. $ 450 is good money. All I have is independence from this money and 4 tools. Let’s Go.

Why should I do cryptocurrency analysis (capitalization, tech background, community strength...) if thousands of other people have done it hundred times, and better than me? So… «OK Google» Show me all related articles «best altcoins to invest in 2021.

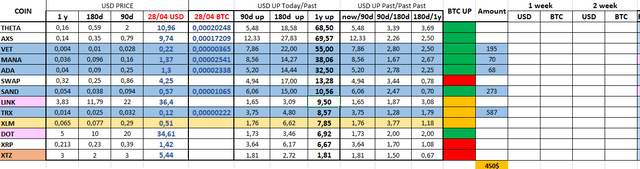

After reading about 30 articles with a publication date of 2020, which repeat each other by about 80%, I chose 14 altcoins. CoinGecko allowed me to select these coins according to the following criteria:

- Selected coins really grown up in 2021 (you will see it in the table). I just compared prices 1 year, 180 days, 90 days ago and today. Oddly enough, «Google analytics» almost made no mistakes.

- The coin should be inexpensive. Still, it is better to buy 100 coins for $1, than 1 coin for $100. Why? Flexibility. Diversification of assets. And I like big numbers.

- The coin should grow not only in USD, but primarily in BTC.

- I excluded the old, big players like LTC and ETH. They are too expensive, for multiple growth.

I entered all the data into the table.

I entered all the data into the table. There are 14 coins in total, of which I decided to choose 5 for the distribution of $ 450. VET, MANA, ADA, SAND, TRX.

- USD PRICE block - the price of the currency in dollars 1 year ago, 180 days, 90 days and today.

- USD UP Today/Past block- Multiple price increase for 1 year, 180 days, 90 days and today

- USD UP Past/Past Past - Price increase for 90 days, in the interval of 90 and 180 days ago, in the interval of 180 days and 1 year ago

- BTC UP- growth not only in USD but also in BTC for 1 year. Green - yes, Orange - not exactly. Red – no.

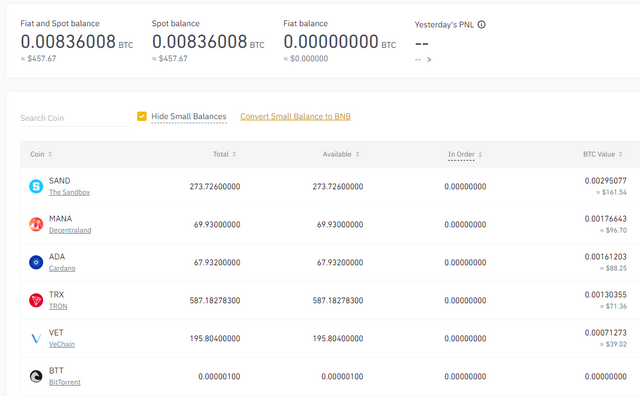

So, my balance at the beginning of the experiment looks like this. Let's see how it will look in a week.

Of course, I'm not going to sell these coins in a week, despite their rise or fall. In fact, I do this in order not to forget to keep statistics. And I think that this table will gradually become more complex.

Maybe, if one of the coins grows multiple, it makes sense to sell a part in order to reinvest in the rest of the coins from the list. For example DOT and LINK look very attractive.