Starting your business with little or no money can be a long lonely journey as you have to start small and often slow. Starting a business with little or no money can be done in two ways, either by starting with your own money or by using other money (Money from friends, family and borrowing from other people or institution). Business that are financed with little own money are usually businesses that starts as part-time and sometimes home-based after which they start to grow gradually. The business owners tries not to make any mistakes but the margin for error is so slim that the possibilities of succeeding in the business is very difficult.

As an entrepreneur who has little or no finance you can make use other people’s money to start your business or grow your existing business. There are always people who are willing to invest in businesses but finding them is the biggest problem for these entrepreneur. Never forget that no person investing in a business either relative or angel investor will put their money into an idea alone without checking for facts and figures to back the rosy rhetoric the entrepreneur is bringing to the table. This means that you need a solid business plan that is detailed when you are looking for investors or people you want borrow money from. When looking for investors you need to understand that you are playing a game of numbers and your numbers need to be right.

People will not come to your doorsteps asking if you have a good business ide that they can invest in rather, you will have to go knock from door to door. Most investors will want to see what they are investing their money into and why they should invest. An investors knows the business could either be a failed scam or a big success and you have to make them trust that it will be a success.

How do you get an Angel investor to invest in your business?

First an angel investor as the name implies is a person who already has made money and still making money from various investment and are looking for startups they can invest in. Finding an angel investor is like finding an Angel in reality, you need networking in other to find one you could ask your broker, account officer/banker, lawyer, a sales rep, or colleague. You could also find them on the internet through sites like crunchbase.com (for reference purposes. Do not use this site only if you have made your research)

It might take time to find an angel investor but when you finally get one, you need to make them invest in your business idea and this is what you can do to get it done;

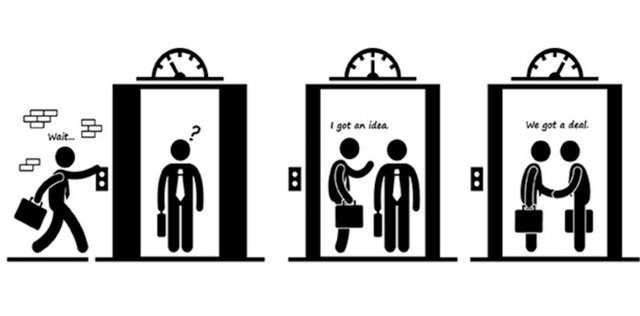

Always be ready for an elevator pitch

You must be able to set the investor mind right and you have a maximum of 30 seconds to get this right. At this point, you have to be able to explain in business jargon all that is in your proposal. It must be intriguing, short and powerful enough to make the investor want to know more.

Be ready for a meeting

If your elevator pitch works, you are not going to get any other thing except a date to meet with the investor, which is the purpose of the elevator pitch. Make sure your business plan is flawless and well prepared. Never make the mistake of not knowing a little about your investor, you can’t ask someone to invest when you know nothing about them. In other to get the investor to pay attention to your proposal, you need to explain your idea to them piquing on their interests, as well as create rapport between yourself and your investor (it is not an interview, it is a meeting to know you better and understand your business idea), be enthusiastic and show that you and your business have potentials.

Do your homework following up

Your investor at the end of the meeting already has an answer but would prefer to go through your proposal at the golf club with a friend or two talking more about you and a little about the business. He needs to see potential in you before believing in your business (If you give a fool Apple inc, the company will close down in less than three month). He needs to see potentials in you. Do your follow ups on some reference to the angel investor and if you get a positive response from them, then your congratulations are in order.

Other ways to start a business with little or no funds as a shoestring is by finding partners. Teaming up with the right business partner who has the finance while you have the idea is a good way to start your business. This might only cost you splitting business ownership percentage. In most cases, most partners tend to sell their stakes when they realize they’ve made enough profit.

On a concluding note, I do not advice taking a mortgage or home equity loan to start a business, as the business might fail leaving in debt and putting your home at risk. Also never use credit cards to fund your startup company, you might end up paying interest that might close down the business at the end.

Solid read. Resteemed already. Upvote on the way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 0/20 - need recharge?)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One thing that has remained a problem is finding the angel investors to contribute to the growth of the business.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have done a lot of elevator business chats with business owners, one thing i realize is that if you do not make your point before the elevator reaches its destination, you might not be attended to again. I remember the experience i had with a man i who i wanted to finance a small project, when i got to his office the first time, his secretary advice i had a elevator pitch with him but trust me, i missed my first shot because it was too long and he stopped listening when he got off the elevator. I had to go back home make a summary of what the project entails, why he should support and what he would be getting back. My second trial was a success.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @ajewa

Interesting choice of topic buddy. Solid read.

I found it very tricky to use funding coming from investors. Their patience and expectations can become a major headache for those, who are just starting up their new business.

Very true. And creating solid business plan may be sometimes very tricky. Especially if we're entering some industry which is quite new and unexplored.

It's also important to work with investors who do understand what we're trying to achieve. Investors understanding our business model and our goals.

Upvoted already,

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If it is possible to get funds required by start-ups from friends and families then i will prefer it to looking for an angel investor who will not want to hear anything about business hiccups, all he wants is his money refunded

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Does this "elevator pitch" have an online, written version? I like to write but have mostly difficulties if I have to speak quickly... Forums, blogs, chats?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit