You are maybe asking what is a Trailing Stop Order? And how does it benefit you as a trader? I was not using this strategy before but lately as I implement a new plan, I am looking forward to using this feature in most of my trading activities.

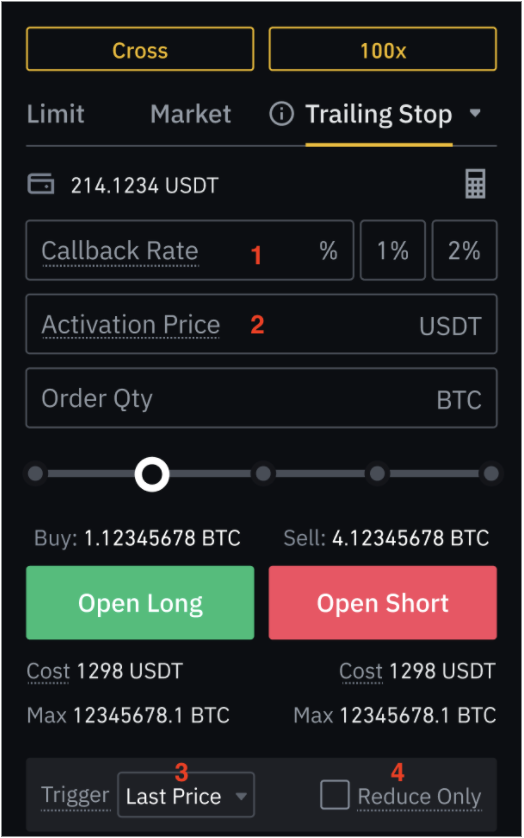

First, to define the Trailing Stop Order, it is simply a feature where you can lock in your profits by liquidating your position when the market starts to move against you, To better illustrate it, take a look at the image below.

The said image we put in a callback rate of 10%. Your profits are locked with your assigned trigger price. The trigger price serves as your Take Profit level but then you continuously follow the trend. When you are in a long position, a sell order will be activated when the price drops by 10% from its latest peak after the purchase. The short or sell order just works like a mirror image with a long position.

Unlike standard stop-loss that is activated when the price drops 10% from the initial buy price, trailing stop-loss is recalculated from the latest peak price.

This is a good strategy to maximize your profits especially when the trend goes in an extended period. If you are into trading, I think this is one good feature you should carefully look into.

For a more detailed explana\tion about this feature here is an article from Binance about the said feature. What is a Trailing Stop Order?

@arnel wow this is something new concept I learned today. Will be definitely trying this option in the next trade that I will set. Thanks for giving such a good information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome. I am glad you like it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit