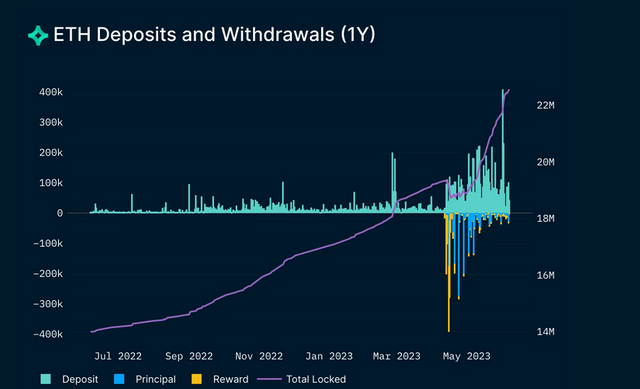

The recent announcement by SEC that the ETH spot ETF has been postponed till next year might be a setback to the price rally of ETH but on analysis of on-chain data, it seems the announcement has not slowed down the demand for ETH with lots of DeFi users still opting for staking in the wake of increased adoption Liquid Staking and more DeFi transactions that has lead to the burn of more ETH.

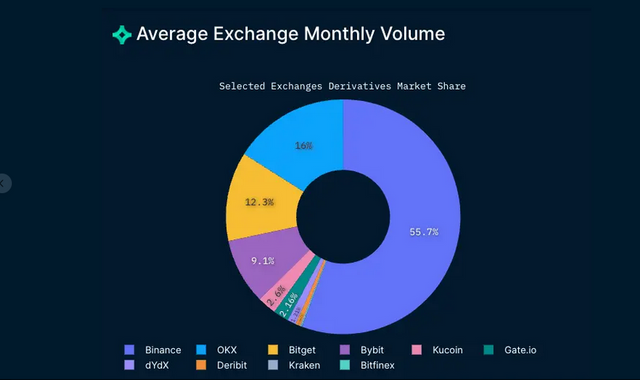

A good example of this increased in transaction can be seen in the increase in "task2earn" and cryptopedia airdrops across many new and existing projects like Zeta, Kaspa, Avive in collabo with Bitget wallet and OKX wallet where users will need to interact with a list of DApps to win airdrops and mint NFTs. Most of these DApps interactions involve swaps, staking and NFT buys which involves the use of ETH as gas fees. Records shows that over 1.5 million users have interacted with these DApps.

These and more are pointers that the postponement of ETH Spot ETF by SEC might not affect the recent price surge of ETH.

Anyways, what do y'all think?