INTRODUCTION

Recently, many eyes around the world were directed towards the FED meeting and the level of fear and uncertainty has been really high lately.

However, when I realised that nothing has been really announced ... part of me didn't even feel surprised. I felt like they did exactly what I would do if I were in their own shoes: simply nothing. Nothing more, than just "talking". Empty words, one could say.

Today I would like to share with all of you my thought process and I hope to hear from you as well. So I could learn other points of view on that particular topic, and perhaps revise my own opinion in discussed matter.

REDUCING BALANCE SHEETS?

First of all, their idea of reducing the balance sheet is making me quite confused. For several weeks now, they have been planning to reduce their balance sheet, but at the same time they ONLY plan to slow down printing new money.

Not to stop it, but to slow it down.

Can anyone let me know HOW IT'S EVEN POSSIBLE? To achieve both such opposite goals.

WHEN TO EXPECT HIGHER INTEREST RATES?

Recent lack of actions could be expected by many investors and I belong to such a group. In my personal opinion, there have been too many eyes directed at the FED. More than anytime before within recent years, and I'm sure they didn't like the attention. Especially since this time this attention has also been coming from mass media.

I would rather expect interest rates to be hiked "QUIETLY".

Let's wait for some other news which will grab everyone's attention. Be it conflict between China and Taiwan, or "invasion" Russia on Ukraine or anything else which will take people's attention away from topics related to inflation and FED.

JOE BIDEN says: "INFLATION IS A GREAT ASSET"

Another thing worth mentioning is the fact that the current US administration (under Joe Biden) seems to rely greatly on public spending. It does look like they are addicted to money printing.

Joe Biden clearly doesn't understand the basics of economics and when recently he was asked about inflation, he replied "That's a great asset, more inflation".

Shocking statement, isn't it?

Let's face it. President Joe Biden is already quite old and so often he doesn't even look like he is "connected" with the world around him.

I don't really think he gave much thought to the idea of being re-elected and all he care is to leave some sort of LEGACY behind. He clearly don't want to have large social unrest on his hands. And we need to take this into consideration as well.

MY PERSONAL VIEW: BETWEEN ROCK AND A HARD PLACE

FED is clearly between a rock and a hard place and they surely do not enjoy all the attention they are receiving.

I wouldn't be surprised if soon they would try to address the problem of inflation with stricter actions. And they will do it most likely once they will feel even more pressure. Timing it well and waiting until mass media will be occupied with other topics. Not related to FED, US administration and money printing. When all eyes will look elsewhere.

However, even if they will do it -> then it will most likely be short-lived.

Inflation at this stage cannot be stopped any more, not without hiking interest rates heavily. And that would be a huge problem for the government, which would have to pay billions just to serve their debt alone. Crashing all dreams of enormous public spending by current US administration.

Important detail often ignored:

At the same time higher interest rates means much higher loans and mortgages, which may be a nail to the coffin and it will most likely push people into the streets.

So social unrest is pretty much guaranteed at this stage, and I'm not sure if they would be willing to also witness WALL STREET and stock markets going through difficult times. After all: it is one thing to mess with masses of regular people, and it's a completely different challenge to upset wealthy billionaires and upset your own president.

SHARE YOUR VIEW WITH ME

What do you think? Is there any way out of this situation? Can we kick the can down the road a bit longer before social unrest will explode?

How do you look at FED actions in short and long term? Did you believe that interest rates may be increased in any MEANINGFUL WAY sometime in the future? With all consequences that it may cause?

Share your thoughts with me. I appreciate all the valuable comments.

Yours, @crypto.piotr

@project.hope founder

check out our community: https://hive.blog/trending/hive-175254

Good job! You just got yourself a 100% upvote from ACOM. Enjoy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @crypto.piotr, Currently important things are happening that we must take into account and in your post you have shown a good summary.

I think the consequences point to a total collapse of the world economy driven only in part by rising interest rates, the fact that people who "move" on the axis of the minor economy and the local economy lose their homes , their jobs and their businesses is the same as saying that this majority will be witnessing a period of famine, in the same sense the stock market would be on the verge of an absolute collapse and no business model will be feasible, who would dare to invest or maintain the operations of their companies? How many jobs will be lost? How many people with mortgages will lose their houses, cars or how they will pay their loans?

What worries me the most is, if the production lines stop, how many of us will survive?

I no longer want to continue imagining this possible chaos.

:(

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciate your comment @tocho2

Perhaps you should step back and look at things without emotions?

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From the inception of decentralized currency the FED have undergone a psychological unrest looking for means to discourage public from adopting the new technology.

Looking at how the world economy is heading not sure how inflation can be tackled completely as some prominent elite deem it as good asset to the economy.

The Fed have actually been a major hindrance when it comes to blockchain wide adoption and at moment a lot of individuals are patiently waiting for the fed to take their next move which might indirectly affect the crypto space.

My take on inflation at the moment is it has become a world problem gradually expending across the continent i hope more tactical means of handling the problem will be unvail sooner.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @mccoy02

Thanks for taking the time to read my publications share your thoughts with all of us.

How crazy is that? Right?

I only can imagine, that Joe Biden sees inflation as a way to devalue US goverment debt. And futher money printing is required to cover extensive public spending. Which he is great proponent.

Wouldn't you agree?

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Covering extensive spending that will lead to more inflation which i consider bad for the economy as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend, certainly the last two presidents of the United States have taken uncertain economic measures making inflation in that country one of the highest in the last decade, to this is added the already archaic and deteriorated world economy which is suffering its debacle.

The FED and the United States are focusing their attention on their economic problems, when really the relevant issue is the outcome of the possible conflict with Ukraine.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @carlir

My guess is that this conflict will not escalate. It's a way for Russia to put political pressure on european union.

After all, Russia already attacked Ukraine once (within recent years) and didn't achieve much. It would be very expensive for them to go into war. Especially without many allies and economy struggling.

That's my own little opinion :)

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @crypto.piotr ❤️💕

This aspect is also getting me confused just the same way you are. Reducing the balance sheet and the plan to print out new money doesn't really sounds correlating to me but I think the government might have their plans to make this happen. Let's just keep watching what happens in this aspect.

I really can't say much about this for now because are still some certain conversations and information which are hidden or unknown to most of us. This may actually be a political game.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead 💕❤️💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciate your comment @hardaeborla

It clearly seem that we're both on the same page here.

And we're both confused hehe :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello @crypto.piotr,

i think that the way out that the united states will take to face its inflation problem is war, russia knows that the united states economy is in trouble and can bet on a rupture of the american economy, something similar to the strategy that the united states took against the ussr. a war implies the activation of industries and social union, that's why I think a U.S. war with Russia is the way out that both will take.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @trabajosdelsiglo

Do you really believe that US would go for war with Russia? I think it's very unlikely to happen.

Even if US would decide to join (why would they?) - they surely would wait until Russia already would be bleeding out while trying to conquer Ukraine.

My personal guess is that this conflict will NOT escalate. I see it as a way for Russia to put political pressure on european union.

After all, Russia already attacked Ukraine once (within recent years) and didn't achieve much. It would be very expensive for them to go into war. Especially without many allies and economy struggling.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I did the "Fine Tuning" on our Corrected Monetary System... I have Hundreds and Hundreds of Posts, looking at it from every possible angle... Feel free to stop by...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with you @crypto.piotr. This uncertainty is increasing day by day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @crypto.piotr

In all of this, more ala the serious economic consequences that are post-pandemic, I think the effect that social networks and other media are having are becoming more and more evident.

Any announcement or "possible announcement" causes many people to be influenced more by the rumor than by what has actually happened.

I do not believe that the United States wants to generate global chaos, much less in its own territory, although those who have economic power think very differently from us.

If it is in their interest to generate that chaos, they will make the announcement they have to make, regardless of the consequences.

It seems to me totally absurd that the crypto market moves on a par with the traditional market, such as the stock market, which we know are totally centralized, but, I understand that much of the capital invested is institutional capital.

I do not know what to expect specifically from the FED, however, the market is affected a lot by what it says, and even much more by what it does not clearly say, because this is precisely what gives rise to the rumor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You nailed it @josevas217

It looks like they are testing out how far can they influence the markets without really doing much.

haahaha tell me about it. They surely do not see world the way regular Joe does.

However, I don't think generating chaos is anyones agenda. It's more like FED knows that they need to do something to combat inflation, but they do not want to do it while so much attention is directed towards them.

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First of all I agree with your. Now regarding the topic inflation will be increasing day by day we cannot reduce inflation their are any reason for the same. Like crude price , stock market , unemployment etc.

All this wi take place to increase the inflation government need to control it by making good measure otherwise suitation like Kazakishstan will happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend @crypto.piotr, currently uncommon events have been unleashed that have attacked all financial markets, including the cryptocurrency market has been affected by conflicts between countries and by the decisions that have been taken by countries like Russia to prohibit and veto the use of digital assets.

We are in a difficult time for all sectors and I agree with your opinion, drastic measures will come once the media redirect their attention to other scenarios that do not FED and unfortunately those measures will end up affecting the ordinary citizen, which will end up generating a social upheaval that will affect a government that does not end up implementing clear economic policies.

Good point of view. Regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed. We are in difficult times @madridbg

Clearly we're on the same page with our views buddy.

Thanks for sharing your thoughts with me.

Appreciate it greatly :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto.piotr ,

I totally agree with you! At this point it jsut seems like they are just kicking the can down the road! There is a tweet that pretty much summarizes this FED meeting:

Regarding the point with slowing down the money printer, I think that they dont want to shock the economy and stock market. It is probably easier to adjust if the tapering is happening more slowly.

Regarding the president's statement: I think this is quite a shocking statement. Inflation at this rate should not be considered an asset. Maybe he is trying to calm down people with such a statement, but honestly I assume he didnt think it through.

Regarding the current situation: As far as I understoodthe first interest rate raise will happen something around March and two further raises will follow this year. Nevertheless, I think it is a highly critical situation we are in right now. Some people even talk about the great reset. I am not believing in it yet but it seems like a real possibility to me now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing your thoughts with me @ga38jem

Just like this tweet says: they talk and talk about raising interest rates SLOWLY in the future. It's hard to take it seriously at this stage.

True. But it's a bit like seeing that we're driving very fast towards the cliff and ... thinking about adjusting car speed (slowing down) and thinking about adjusting driving direction (angle) away from that cliff.

Shock will come either way. And will be more painful or even deadly (For many).

What would that "Great reset" means? I've heard people saying that for quite sometime. I did used that phrase in the past. When pandemic, lockdown and money printing started -> I strongly believed that we won't get away this time around and that most major developed countries will end up defaulting on their debt (which would be considered a "great rest").

In a way I'm glad we didn't get to that point. But we just postponed it and most likely it will all take place in upcoming several years. During our lifetime for sure. And it will be the most painful process for global economy one can imagine.

(little bit doom and gloom hehe)

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto.piotr, you have summarized very important points to keep in mind about the Fed's actions, I think that meeting, talking and coming up with nothing, suggests that the action at this point is just to delay the inevitable, i.e. slowing down the issuance of new money is like knowing you are going to collapse but try to slow down, maybe they hope to get the ball rolling until another administration, we Venezuelans know very well the consequences of high inflation, and for Biden to comment that inflation is a great asset, makes me wonder for whom? as you say, maybe he is only thinking about going out and leaving a legacy and not riots in the streets.

In the future I think they will raise interest rates, Powell has already announced that they will do so gradually starting in March, arguing that the US labor market is healthy and dynamic, but over time various types of loans such as mortgages, credit cards, auto loans and business credit will become more expensive, and while this could slow down consumer spending it could also slow down the economy.

What is certain is that investors and many people will continue to keep an eye on the inflation data, so other news is unlikely to take their eyes off the Fed, at least not for long.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing your thoughts with me @emiliomoron

It clearly seem that we're both on the same page here.

I only can imagine, that he sees inflation as a way to devalue US goverment debt. And futher money printing is required to cover extensive public spending. Which he is great proponent.

Wouldn't you agree?

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @crypto.piotr

I particularly think that the US economy is on the way to a big failure and this has been happening gradually for a long time, since they print bills when they need to without any economic backing to cover their public spending.

The inflation that is being generated I am sure will go up a little more and they will try to balance it with the interest rates as you mentioned.

In addition, President Joe Biden's statements are illogical for economists, but it is worth noting that those who have administered the country in recent periods see the American economy in this way, as they have not generated income from the wars that they themselves create and promote, nor the sale of weapons, they must print money at will to support spending.

Today many of the things you mention are happening, such as people living in the streets, shelters completely full, unemployment, but the news networks do not pass any of that, only mirage of a wonderful country where it is territory of the possible and where everyone pursues the American dream.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Late thank you for your awesome feedback @dgalan :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

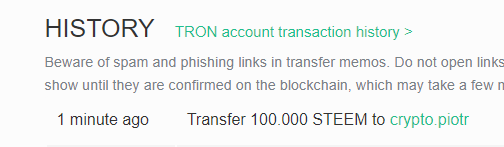

Check your wallet

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @crypto.piotr

In particular, it seems to me that it is another political strategy of Joe Biden, to achieve his interests as all politicians do.

FED, is clear about what they are going to do and when they are going to do it.

I agree with you that they will when the world's attention is on another matter.

Regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto.piotr

I believe that inflation is not good but we can't control it because over time this will take place. We can even say that its on going and it creases over the time.

There is no way we can control it and some unexpected situations contribute in the increase of inflation and as of now, covid is the biggest one. Other components like crude oil and even fiat currency value also result in the increase of inflation in the country. Thanks

Solid post my friend,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by @alokkumar121 and sharing your thoughts on this particular topic.

Appreciate it greatly. And have a pleasent weekend buddy :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend @crypto.piotr, the Fed has a radical message and it is thought that they took extreme measures to curb inflation, I consider that if what they are proclaiming will affect much the population, which could change the lifestyle of many, They want to save the economy at the cost of what they want.

The markets are seeing affects investors are terrified, let’s hope to see what comes out of all this.

So long, have a great weekend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing your thoughts with me @amestyj

Appreciate it greatly :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi dear friend @crypto.piotr

I believe that the governments of the United States and the FED have always had good economists, I believe that they always try to do things better, I believe that if there is no strange war they will make decisions that will benefit us in the long term, but there are no miracles in the economy.

god bless you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @ramsesuchiha

They surely hire many well qualified economists. Problem is, that those who make decisions on behalf of various central banks do care more often about politics and pleasing their supporters than real economy, which will affect millions of regular people.

I surely do not share your belief that they always try to make things better. Better for wealthy and powerful - for sure. But not "better" for us. Common people.

Thanks for dropping by buddy

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Inflation is no doubt the most dangerous threat to our lives and it keeps getting serious over time, but honestly, part of me sees it as the "necessary evil" that must happen sooner or later so that all people understand and feel the importance of Bitcoin and cryptocurrencies. Maybe, this inflation is the only way to spread awareness toward crypto and accelerate mass adoption (at least i hope so)

This shows how clueless Joe Biden is about how things work, but I liked his reply though... lol 😂

Interesting read. Thanks for sharing :))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @qsyal

Thanks for taking the time to read my publications share your thoughts with all of us.

It's indeed hard not to agree, that inflation is the most dangerous threats to our lifes. I could argue that deflation is even worse, but it's not a real threat so we can ignore it.

You're most likely right. Inflation will bring more people awareness to the fact, that holding to their FIAT currency is a losing game. And they will be looking for ways to protect their wealth and savings. And crypto will be surely one of most popular options out there.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Cure for Inflation is a Stable Currency, backed by Silver and Gold Coins... Yes, we will continue to have Supply and Demand issues, but we can't do better than having a Stable Monetary System... I came up with the answers need to return to Silver and Gold Coinage... What's interesting about my Monetary Vision is that will will need to make change for our Corrected Silver and Gold Coins... Guess what we'll be using or change...???

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe you can tell me @pocket-change?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow... I sure made a lot of typo's... My Screen Name gives the answer away, but I'll write it anyway... Common U.S. Coinage will be used to "make change" for our Corrected U.S. Silver and Gold Coins... I have Thousands of Posts on the coming U.S. Monetary Correction...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for being so responsive @pocket-change

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your thanks have been received and welcomed...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think that they should not get involved in trying to lower inflation, since logically if they try to achieve it by raising the interest rate and reducing the printing of dollars they will get into serious trouble.

Inflation is not bad at all, with inflation it is easier for them to cover public spending, besides there is a greater incentive to pay, logically in inflation prices go up, but the United States has an economy centered on consumerism of products that generate a solid economy.

To lower inflation they should simply go little by little without generating a negative social impact that would be generated if they raise interest rates, and as you very well say in the post that if they do so they would be messing with millionaires.

I think that everything has been a detour of publicity towards the FED and the US economy, I think that when the attention is diverted to the war conflicts that are ongoing nobody will touch again this inflation issue, besides the inflation issue with respect to the US economy is an evil that has been dragging on for a long time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting point of view @carlos84

One that I didn't expect. After all - if not FED, then what other entity would try to combat inflation? Surely serious trouble are on the horizon, either way. Question is only: what kind of trouble they will chose to face.

What shocked me the most is that you wrote that "Inflation is not bad at all". While you're from Venezuela and you experienced inflation on your own skin.

Maybe I your words it wrongly. But it does sound like you don't see an issue with inflation. Should I understand that you're saying that it's not bad at all from GOVERMENT POINT OF VIEW only?

We kind of disagree on that. I believe, that this is when interest rates will be "quietly" increased. I don't think FED cares about wars around the world. They however care about mess they created and they don't like all attention they are receiving. So whatever actions they plan - they will most likely wait until people and mass media attention will be elsewhere.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is a two part meeting. So, there wasn't any announcement to be made, as a conclusive decision is yet to be reached. The second meeting will be in the month of March and that's the big announcement.

Although, I feel it will be a positive announcement, as this is election year, mid term, hence, some politics will come into play.

Higher interest rates, should be next year because this is an election year(Mid-Term), politics will always win in this kind of issue. 2023 will be a rough year. I will definitely be selling my positions before 2023 and buying again when the price gets low, because they will.

Thanks for this wonderful article. I really enjoyed reading through @crypto.piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @menoski

Thanks for dropping by and sharing your thoughts with me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got it right. Things are so out of wack and they have printed their way there. They have zero credibility and have been pulling this con job on society for way too long.

There's no price discovery, everything is distorted and I've yet to hear one statement from any of those central bankers that has an ounce of truth in it.

They are the entire market, not just in the U.S. but all around the world, and it's completely fake. I heard sometime ago that it would get to a point that regardless how much they buy into the market they will not be able to keep of with the selling.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow. look who visited my post @bitshares101

Glad to know you're still around.

ps. do you check your discord sometimes? I've tried to DM you few times

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're not doing yourself any favors, letting your Steem Power run down to 36%... Did you notice how my rewards got smaller with each of your up-votes...??? You could do so much better with your Steem Power...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The kind of attention that fed is getting simply points towards how centralized and flawed the whole system is. There are hardly any options for them and they choose to print money or print more money.

Just imagine the who fed and all that non transparency be replaced by a DAO

every thing governed by smart contracts and everything becoming more transparent.

This is hypothetical, though fed would not give up its power so easily though the power is slipping from its hands and the crypto world or part of it with efficient blockchains is evolving as a viable alternative.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Clearly we're on the same page with our views. Attention towards FED and power of their decisions are indeed super centralized to the point of being sickening :/

Thanks for sharing your thoughts with me @thetimetravelerz

Appreciate it greatly :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Piotr!

Well I will comment in the things that I have some knowledge about. Let's start with FED meeting, I actually asked my brother to keep my up with news about that at first like when is the meeting and what does he expect, then I asked him again to bring me the news since I'm kinda busy taking trading courses and studying. Well I was waiting something big to be announced yet there is nothing important at all, so I just ignored it like nothing happened. Few days ago I've been seeing those sponsored news pages for the first time in life, and it's only talking about Russia and Ukraine war. That's surprising, why would someone like me have those is his timeline continuously.... After reading what you've said here, it makes way more sense than I thought it's just empty things and have nothing to do with each other.

Reading about inflation, I can't really comment on that, I don't have much knowledge, yet all I can say that I almost forgot that Biden still there LOL.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @lennyblogs

Thanks for dropping by and sharing your thoughts with me.

Indeed. So much attention is at that possible threat.

Hovwer, my guess is that this conflict will NOT escalate. I see it as a way for Russia to put political pressure on european union.

After all, Russia already attacked Ukraine once (within recent years) and didn't achieve much. It would be very expensive for them to go into war. Especially without many allies and economy struggling.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @crypto.piotr I read recently that the Fed is currently trying to curb the high inflation of 7%, the highest since June 82. It has therefore been clear that its priority is to ensure price stability and, to this end, it is willing to raise rates for longer. At the same time, the institution wants to prevent this measure from provoking a rapid exit in the markets, which are now in the doldrums, not knowing what to do between the economic slowdown and the fear of a Russian conflict with OTAN

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing your thoughts with me @aplausos

Appreciate it greatly :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with you. The amount of rate hikes everyone is expecting is just not possible. Government is overleveraged, corporations are overleveraged and so is the consumer. How can one raise interest rates in such an environment? Have the poor seen a massive rise in wealth in the past? It is so stupid what the Fed is saying it will do. Also, this inflation is not primarily demand and credit-driven. As lockdowns ended and companies had to meet whatever little demand, supply just wasn't there to even meet that. And now look at what is happening in Ukraine. Brent is at $90! Just over a year ago, crude oil futures traded for a negative value because there was so much overproduction. What happens to inflation if the situation in Ukraine worsens? And as you mentioned if China wants to take advantage of that in Taiwan. This rate hike talk is so absurd! especially expecting 4 hikes in a year. If they are able to do 2, I will be surprised.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @karamyog

Thanks for taking the time to read my publications share your thoughts with all of us.

I've been following some of your recent publications related to same topic (FED and markets). And I was hoping to hear your opinion on discussed topic.

Just 3 rate hikes within a year - it's doesn't sound impossible to me. Especialy since those increases will be ... almost not noticable. Meaningless. We could probably have even 4 similar rate hikes. And it wouldn't change much, since spread between interest rates and inflation is already so huge.

But that's just my own 2 cents.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this inflation is transient. inflation can't always be 5%-10%. Next year, due to a higher base, inflation will be lower. If it continues to be 5%+, then surely they can raise rates. Interest rate hikes of 1% will nearly double the interest liability, and overleveraged companies, governments, and individuals cannot afford that. We've been in a long period of low-interest-rate environment, say from 2006, barring a period of high rates between 2016-18. It took 3 years for the Fed Funds rate to hit 2%. Fed can't raise rates by 1%, remove QE, all in 1 year. It can happen slowly and not at the expense of the equity markets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @karamyog

Of course there will be time where inflation will stop. Even in Venezuela it slowed down greatly.

It surely cannot always be 5-10% level. But it also may jump to much higher levels before things will get any better.

That's correct. And this low-interest-rate environment will most likely continue. With every week amount of debt is only increasing, and cost of servicing that debt alone will be also only more of a problem.

If money printing will continue (and FED is not the only one doing it) then supply of money will only increase. Since businesses are going belly up all over the world, then supply of goods and services will be only getting smaller.

How to stop inflation in such an environment without increasing rates in MEANINGFUL WAY (at least to 3-4%) without crashing entire equity markets?

I think FED is trapped and there isn't much they can do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Piter!

In Poland, inflation is getting higher and higher. The media are lying to us and the real inflation is about 5% higher. The prices in stores are getting more expensive every day. Since the new year there has been a "New Deal" and in fact there is quite a mess in the economy. I observe what is happening on the border with Ukraine. Look at Germany. I think they'll be the first to bust their asses at us. They talk to each other on the side and we are little pawns. People are additionally blinded by the fake news about covid-19. I don't have poverty at home but it really is going badly and the future of my children is bleak.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dziekuje ze Twoje komentarz @jozef230 :)

If only only 5%. The way inflation index (the one central banks and goverments are promoting) is measured without taking prices of food and accomodation into consideration.

So absolutely stuipid. It makes me wonder: how bloody fake this number must be, right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @crypto.piot

You may be right and in these scenarios they really are rock and a hard place, from my perspective for almost a decade now the US economic and financial structure is at a precipice and this may be the end of the road, I think from the social I think tough times are ahead for the US executive branch, it is inevitable that interest rates will rise significantly.

Best regards, be well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Many countries in history have tried that path. None of them succeeded....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hii @crypto.piotr

You have explained the situation and your thoughts very clearly excellent👌

I think there can be a way, If they start hiking interest rates at midium level (instead of hiking it heavily at ones) it will catch the attention of people and they may start depositing considering a stable situation but there is a big "if" if everything goes well than situation can be in under government's control otherwise

( economy will crash very badly )

Otherwise It cannot be stopped ( keeping in mind all the consequences)

I think FED will increase interest rates but not that fast they will monitor the whole

situation and then they will proceed with increasing interest rates. And at this stage I don't think that Government will be able to face huge cost of people if anything goes wrong while recovering from the situation because it's already too late,

Thank you so much for sharing such a wonderful and informative post : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciate your comment @winy

Don't you think that currently planned and announced interest rates hikes are at actually at quite low level? I wouldn't even consider it to be "medium".

Those interest rates hikes should (in theory) go up as much as inflation does. So spread between inflation and interest rates wouldn't be to wide (as it encourages capital to move away from the currency to other currencies or other assets).

Have a grear weekend buddy,

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Morning @crypto.Piotr,

Certainly they are not medium, but they (fed) have to change it to a certain (Fair) point keeping in mind all the consequences,

Correct, That's right

Referance from the publication

As per the depositories data, FPIs took out Rs 28,243 crore from equities between January 3-28. During the same period, they pumped Rs 2,210 crore into the debt segment and Rs 1,696 crore into hybrid instruments. The total net outflow stood at Rs 24,337 crore. The total net outflow stood at Rs 24,337 crore

[with the latest pull out of funds from Indian markets, FPIs have become net sellers for fourth consecutive month. "With US Fed signalling that it will start hiking interest rates soon and shrink its bond holdings, FPIs went on a selling spree in the Indian equity markets," said Himanshu Srivastava, Associate Director - Manager Research, Morningstar India.]

I think FED will start hiking rates very soon /

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for being so responsive @winy

question is: will they raise them in any meaninful way? Because raising it by 0.25% is nothing but a joke at this stage.

If spread between inflation and interest rates is higher than 3-5%, then investors and regular people will be trying to protect their savings moving every bit of FIAT currency they have into different sort of assets (or to more stable currencies, like Swiss Frank - CHF).

I'm not sure if FED can ever afford to increase those rates to levels, which would really change much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hii @crypto.piotr,

Thanks to you too,

certainly, it is a joke at this stage, They have to do something about it,

They certainly cannot afford that much amount of increase i think that's why they are withdrawing equity money from other countries as I have mentioned

IT IS BECOMING VERY INTERESTING NOW 😃

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The problem I see is that the inflation worldwide is drivent by an expansive money policy on one side and an increase of transportation costs and production costs of many products mainly because of a deficiency in the supply chains.

In a way the central banks should increase the interest rates to slow down the inflation. At the same time however, higher rates will have catastrophic effects on real estate markets and also on state dept. So higher interests could totally kill the growth and plunge us into the next crisis.

If they can't increate the interests, the best next thing is the speak about increasing the interest :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

YOU NAILED IT! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit